Trump’s Endorsement Highlights Bitcoin’s Scarcity

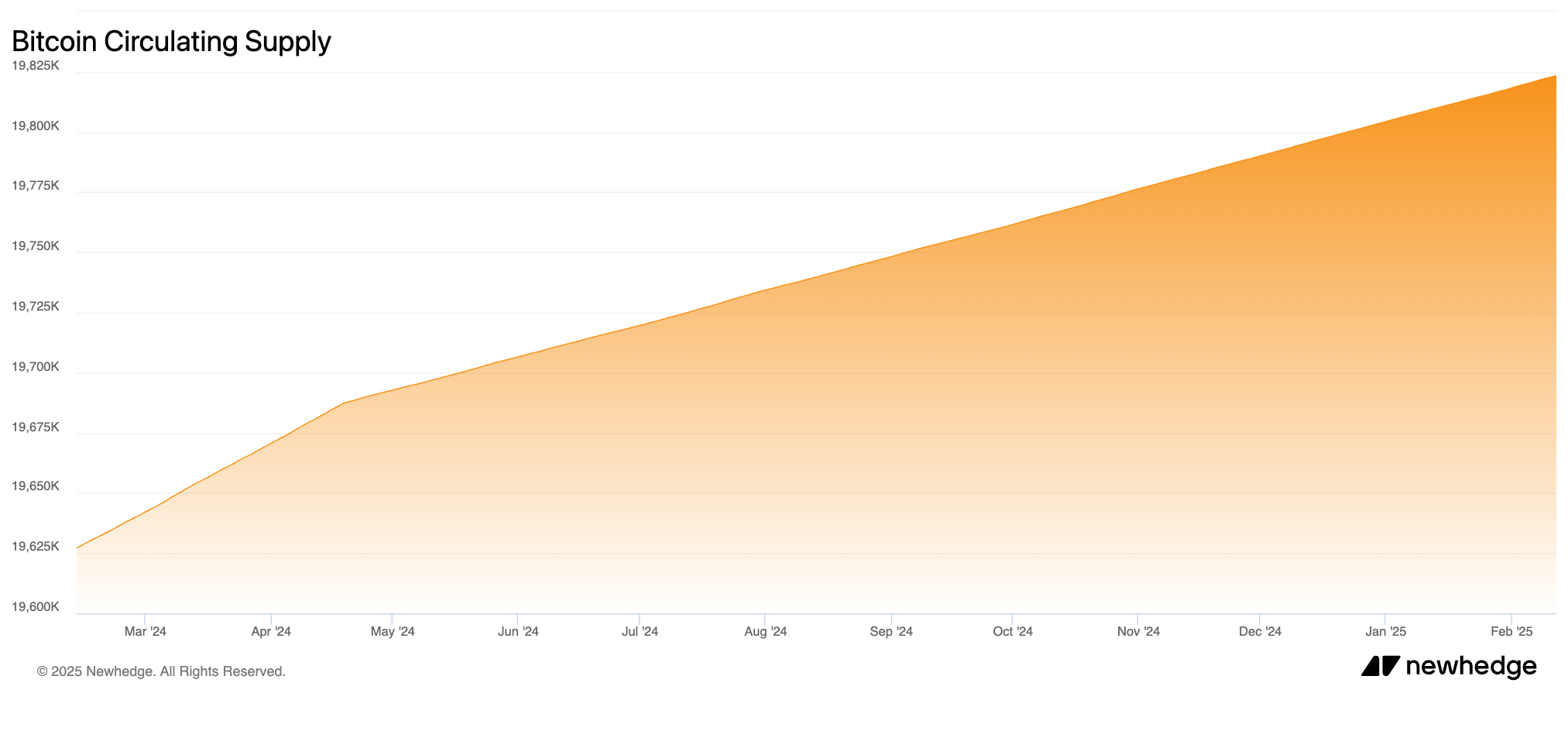

Bitcoin mined has surpassed the 19.96 million milestone, indicating that over 95% of the full Bitcoin provide has been issued. The main cryptocurrency might quickly face shortage as BTC withdrawals from exchanges speed up. U.S. President Donald Trump’s proposal for a strategic Bitcoin reserve, mixed with institutional adoption and the rollout of Layer 2 options on Bitcoin, might drive additional demand for the digital asset.

Bitcoin shortage and BTC demand drivers

Bitcoin provide on exchanges has dropped by almost 15% for the reason that announcement of the U.S. Presidential election leads to November 2024. Throughout the identical interval, provide held outdoors exchanges has risen from 17.99 million to 18.3 million, in accordance with Santiment knowledge.

A decline in trade provide coupled with a rise in BTC held in exterior wallets is commonly seen as a bullish indicator. The amount of BTC on exchanges has reached its lowest degree in almost three and a half years.

Decreased provide on exchanges alleviates promoting stress, and sustained demand has traditionally pushed value will increase.

Matthew Sigel, Head of Digital Belongings Analysis at VanEck, analyzed 20 state-level Bitcoin reserve payments. Sigel predicts that if enacted, these payments might generate $23 billion in demand for BTC, equal to 247,000 BTC at present costs.

This determine excludes potential pension fund allocations, which might improve if legislators advance these proposals.

Knowledge from Bitbo.io reveals that just one.039 million Bitcoin (BTC) tokens stay to be mined. Over 95% of mined Bitcoin is both in circulation or held in wallets outdoors exchanges by massive buyers and entities. Institutional demand is anticipated to be a key driver of Bitcoin’s value in 2025.

U.S. Strategic Bitcoin Reserve progress and Trump’s plan for Bitcoin

U.S. President Donald Trump has proposed establishing a Strategic Bitcoin Reserve, a growth seen as a game-changer for the crypto business. Reserve belongings, equivalent to Gold and Oil, are usually held by nations to mitigate provide shocks throughout crises.

The suggestion to carry Bitcoin as a reserve asset strengthens demand for the token from the U.S. authorities, which at present holds almost 200,000 BTC seized by means of FBI legal investigations.

A Monetary Occasions report from February 12 notes that whereas the federal government has beforehand offered its BTC holdings, that is unlikely underneath the Trump administration given the continuing discussions a few Bitcoin reserve.

Bitcoin’s finite provide has attracted advocates who consider shortage enhances worth, with these holding BTC anticipating long-term appreciation.

As President Trump helps Bitcoin and digital belongings as a part of his pro-crypto stance, institutional buyers and Wall Avenue are exploring the feasibility of including Bitcoin to their stability sheets. Trump’s Crypto and AI Tsar, David Sacks, said, “One of many first issues we’re going to take a look at is the feasibility of a Bitcoin reserve.”

Bitcoin Layer 2 protocols

Kevin Liu, founder and CEO of GOAT Community, mentioned technological developments on the Bitcoin blockchain and the way forward for Bitcoin Layer 2 protocols in an unique interview with Crypto.information.

Liu remarked:

“It solely is sensible to supply quite a few methods for that rising variety of customers to have interaction with Bitcoin. Most Bitcoin Layer 2 networks depend on Bitcoin to gasoline their economies, whereas most Ethereum Layer 2s lean on Ether. Completely different choices for various customers.

I do suppose Bitcoin L2s are effectively positioned as a result of Bitcoin is the undisputed king of cryptocurrencies by market cap, mindshare, and almost each different main metric. Since Bitcoin L2s are comparatively new, there’s vital room for progress and novel use instances in comparison with the extra mature Ethereum L2 and alt-L1 markets.”

Liu advised Crypto.information that many massive establishments are actively exploring Bitcoin Layer 2 networks and BTCFi.

“Each establishments and particular person customers don’t need to promote their Bitcoin. They need to put it to work, incomes actual BTC yield. They’ll then use that yield to, say, pay for capital positive factors or on a regular basis bills. If the BTC yield is substantial, there’s potential to cowl day-to-day wants and develop their total holdings.”

Concerning the altcoin season and Bitcoin dominance on this market cycle, Liu mentioned:

“Each bull market has seen Bitcoin dominance surge dramatically in some unspecified time in the future, draining liquidity from most altcoins. That’s largely what’s occurring on this cycle too. How altcoins carry out from right here will decide the general market’s trajectory.

What we are able to say is that BTCFi presents a brand new and thrilling alternative for crypto customers. The power to earn actual BTC yield provides vital potential to maximise returns by means of BTCFi. We goal to play a key position in BTCFi’s progress.”

Whales and establishments don’t need to promote Bitcoin, what to anticipate

Crypto intelligence tracker Santiment predicts an upcoming capitulation in Bitcoin. Capitulation happens when a lot of buyers promote an asset as a result of fears of additional value declines, typically adopted by a restoration.

Santiment analyzed the variety of non-empty wallets on the Bitcoin blockchain and famous a decline, suggesting that retail buyers are offloading their holdings whereas whales and enormous entities proceed to build up BTC.

Within the final three weeks, the variety of non-empty wallets on the Bitcoin blockchain has decreased by 277,240, a major drop in accordance with Santiment.

In the long run, this conduct aligns with “capitulation” and helps a bullish outlook for Bitcoin in 2025.

Bitcoin value forecast for February 2025

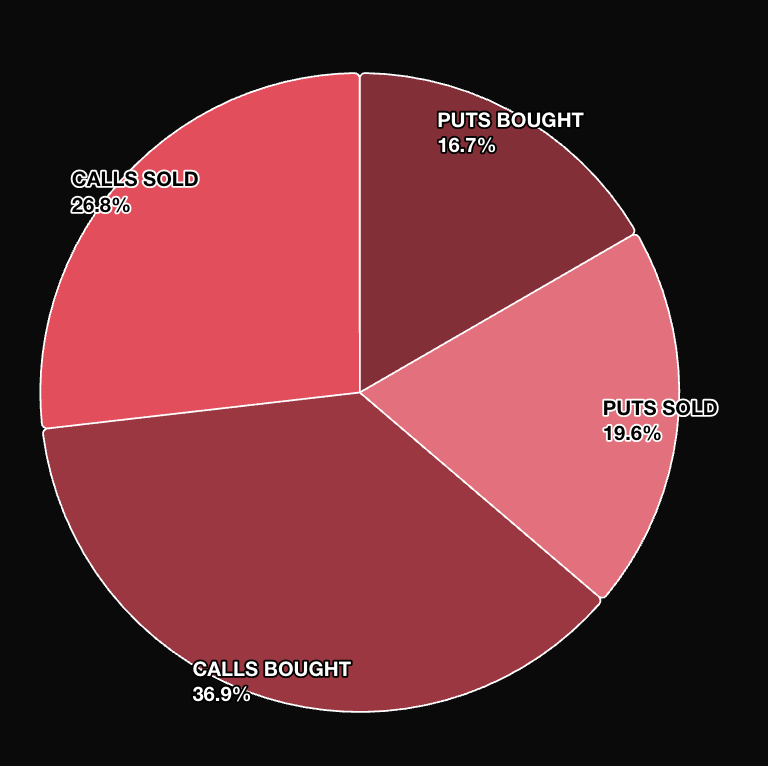

Analyzing derivatives market knowledge from Derive.xyz, 47.3% of all premiums had been calls offered, whereas 24.4% had been calls purchased, indicating merchants anticipate reasonable upside in Bitcoin’s value.

Dr. Sean Dawson, Head of Analysis at Derive.xyz, advised Crypto.information:

“We’re experiencing a short lived lull in volatility because the market recovers from final week’s turbulence brought on by Trump’s tariff bulletins.

BTC At-the-Cash (ATM) 7-day Implied Volatility (IV) dropped 7 share factors—from 47% to 40% during the last 24 hours. BTC’s probability of reaching $125,000 by June 27 has improved to 44.4%, up from 41.9%.”

Dr. Dawson stays optimistic about Bitcoin’s value in each the close to and long run.

To forecast Bitcoin’s value for February 2025, we analyzed the weekly and each day value charts for BTC/USDT. On the each day timeframe, technical indicators counsel a bullish development, with Bitcoin more likely to retest its all-time excessive of $109,588.

The RSI is at 44 and rising, whereas the MACD reveals shorter pink histogram bars, indicating weakening unfavourable momentum.

Bitcoin might face resistance at $100,000, with help ranges at $93,646 and $90,000 on the each day timeframe. The three EMAs spotlight $98,154 (10-day EMA) as a resistance degree and $84,534 (200-day EMA) as key help.

On the weekly timeframe, Bitcoin is 13% beneath its all-time excessive, with a retest seemingly in February 2025. Nonetheless, merchants ought to carefully monitor the value development. Each the MACD and RSI are impartial to bearish, with the RSI at 61 (beneath the “overvalued” zone at 70) and the MACD exhibiting a pink histogram bar beneath the impartial line after weeks of optimistic momentum.

Whereas a correction is feasible, a restoration is probably going, with the $100,000 milestone being a key degree to look at within the coming weeks.