SEC signals lighter crypto regulation

Hester Peirce, a leading figure in the Securities and Exchange Commission (SEC) Crypto Task Force, indicated last week in a Bloomberg interview that many memecoins might not fall under the SEC’s regulatory purview as currently defined. She suggested that while Congress or the Commodity Futures Trading Commission (CFTC) could potentially regulate these tokens, for now, numerous memecoins likely reside outside of the SEC’s jurisdictional reach.

From my perspective, Peirce’s statement clearly implies that memecoin launches, similar to Donald Trump’s initiative, are essentially permitted. Launching a memecoin comes with a reduced risk of SEC investigation or prosecution, signaling a significant departure from the Biden administration and former SEC Chair Gary Gensler’s stricter, enforcement-focused stance.

title=”YouTube video player” frameborder=”0″ allow=”accelerometer; autoplay; clipboard-write; encrypted-media; gyroscope; picture-in-picture; web-share” referrerpolicy=”strict-origin-when-cross-origin” allowfullscreen=””>

When questioned about the future regulatory body for digital currencies – SEC or CFTC – Peirce gave a vague response. She stated, “We are evaluating our jurisdiction, identifying regulatory gaps, and bringing these to the attention of Congress.” Essentially, she deferred clarity on digital asset regulation, suggesting potential Congressional intervention might be necessary, particularly when enforcement responsibility remains undefined.

This current administration, which pledged enhanced regulatory clarity for digital assets, now appears to be adopting a more lenient approach. With Peirce, recognized for her crypto-friendly views and leadership of the Crypto Task Force, a less aggressive approach seems likely regarding enforcement actions, regulatory oversight, and reporting obligations for digital asset companies, possibly even becoming negligible.

Federal Reserve Begins to Accommodate Digital Asset Banking

JUST IN: 🇺🇸 Fed Chair Jerome Powell says the Federal Reserve won’t block banks from serving legal crypto customer.

— Watcher.Guru (@WatcherGuru) February 12, 2025

Parallel to the SEC’s apparent shift away from stringent digital asset enforcement, the Federal Reserve is also moving towards a more neutral position. Fed Chair Jerome Powell has affirmed that the Federal Reserve will permit banks to cater to crypto businesses that operate within legal boundaries. Although not explicit endorsement, this marks a distinct change from the Fed’s previous stance of actively discouraging bank involvement with digital asset firms.

Previously, the Federal Reserve had denied federal banking charters to institutions involved with digital assets, citing concerns about fraud, instability, and regulatory ambiguities. They also implemented stringent oversight measures, such as the Novel Activities Supervision Program, which imposed stricter compliance standards on entities servicing digital asset businesses or engaging in blockchain/digital asset-related activities.

Now, Powell’s comments suggest a shift in the Fed’s posture from negative to neutral. It seems the Fed will likely not impede a bank’s decision to serve digital asset businesses, provided they maintain compliance.

While market participants may react positively to this news, the broader industry implications beyond immediate price increases are less discussed. This shift, coupled with the SEC’s hands-off approach, could trigger a surge of traditional banks expanding into digital asset services. This expansion may disrupt the established market position of entities like Coinbase (NASDAQ: COIN). If major banks enter the digital asset arena, leveraging their substantial resources and competitive pricing enabled by scale, smaller, digital asset-native companies could face challenges in customer retention and subsequently lose market share to traditional financial institutions.

JUST IN: World’s largest custodian bank State Street & Citi bank to launch crypto custody services.

— Watcher.Guru (@WatcherGuru) February 14, 2025

Robinhood’s Profit Surge Fueled by ‘Crypto’ Trading Boom

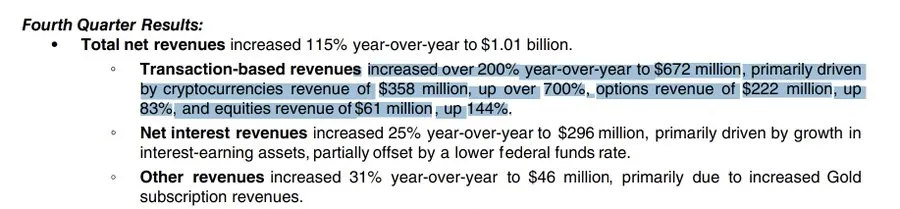

Robinhood (NASDAQ: HOOD) released an earnings report that surpassed analyst forecasts, reporting $0.54 earnings per share, significantly higher than the projected $0.42. Digital assets emerged as a primary growth catalyst for Robinhood in Q4 2024.

Revenue from Robinhood’s digital asset division exceeded its equities division by over six times, emphasizing the platform’s significant reliance on digital asset trading for its financial success. Robinhood’s prosperity is closely tied to the ‘crypto’ market’s performance. Market downturns, like that of 2021-2023, negatively impact the trading firm’s revenue.

This underscores a key aspect of consumer behavior: the preference for unified investment platforms. Initially, digital asset investors needed dedicated platforms. Now, mainstream financial service providers like Robinhood are integrating digital assets, simplifying the process for users to manage both stock and digital currency trading in one place.

As more traditional banks and investment firms receive regulatory clarity for engaging with digital assets, a market shift from digital asset-native exchanges towards well-established financial institutions may occur. This leads back to a critical question: Can original digital asset businesses effectively compete with conventional financial institutions, especially given the latter’s improved regulatory standing, greater customer trust, and stronger financial resources, and begin to offer comparable services?

Is ‘Crypto’ Entering a New ‘Wild West’ Era?

Considering the SEC’s relaxed position on memecoins, the Fed’s non-intervention policy toward banks serving digital asset clients, and Robinhood’s earnings dependence on digital assets, some trends are apparent. ‘Crypto’ is becoming increasingly intertwined with traditional finance, and regulatory bodies appear to be taking a more passive role, potentially overlooking activities that previously faced stringent scrutiny.

While this development will likely benefit crypto investors, it raises concerns about how these agencies will address the inevitable illicit activities that arise with financial opportunities. Furthermore, questions arise about the impact on everyday consumers who, seeking quick returns, may suffer significant losses from scams like ‘rug pulls’. Finally, the combined effect of these factors on traditional financial institutions entering and expanding within the digital asset industry warrants consideration.