CBDC Rollouts Delayed Globally

-

Central banks face mounting delays in CBDC issuance: report

A recent study indicates that while a significant majority of central banks globally are interested in launching central bank digital currencies (CBDCs), a growing number are experiencing postponements in their launch plans due to unforeseen challenges.

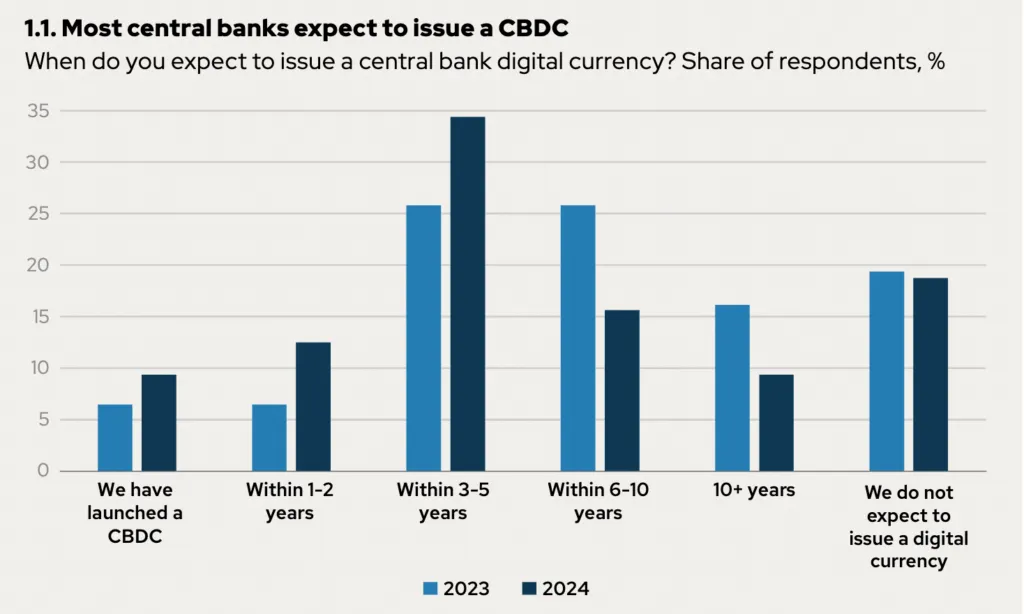

The report from the Official Monetary and Financial Institutions Forum (OMFIF) revealed that 48% of surveyed central banks anticipate issuing a CBDC within the next 3 to 5 years. Interestingly, 12% are targeting a launch in the next two years, doubling the proportion compared to the findings in 2023.

In general, there has been a slight decrease in the overall number of central banks planning to introduce a CBDC. However, the segment of those aiming for a launch within the next five years has actually increased.

OMFIF’s research highlighted that emerging economies are demonstrating a stronger drive towards CBDC implementation compared to developed nations. Approximately 20% of central banks in developing countries foresee a CBDC launch within the coming two years, whereas no developed countries anticipate a launch within the same timeframe.

The study also indicated that the majority of central banks have already made a decision concerning CBDC adoption, with the percentage of countries not interested in digital currencies remaining stable at 19% for the past couple of years.

Nevertheless, despite their continued interest in CBDCs, some central banks are adjusting their projected timelines. OMFIF’s findings reveal that 31% of surveyed banks have postponed their issuance plans, while only 10% have expedited them. The primary reasons for delays are the absence of necessary legal frameworks and the consideration of alternative solutions to digital currencies. Banking officials acknowledged that legislative approval is a critical factor as lawmakers hold the ultimate authority on whether central banks can issue a digital currency.

On a global scale, CBDCs have become a politically sensitive topic, impacting the likelihood of swift implementation. Certain political groups, such as Republicans in the U.S., have voiced concerns that CBDCs could be used by governments to monitor citizens’ spending habits and limit individual financial freedom. Such political viewpoints have overshadowed the technical and economic advantages of CBDCs and turned them into a partisan issue.

However, the report emphasizes that different types of CBDCs face varying levels of difficulty. Retail CBDCs are encountering more significant hurdles compared to wholesale CBDCs. Among those who reported delaying their issuance schedules, retail CBDCs were disproportionately represented, which aligns with previous conclusions from the Bank for International Settlements (BIS).

The research also identified that offline payment capability is the most crucial CBDC feature for central banks, surpassing privacy concerns. Instant payment settlements and programmability are also highly prioritized, although programmability has sparked controversy due to concerns that it might grant central banks excessive control over citizens’ funds.

What is the future of CBDCs after Trump’s opposition to a digital dollar?

Donald Trump has been a vocal critic of a potential digital dollar. Consequently, it was not unexpected that among his first executive orders as the newly inaugurated president, one explicitly forbade U.S. federal agencies from “taking any steps to establish, issue, or promote CBDCs.”

The prospect of a digital dollar appears to be effectively halted, at least for the duration of Trump’s presidency and Republican control of Congress. Any remaining hopes were dashed when Federal Reserve Chairman Jerome Powell stated before the Senate that no CBDC would be developed during his tenure.

The U.S. government’s position has caused divided reactions. Supporters argue that it was a necessary step after years of ambiguity from the Fed regarding its intentions to pursue a digital dollar. Others have noted that it simply formalized the widely understood fact that the Fed was not interested in a retail CBDC.

However, critics contend that the broader implications will be substantial, particularly regarding America’s leadership in financial technology.

“The most important consequence of the executive order is the message it sends globally. It signals to Europe that they are now in a position to independently define privacy and cybersecurity standards for the digital euro,” commented Josh Lipsky, head of the CBDC tracker at the Atlantic Council.

Lipsky also expressed concern that China could now become the undisputed global leader in CBDCs, potentially influencing other nations to look to China for guidance and standards. China possesses the most advanced CBDC among major economies with its digital yuan.

Trump’s order also raised questions about whether the prohibition extends to wholesale CBDC solutions and other currency tokenization projects involving the Fed. One such project is Project Agora, led by the BIS, which focuses on the tokenization of bank deposits.

In a recent statement, Federal Reserve Governor Christopher Waller distanced Project Agora from CBDC connections, clarifying that the project is solely aimed at discovering more efficient methods for trading bank reserves.

Waller further emphasized the Fed’s shift away from CBDCs, stating, “we have completely stopped using this term [CBDC].”