CryptoQuant: RLUSD Market Cap Surpasses $120M

Ripple’s dollar-pegged stablecoin, RLUSD, has achieved a significant milestone.

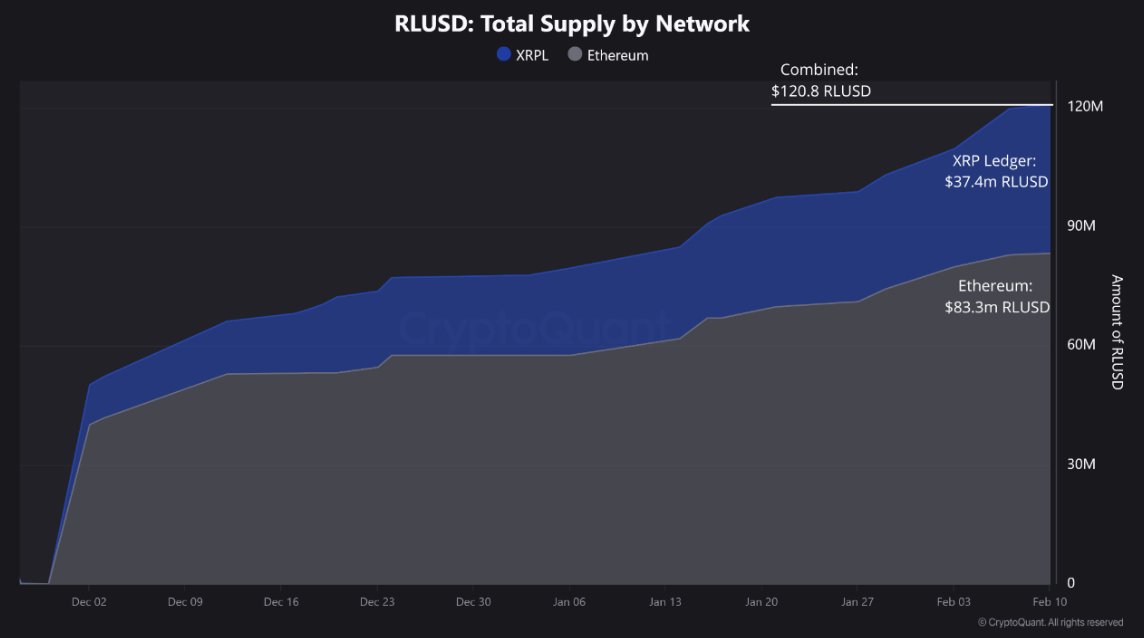

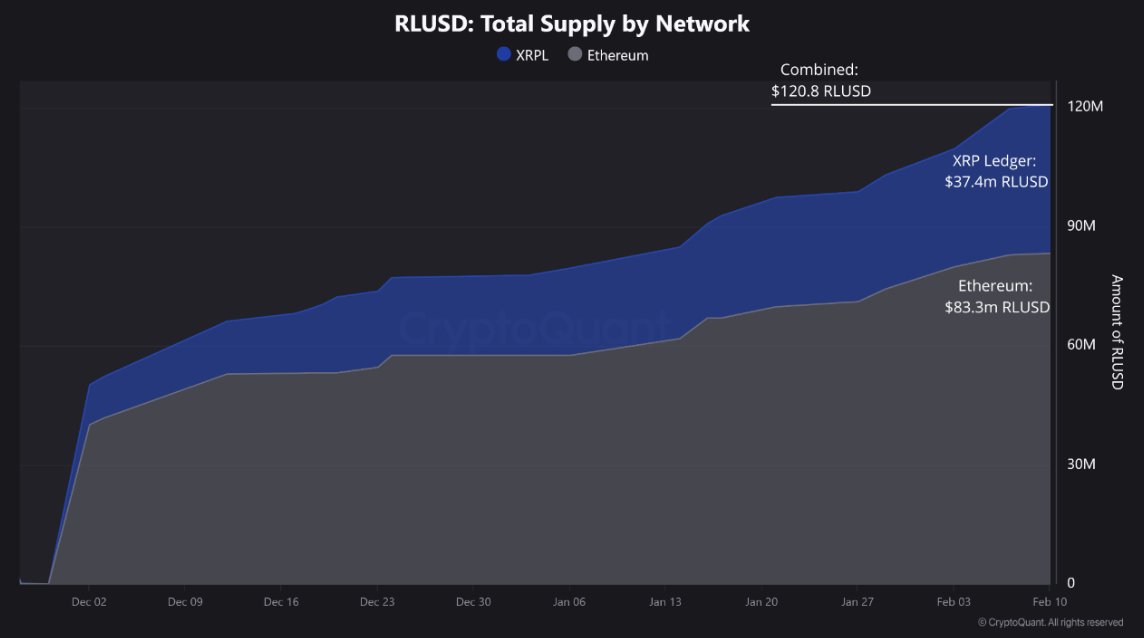

According to a recent analysis from CryptoQuant, a leading cryptocurrency analytics platform, RLUSD’s total supply has reached $120 million. CryptoQuant’s analyst J.A. Maartunn’s report emphasizes that RLUSD has reached this supply level within just two months of its launch, demonstrating increasing adoption. The current total supply of the stablecoin is approximately $120.8 million.

The analyst pointed out that Ethereum holds the majority of the supply, with around $83.3 million RLUSD residing on the network, while the XRP Ledger accounts for approximately $37.4 million RLUSD.

However, Maartunn highlighted that the XRP Ledger has been the primary driver of supply growth in recent weeks. In contrast, RLUSD supply growth on Ethereum has stabilized after an initial surge in the initial weeks, indicating a change in demand trends.

Maartunn suggested that the shift in demand is due to the cheaper transaction fees on the XRP Ledger compared to Ethereum. The growing integration of RLUSD within the XRPL’s decentralized finance (DeFi) ecosystem is also likely a contributing element. Current xpmarket data indicates the presence of 80 liquidity pools utilizing the stablecoin.

This supply achievement follows the stablecoin previously reaching 100,000 transactions earlier this month. Reflecting the increasing demand on the XRP Ledger, 95% of RLUSD transactions were executed on this network at that time.

Despite these accomplishments, RLUSD remains significantly smaller than market leaders such as Tether and Circle. Their primary stablecoins, USDT and USDC, possess market capitalizations of $142 billion and $56 billion, respectively.

However, many predict that RLUSD’s position could change if major exchanges like Binance and Coinbase offer greater support. Furthermore, Ripple has not yet incorporated RLUSD into its primary payments business operations.

RLUSD is anticipated to enhance XRP’s liquidity and boost DeFi activity by offering a straightforward entry point for participants and a stable valuation reference for services like lending.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.