Network Downtime and Price Hikes

Solana’s very own token, SOL, has unfortunately found itself among the cryptocurrencies struggling the most recently. Once hailed as a favorite within the meme coin community, this well-known blockchain is now facing a serious challenge, grappling with a significant price plummet and a noticeable decrease in network activity.

Currently, SOL is trading around $173. However, if you check the numbers, it’s dipped almost 10% compared to last week’s price, and a further 15% from where it stood just two weeks prior. Taking a broader look at its price history, the token has actually fallen by a substantial 27.5% over the past month.

Related Reading

Just last Tuesday, Solana experienced a sharp 10% drop in a single 24-hour period, which understandably sparked worries amongst both current holders and those invested for the long haul. According to on-chain data, part of this token downturn appears to be linked to the rocky launch of LIBRA, which is currently under scrutiny. LIBRA’s price collapse shortly after its debut seems to have triggered panic, particularly amongst meme coin enthusiasts, and SOL unfortunately got caught in the fallout.

Network Activity Takes a 55% Plunge with Low Volume

Solana’s current difficulties extend beyond just recent price fluctuations. Data shared by crypto analyst Ali Martinez indicates that activity on the Solana network is slowing down considerably. A post on Twitter/X from February 17th highlighted a significant drop in active addresses on the network, falling to 8.4 million today, down from a high of 18.5 million back in November 2024. This 55% decrease is a worrying signal, potentially indicating that developers are leaving the platform in significant numbers.

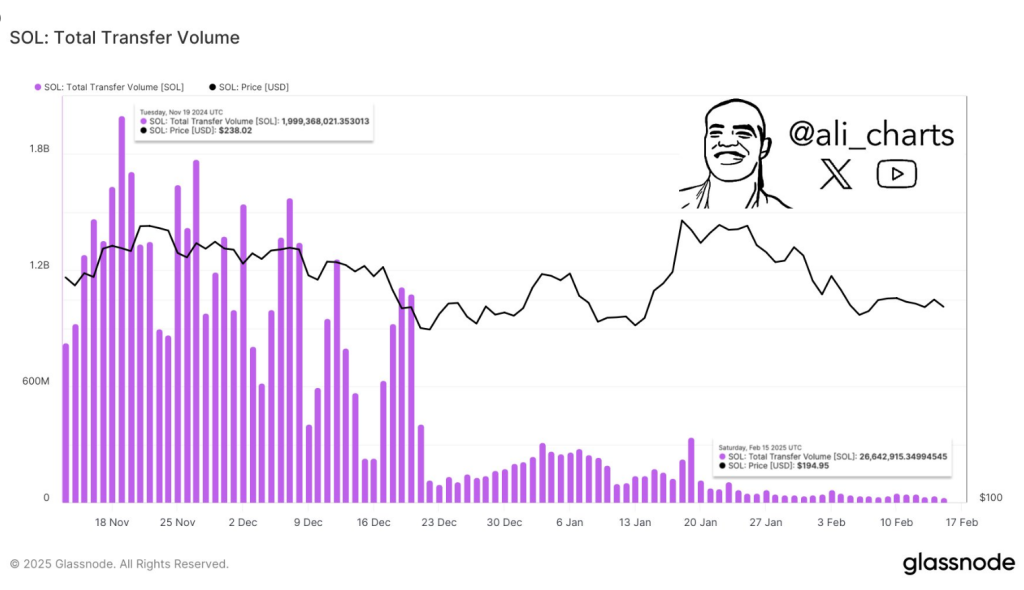

Adding to these concerns, the total volume of assets transferred on the network has also plummeted dramatically, from $2 billion in November to a mere $26 million this week. This massive 99% drop really underscores a loss of momentum for the project.

The total volume transferred on the #Solana $SOL network has dropped from $2 billion in November to just $26 million today! pic.twitter.com/qgCOmjd2It

— Ali (@ali_charts) February 17, 2025

More Headwinds on the Horizon for SOL

Cryptocurrency analysts are preparing for potentially tougher times ahead for SOL in the coming weeks. Over the next three months, a substantial amount of around 15 million SOL tokens, valued at a hefty $7 billion, are scheduled to be unlocked. When you factor in the existing 4.715% inflation rate, this influx of new SOL tokens into the market is likely to create increased selling pressure.

While SOL is currently showing a slight upward tick, its price remains considerably lower than its previous high. The token is still down 27.5% compared to last month, despite holding a significant market capitalization of around $84 billion. Now, both industry insiders and investors are pinning their hopes on the possibility of spot SOL ETFs being approved in the near future.

Could SOL Meme Coins Be Next to Suffer?

The price performance of SOL previously received a boost from the explosion of newly created meme coins on the Solana platform. However, the creation of new tokens on the platform has significantly slowed down over the past few months. Solana, once the go-to platform for those in the DeFi space and developers, largely due to its speedy transactions and low fees, is seeing this appeal wane.

Recent events have taken a toll on the platform’s reputation, particularly the launches of SOL-based meme coins like MELANIA and LIBRA, which haven’t exactly gone smoothly.

Related Reading

Take LIBRA, for instance. It launched with significant hype, even with Argentine President Javier Milei sharing a post and seemingly endorsing the project. However, just minutes after his public endorsement pushed the token’s price past $5, it instantly crashed. This led many to label it a textbook example of a “rug-pull.” Adding another layer to the story, MELANIA also appears to be connected to LIBRA, with some analysts suggesting they might even share the same development team.