Altseason Watch: Ethereum’s $2,600 Test – Analyst Opinion

- February saw crypto markets continue their slide, with ETH dropping to $2.3K.

- Altcoins struggled to gain momentum as Bitcoin’s dominance in the market grew.

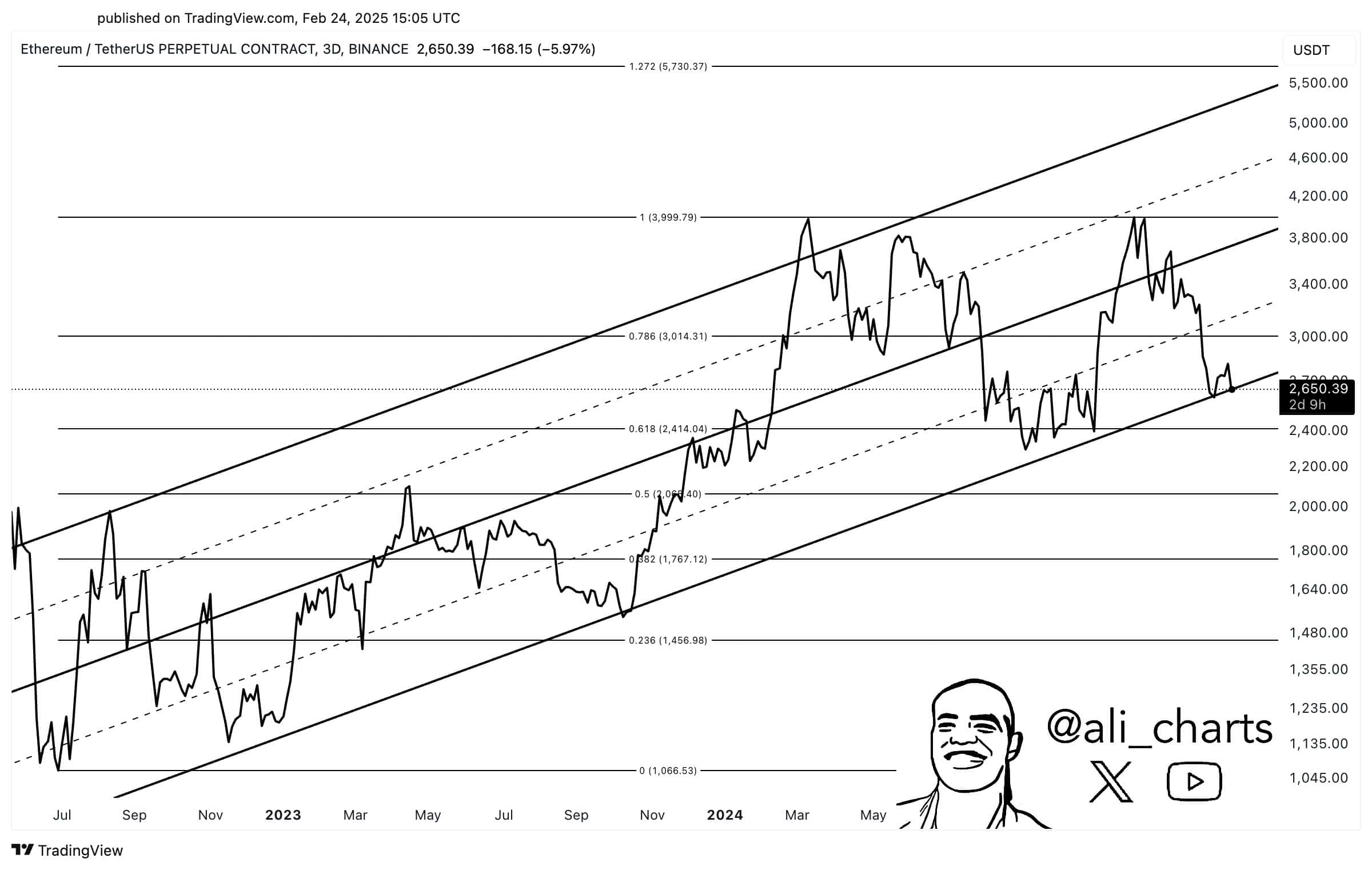

February 25th brought more turbulence for crypto, as Ethereum [ETH] took another downturn, falling to $2.3K. This drop pushed it below the critical $2.6K mark, a level that crypto analyst Ali Martinez had warned could potentially “cancel altcoin season.”

According to Martinez’s analysis, this breach of Ethereum’s long-term upward trendline could indicate a shift in ETH’s market structure, casting a shadow over the broader altcoin market.

“If #Ethereum $ETH can’t hold $2,600, altseason is off the table!”

Source: X

Altcoin season status

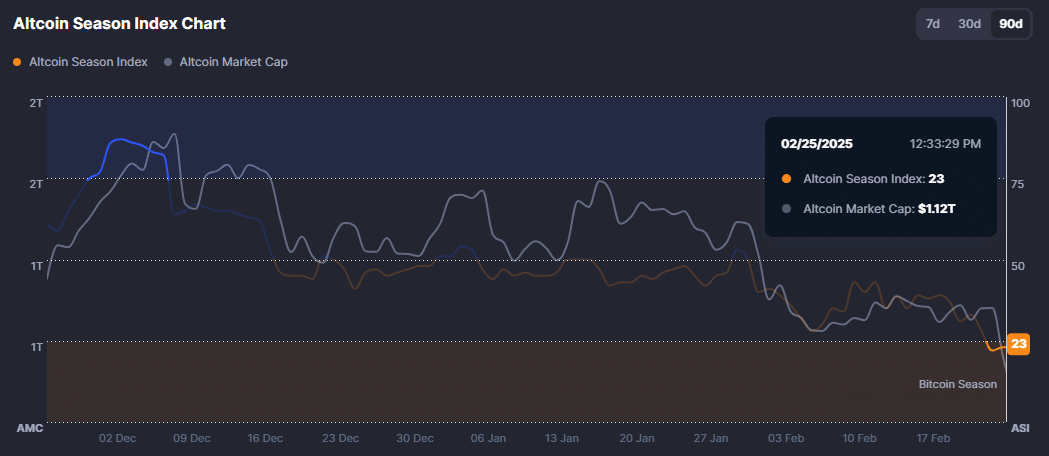

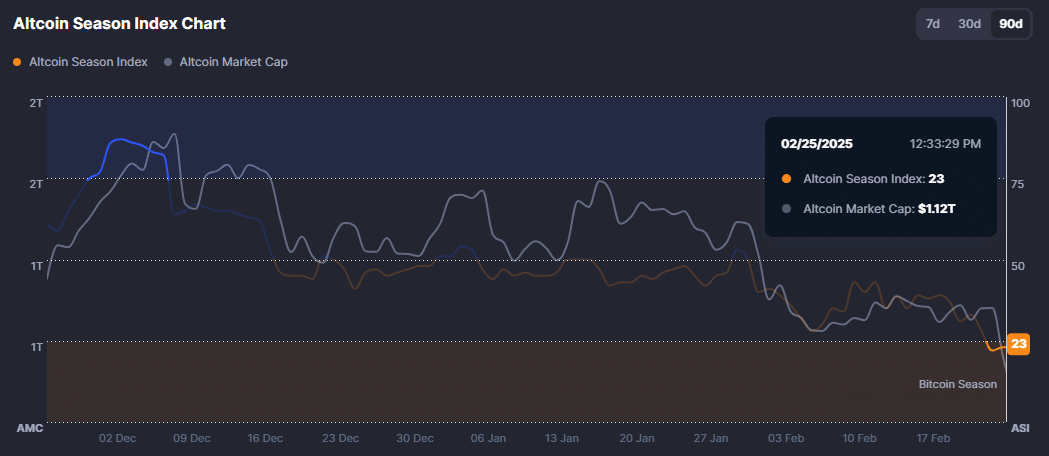

The altcoin market experienced further pain in the last 24 hours, losing another $160 billion in market capitalization. This brought the total market cap down from $1.28 trillion to $1.12 trillion.

Since reaching a peak last December, the altcoin sector has now seen over $590 billion wiped out amidst ongoing bearish market conditions.

Source: CoinMarketCap

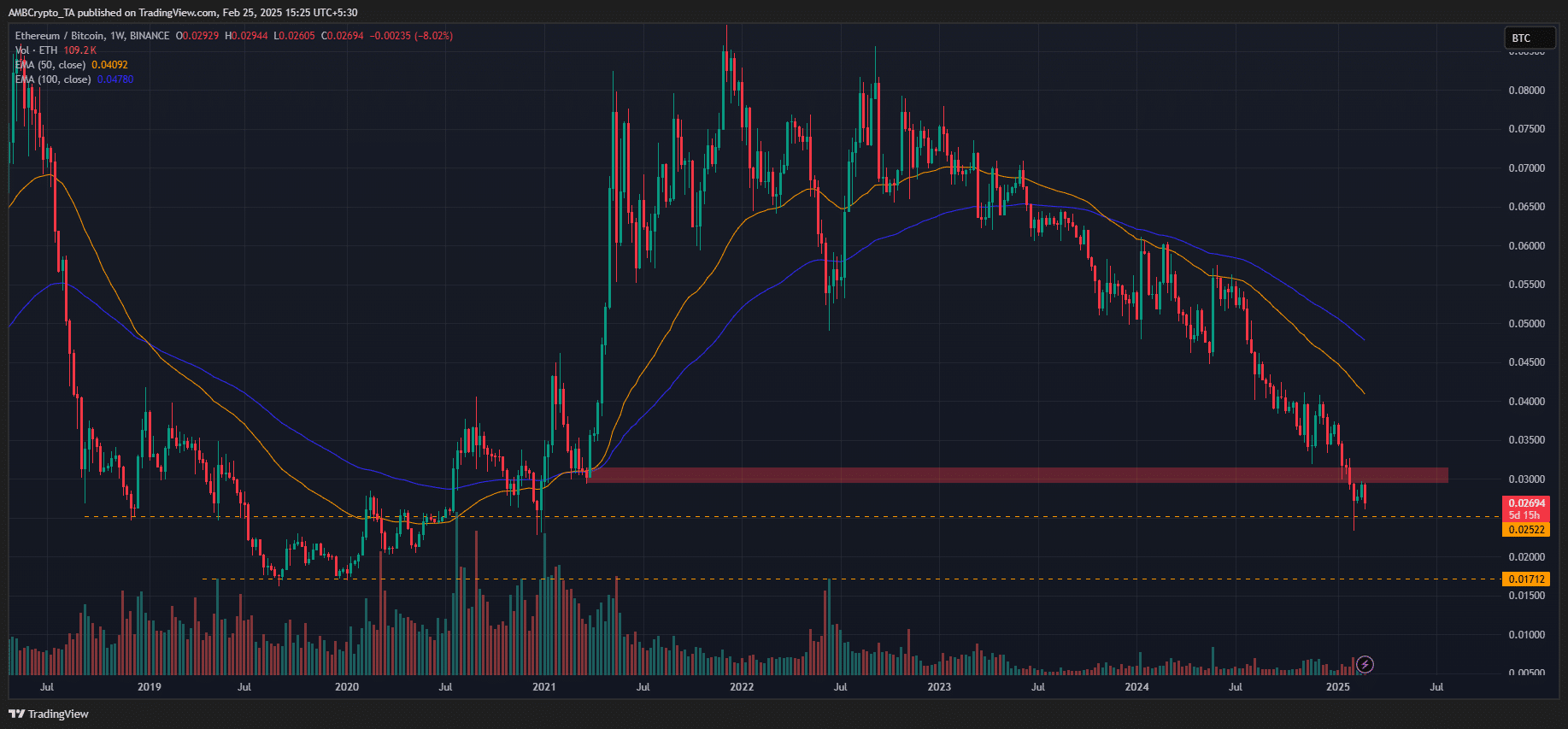

Even the ETH/BTC ratio, often watched as a gauge of altcoin strength relative to Ethereum, hasn’t yet found a stable bottom.

This ratio has plummeted by 68%, reaching levels not seen in five years.

Source: ETH/BTC ratio, TradingView

Unlike a brief recovery in late 2024 that fueled the November altcoin surge, this ratio hasn’t shown signs of a robust rebound in 2025. This lack of momentum could temper expectations for a strong altcoin season.

However, Ki Young Ju from CryptoQuant pointed out a positive trend: addresses holding substantial amounts of ETH ($10K-$100K) have jumped by 24% over the past year.

Furthermore, with an average purchase price around $2,199, sustained recovery for ETH may hinge on its ability to stay above the $2.2K level.

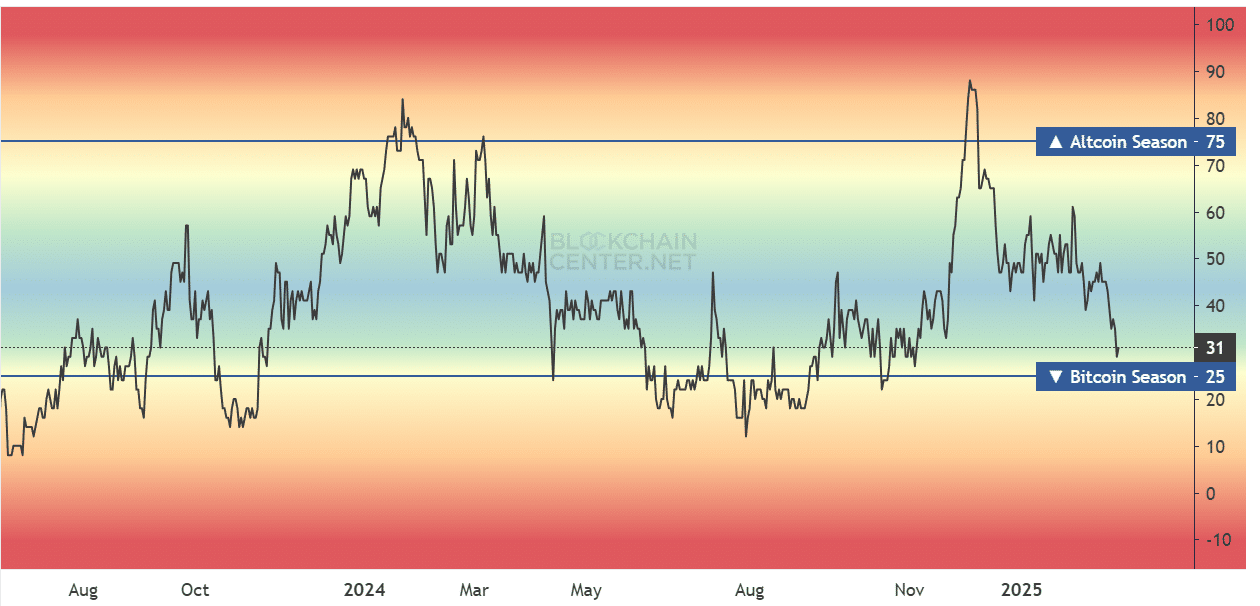

Despite these glimmers of hope, the altcoin season index currently sits at 31, firmly indicating a “BTC season” where Bitcoin is outperforming altcoins.

Source: Blockchain Center

Adding to the challenging outlook for altcoins, Bitcoin’s dominance has climbed over 2% in the past week, rising from 60% to 62%. This increasing dominance could further restrict any potential short-term recovery for altcoins.

Interestingly, amidst this widespread bearish sentiment, a few altcoins bucked the trend, posting double-digit gains. Among the top performers for the week were Story [IP], Maker [MKR], Sei [SEI], and Berachain [BERA].

On the other end of the spectrum, Raydium’s RAY token was hit hardest, plummeting 46%. This downturn was likely exacerbated by the launch of Pumpfun’s automated market maker (AMM) for its token offerings.