Whale Alert: Chainlink Rally at Risk After $27M Transfer

The crypto market’s recent rollercoaster ride has shaken things up, and tokens are feeling the turbulence. A prime example? Chainlink (LINK) saw a sharp 30% drop recently. But here’s an interesting twist: even in this shaky market, LINK’s chart is showing some fight, bouncing back by 8.6% today and giving investors a bit of hope. However, just as we see a potential pick-me-up, a big player – a whale – has sent $27 million worth of LINK to a crypto exchange, immediately sparking worries about a possible sell-off. Can this altcoin keep its momentum going? Let’s dive into the details.

Chainlink Price Recovery or Whale Dump on the Horizon?

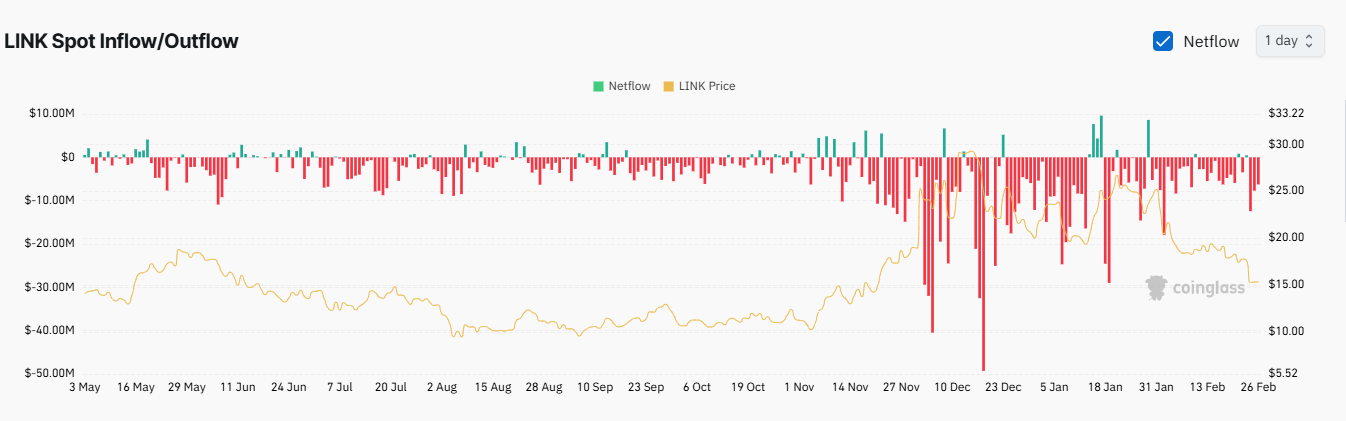

On-chain data is telling us that whales are indeed making moves with this altcoin, possibly gearing up for a sale. Recently, over 600,000 LINK tokens have been transferred to crypto exchanges. This influx is definitely contributing to growing selling pressure on the token. Furthermore, it could signal that investors are becoming less confident in LINK.

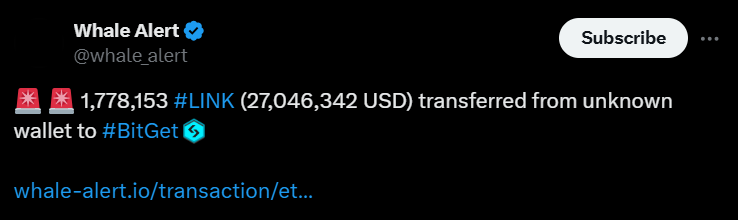

But it might get even more serious. A single whale made a massive deposit of 1.77 million Chainlink tokens, valued at a cool $27 million, on the BitGet exchange. While the exact reasons behind this move are unknown, large transfers like this are often interpreted as a sign that someone is planning to sell. If this whale decides to offload their tokens, it could really push the price downwards.

This is a key concern because Chainlink’s price has only managed a modest 8.6% recovery today. Currently trading at $15.49 with a market cap of $9.87B, LINK remains vulnerable, and this whale activity adds another layer of potential risk for price declines.

Trading Volume Trying to Recover, But Bearish Sentiment Still Lingers

Even with the slight price bump, LINK’s trading volume has barely ticked up after a crash earlier in the day. It’s currently at $626.24M, but it’s not showing the robust activity needed to truly fuel a recovery, which is limiting its potential for growth.

More importantly, open interest, a key gauge of trader engagement, hasn’t bounced back strongly from the recent drop and is still sitting at a low $464.09M.

Looking at the long/short ratio, at 1.0471, we see that nearly half of the traders are actually betting against LINK, anticipating further price drops. Overall, these factors paint a picture of persistent bearish sentiment and ongoing struggles for Chainlink to regain its footing.

Chainlink: Crash Incoming?

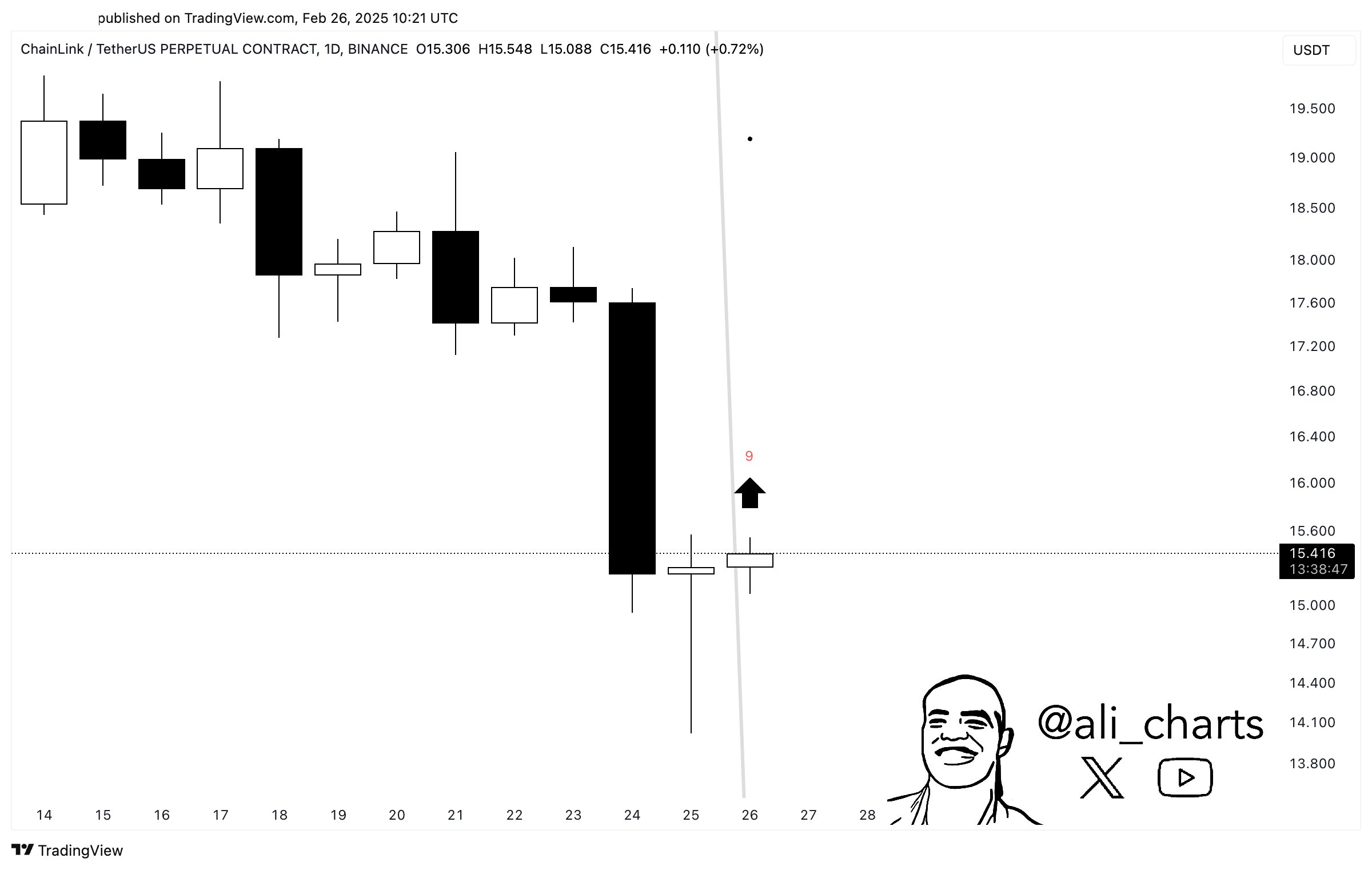

Crypto analyst Ali Martinez is pointing out a potential silver lining: the TD Sequential indicator is flashing a buy signal. Historically, this can suggest a trend reversal after a period of decline. So, there’s a possibility that LINK could see some upward movement, but it will definitely need additional positive factors to confirm this potential shift.

Furthermore, the technical indicators for LINK are currently sending mixed signals, adding to the uncertainty. The critical support level to watch is around $15.4. If LINK falls below this, we could see further downward pressure. However, if it manages to break above $16, analysts’ Chainlink price predictions suggest a potential climb towards $20.

Should You Be Concerned?

The crypto market is known for its ups and downs, and seasoned crypto investors usually don’t panic over minor price swings. LINK token is currently at a critical juncture where its next move could really define its path – it could drop to $12 or bounce back up to $20. The appearance of the TD Sequential indicator offers a glimmer of hope that things might turn around for the better. However, investors should definitely keep a close eye on the market and look for more solid bullish signals before making any decisions.