Bitcoin Rebound? Panic Selling Follows 10% Drop

- Here’s some potentially good news: recent analysis indicates Bitcoin might be gearing up for a market rally after the shake-up from recent panic selling.

- Interestingly, we’re seeing buying activity slowly pick up, which adds weight to the idea of a potential rebound.

It’s been a tough week for Bitcoin [BTC], with the cryptocurrency experiencing a notable 10.77% dip. That’s actually the biggest drop it’s seen in the last month.

And the downward trend didn’t stop there. In the last 24 hours, Bitcoin slid another 2.38%, signaling what appears to be the first significant market capitulation we’ve seen since August 2024.

However, looking back at historical patterns, this could actually be setting the stage for a substantial price recovery. Some data suggests that if buying interest returns, we might even see Bitcoin aiming for new highs before long.

Short-term holders: Why they’re key to any rally

When we talk about market movements, the reactions of short-term holders (STH) are really important. They often play a decisive role in which way the market swings.

In situations like the one we’re in now, digging into the STH-SOPR (Spent Output Profit Ratio) becomes crucial. This indicator helps us understand if these short-term holders are taking profits or selling at a loss. Pairing this with Bollinger Bands, a tool that helps spot when the market is potentially overbought or oversold, can give us valuable clues about where prices might head next.

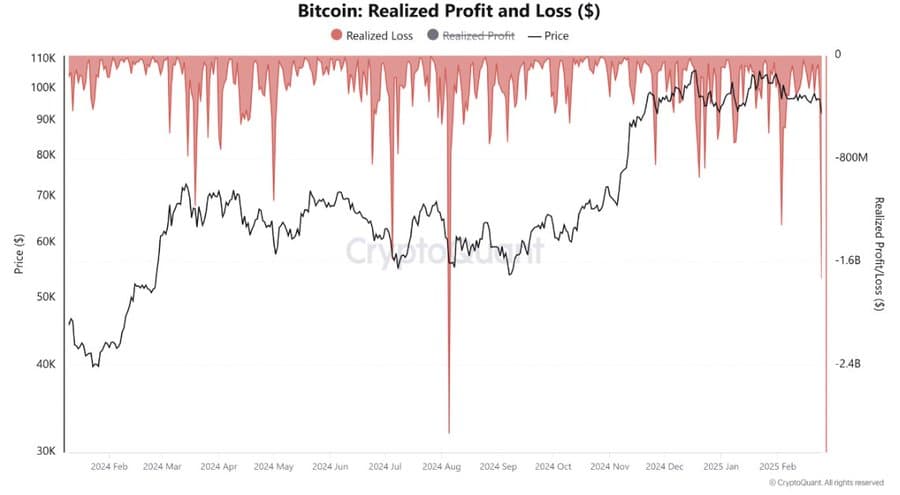

Source: Cryptoquant

Looking at past instances, whenever the STH-SOPR dips below the lower Bollinger Band – you can see this marked by the red circle on the left of the chart – Bitcoin often stages a powerful rally, quickly making up for lost ground.

Historically, these rallies have seen gains anywhere from 8% to a significant 42%. Right now, Bitcoin finds itself in this very situation. If history is any guide, we could be looking at a noticeable upward bounce for Bitcoin, potentially leading to even greater gains.

Opportunity ahead despite major capitulation

Bitcoin just experienced its largest market capitulation in 2025, and the first major one since August of last year. Much of this selling pressure came from newer investors in the market.

This wave of selling resulted in a substantial 79,000 BTC being dumped onto the spot market. Adding to the pressure, around $1.7 billion in derivative contracts were also liquidated. This combination pushed Bitcoin’s price below the $90,000 mark for the first time in three months.

A closer look at the chart reveals something interesting: after the major capitulation in August (look for the red cloud reaching its lowest point on the left), Bitcoin’s price (the black line) started a steady climb upwards.

Given that we’ve just seen a similar event in the last 24 hours, Bitcoin now has a very real possibility of making a sharp move to the upside.

Source: Cryptoquant

However, whether this rally actually happens hinges on buying interest from traders. But here’s a positive sign: AMBCrypto’s analysis is starting to detect increasing bullish vibes in the market.

Buying activity is building up

The feeling that things are turning bullish is gaining momentum. Just in the last four hours, we’ve seen a massive $11.59 million worth of short positions liquidated. Compare that to a mere $663,900 in long liquidations, and you see a big difference.

When short liquidations are significantly higher than long liquidations, it’s a strong indication that the market is pushing against those who were betting on prices to fall (sellers). In this case, with short liquidations outweighing longs by a factor of 17.4, it’s pretty clear that buying activity is picking up pace.

Data from funding rates, another useful market gauge, reinforces this idea that buyers are in control. A positive funding rate of 0.0039% supports the trend.

So, if this increase in buying activity keeps up, Bitcoin could be poised for a significant price jump in the weeks ahead.