Bitcoin Plunge Below $80K: Why and What’s Next?

- Bitcoin’s price took a 5% dive, and here’s why: a mix of regulatory worries, some big players shifting their positions, and ongoing security jitters in the crypto world.

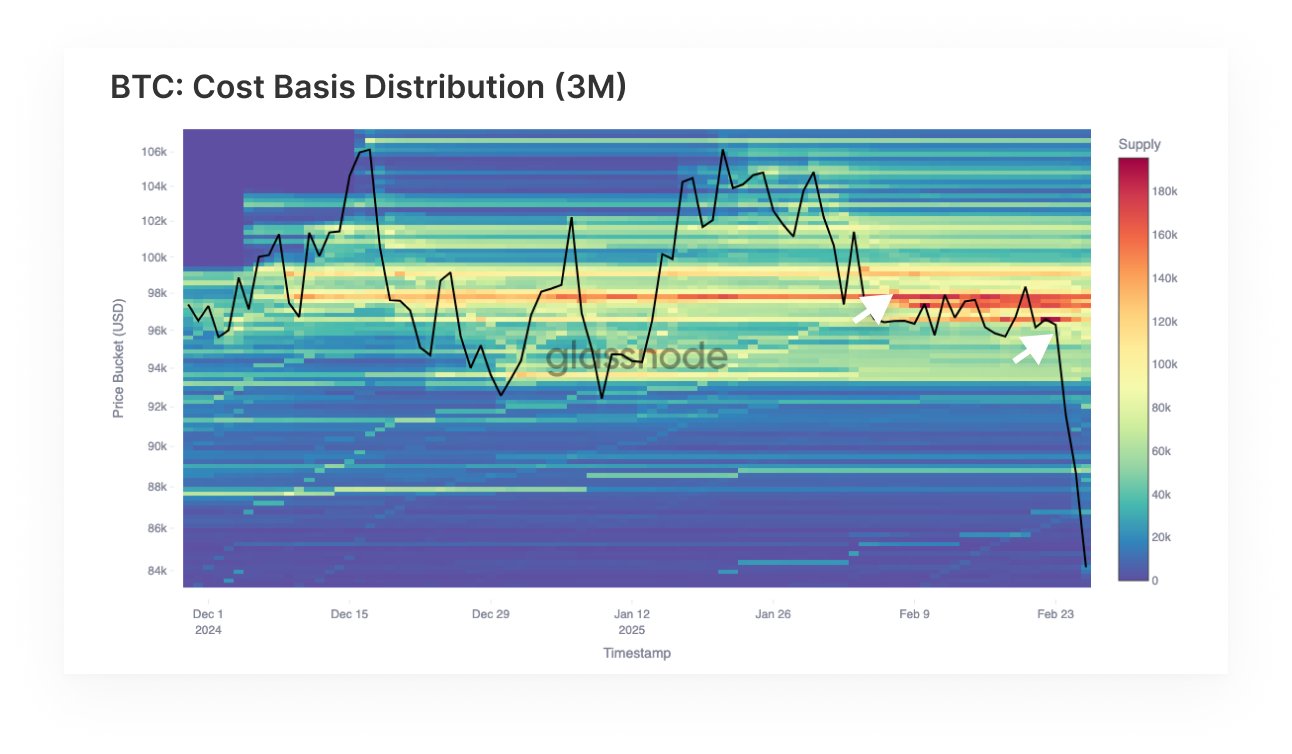

- But here’s a silver lining: even with the dip, folks are still buying in. We’re seeing new areas of interest pop up between $84K and $92K, suggesting people are still keen on BTC.

Bitcoin [BTC], you know, the king of crypto by market size, has definitely seen better days recently. It’s taken a noticeable hit, dropping over 5% and hitting its lowest point in about three and a half months.

As of February 28th, Bitcoin was trading under $80,000 – a level it hadn’t seen since way back on November 11th, 2024.

What’s behind this slump? Well, a few things. For starters, there’s uncertainty swirling around U.S. President Donald Trump’s upcoming decisions on tariffs and crypto regulations. Adding fuel to the fire, investor confidence took a knock after a massive $1.5 billion hack involving Ethereum [ETH]. Ouch.

Factors contributing to the Bitcoin slide

Let’s break down the main reasons why Bitcoin’s been on this downward trend:

Policy Uncertainty: President Trump’s announcement about slapping a 25% tariff on imports from Canada and Mexico, starting March 4th, has really thrown the global markets into a bit of a spin.

This policy move has got people wondering about potential inflation and what it means for the economy. Naturally, investors are rethinking their positions in anything seen as risky, and that definitely includes cryptos like Bitcoin.

Security Breaches: If market confidence was already shaky, it got another big jolt from a massive security breach. Hackers managed to snag around $1.5 billion worth of ETH right out of the Bybit exchange.

This incident, which is being called the biggest crypto heist ever, has made everyone even more nervous about how safe digital assets are, and the platforms holding them.

Investor Sentiment: Remember all that excitement after President Trump’s election? The market was buzzing with hopes for crypto-friendly rules. Well, that initial buzz has faded quite a bit.

The fact that we haven’t seen any solid policy moves yet, like that rumored strategic Bitcoin reserve, has cooled down the market hype that was pushing prices up before.

Insights into investor behavior

Despite the recent price drops, data from the blockchain actually tells an interesting story of investors still jumping in to buy Bitcoin:

September to October 2024: Back then, we saw a lot of buying action happening in the $60,000 to $67,000 price range.

People who bought in at those prices seem to be holding on tight to their coins, showing they really believe in Bitcoin for the long haul.

Source: Glassnode

December 2024 to February 2025: More recently, a new buying zone has popped up between $96,000 and $98,000.

While some of these buyers have started to sell off a bit, there’s still a pretty dense cluster of supply here, which could mean it becomes a tough resistance level if prices climb back up to this area again.

Looking at the shorter term, we’re also seeing new areas of demand forming between $84,000 and $92,000. The big question now is whether this fresh demand is strong enough to fight back against all the selling pressure we’re seeing.

Analyzing the institutional involvement

Big institutions getting involved in Bitcoin has been a major factor in how the price moves:

Strategy’s Aggressive Acquisition: Remember MicroStrategy? Well, now they’re called Strategy, and they’ve gone on a Bitcoin buying spree, adding almost $2 billion to their holdings! They now have around 499,096 bitcoins in total.

This super aggressive buying strategy really highlights that some big institutions are seriously confident about Bitcoin’s future value.

Market Volatility Concerns: Even with these big endorsements, many institutions are still playing it cool and staying cautious. Things like uncertain policies, security worries, and the market’s ups and downs are making some potential big investors hesitant to jump in.

Bitcoin’s future outlook

The crypto market is at a turning point, being pushed and pulled by policy decisions, security fears, and how investors are feeling:

Regulatory Developments: Everyone’s watching closely to see what the Trump administration will do with digital asset policies. Clear and supportive rules could really boost investor confidence and maybe even turn things around from the current downturn.

Market Sentiment: Yes, there’s short-term volatility, which can be tough. But, the fact that we’re seeing these patterns of people still accumulating Bitcoin suggests that a good chunk of investors are still optimistic about where Bitcoin is heading long-term.

How these new demand zones interact with the existing areas of price resistance will be key in deciding which way Bitcoin’s price goes in the months ahead.

Source: TradingView

So, to wrap it up, Bitcoin’s recent dip below $80,000 is really a mix of different pressures: worries about government policies, concerns about security, and shifts in how investors are feeling.

As the market deals with these challenges, what both the big institutional players and everyday investors do next is going to be super important in shaping where the crypto world goes from here.