Buy Recommendation: MSTR Stock at $255

You’ve probably heard the buzz around MicroStrategy (MSTR) stock – it’s been making headlines thanks to its unwavering belief in Bitcoin and some pretty impressive price jumps! This software company does things a bit differently; they’ve been steadily buying Bitcoin for over two years now as part of their corporate strategy. This journey has been quite the ride, with MicroStrategy’s moves influencing Bitcoin’s price and vice versa. Currently, MSTR is trading around $255.5, even with the crypto market feeling a bit down, but some think this could be the perfect moment to jump in and buy. Intrigued? Let’s dive into why.

Is MSTR Stock’s Dip to $255 a Buying Opportunity?

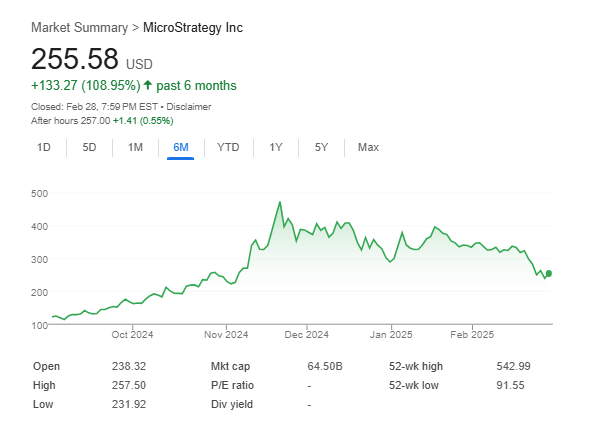

Remember November 2024? MSTR stock was riding high, hitting a peak of $478.83! This surge happened after Donald Trump’s US election win, as he became a vocal supporter of crypto, promising favorable regulations and growth – all great news for MicroStrategy’s value.

However, as the broader crypto market took a tumble, so did MSTR, briefly dropping to $240.05. But don’t count it out! It’s bounced back since then, currently trading at $255.58 after a recent 7% jump. Investors are optimistic, hoping for even bigger gains as the market recovers.

It’s not just wishful thinking either. Even market analysts believe MSTR is currently undervalued and presents a solid buying opportunity. MicroStrategy’s bold strategy of accumulating Bitcoin has historically paid off big time, with their stock outperforming many others, and the potential upside could still be significant.

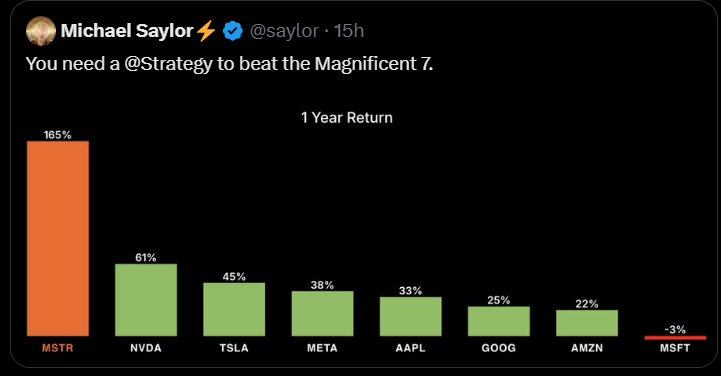

Recent reports highlight just how well this strategy is working. MicroStrategy’s yearly returns have reportedly soared to an impressive 165%! To put that in perspective, giants like NVDA, TSLA, and META didn’t even come close to half of that. It seems Michael Saylor and his team’s unwavering faith in Bitcoin is proving to be a winning play.

What’s more, MicroStrategy doubled down on their commitment with a recent $2 billion Bitcoin purchase, showcasing their strong belief in their strategy. Basically, as Bitcoin goes, so goes MSTR’s stock price, making it an interesting asset to watch.

Microstrategy Stock’s Performance: A Bitcoin Story

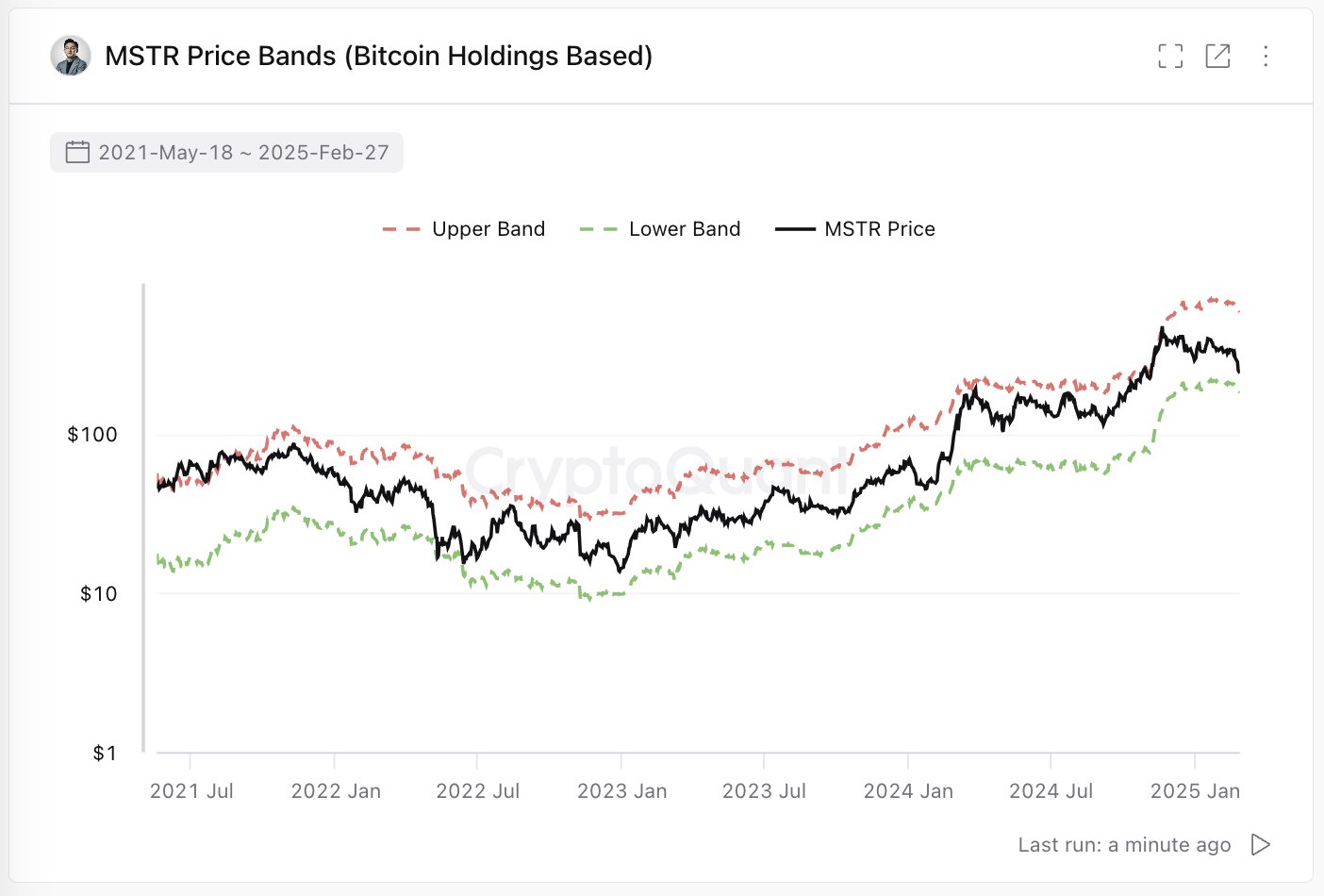

The story of MicroStrategy’s stock is essentially intertwined with the story of Bitcoin’s price. Looking back, it’s clear that MSTR stock tends to rise and fall in sync with Bitcoin’s bull and bear markets. The current market situation only reinforces this connection.

Because investors now see these two as closely linked, any surge in Bitcoin’s price is expected to boost MSTR stock as well. If the crypto market does indeed start trending upwards, MicroStrategy stock is likely to follow suit, potentially making the current price level an opportune entry point for buyers.

Is a 370% Rally for MSTR Stock Price on the Horizon?

Looking at MicroStrategy Incorporated (MSTR) on NASDAQ charts, you can see the price is currently testing its 200-day simple moving average (SMA). This SMA isn’t just any line; it’s historically acted as a strong support level. Interestingly, the last time MSTR tested this level, the stock price skyrocketed by a whopping 372%!

Could history repeat itself? There’s certainly potential. If buyers step in again at this support, the 200-day SMA could indeed become the launchpad for another significant rally, potentially around 370%. Fueling this optimism is the strong connection between Michael Saylor and MicroStrategy with Bitcoin, combined with the anticipated recovery of the broader crypto market.

However, it’s always wise to temper excitement with caution. Investors should look for more signals confirming this upward trend. If the stock price fails to hold at this support level, it could unfortunately decline even further.

So, Should You Buy MSTR Stock Right Now?

MicroStrategy stock is currently sitting at its lowest point in months, which some analysts are calling a “dip worth buying.” At around $255.5, it could be a really attractive opportunity, especially if the price starts to climb again alongside Bitcoin.

Analysts are even predicting a potential 370% rally, drawing on historical patterns and that crucial support level at the 200-day EMA. A solid bounce from this point could very well pave the way for that impressive upward surge.

Keep in mind, though, that there are always factors like regulations and market volatility to consider. Plus, MSTR’s close link to Bitcoin means its price can be quite bouncy. It’s definitely worth doing your own thorough research before making any investment decisions.