Bitcoin braces for Trump “investment announcement”

Bitcoin braces for Trump “investment announcement”

Bitcoin’s price dipped below $90,000, losing as much as 5% on the day, according to data from Cointelegraph Markets Pro and TradingView.

Earlier in the week, there was initial enthusiasm, pushing prices to weekly highs, fueled by speculation about a potential US strategic crypto reserve. However, this excitement faded as traditional finance (TradFi) trading resumed, bringing sell-side pressure.

Adding to the market jitters, US Commerce Secretary Howard Lutnick suggested on CNN that President Donald Trump was expected to make a decision on tariffs against Canada later that day. This contributed to a cautious start for the stock market and amplified the negative sentiment affecting Bitcoin.

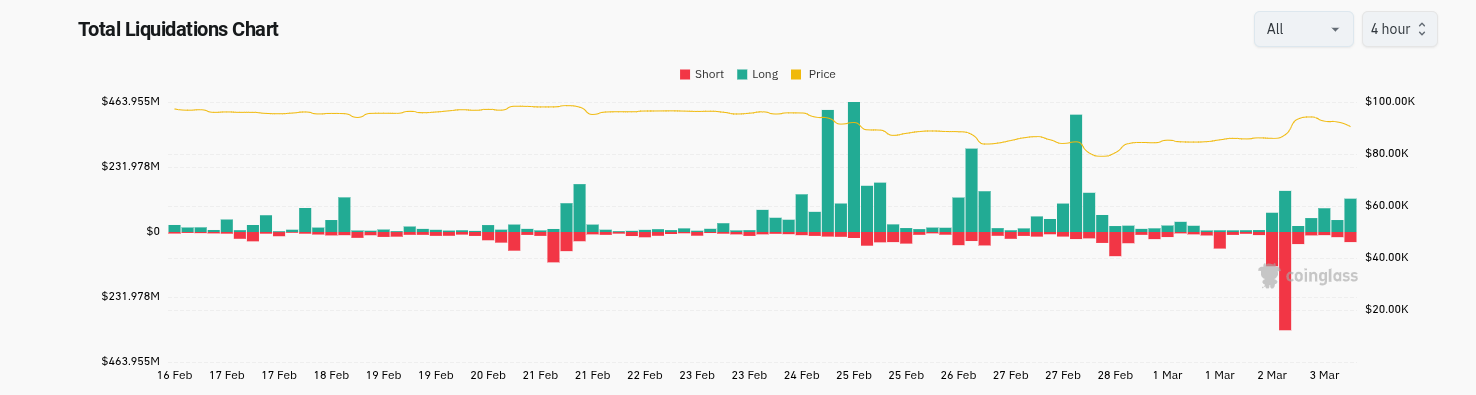

Bitcoin’s price drop triggered significant losses for leveraged traders holding long positions. In just four hours leading up to the time of reporting, cross-crypto liquidations surged past $150 million, according to data from the monitoring resource CoinGlass.

However, amidst the market uncertainty, a potential positive catalyst emerged. Investors were anticipating a reported “investment announcement” scheduled by President Trump for 1:30 pm Eastern Time.

Looking at the overall market situation, trading firm QCP Capital suggested taking a balanced approach moving forward.

In their latest update to Telegram channel subscribers, QCP Capital commented, “Following last night’s clutch announcement, it’s likely that Trump will do whatever it takes to avoid presiding over a prolonged stock market drawdown – a topic he previously championed but struggled with in recent weeks.”

QCP also pointed out the increased levels of the VIX volatility index, which they interpreted as a sign of “broader market unease in risk assets overall.”

Concluding their analysis, QCP Capital added, “Just when we think Trump has exhausted his cards, he may still have more surprises up his sleeve.”

“Which key events could shape the market this week — and could they be the catalyst for that elusive all-time high?”

BTC price teases higher low

Bitcoin traders were watching closely, hoping for a “higher low” pattern to form on the BTC/USD chart. This technical formation could potentially signal a rally back towards previous support levels, possibly even reaching the $100,000 mark.

Related: Biggest CME gap ever at $85K: 5 things to know in Bitcoin this week

Popular trader Jelle shared his analysis on X, stating, “Bitcoin broke down from the range, dumped hard – and immediately climbed back up to reclaim the range lows.”

“Higher low around this area would be perfect. Let’s see.”

Similarly, trader Daan Crypto Trades drew parallels to earlier price action during the bull run.

He told his X followers, “$BTC Showing a similar pattern as the previous consolidations with this recent range breakdown and retake,”

“Expansion -> Range -> Breakdown -> Retake -> Liftoff.”

Earlier, the previous day, Keith Alan, co-founder of trading resource Material Indicators, highlighted the 21-week simple moving average (SMA) as a crucial level to reclaim.

Bitcoin’s weekly close above this SMA, which it subsequently achieved, was considered by Alan as an “extremely bullish” signal.

However, he also cautioned, “That said, be prepared for strong resistance around $90k, and potentially for a fakeout above the 21-Week MA before reverting back to a support test.”