Ethereum 2025 Price: Trump’s Crypto Reserve Impact

Ethereum 2025 price forecast is on everyone’s lips in the crypto world right now, and you can bet its recent addition to Donald Trump’s US Crypto Reserve is fueling the fire.

Most people are feeling bullish, expecting $ETH to capitalize on current vibes and finally escape its long period of sideways trading. However, there’s a dissenting voice suggesting we might see further price dips before any major upward movement.

So, what’s the real story with Ethereum? In this guide, we’re diving deep – analyzing its technical charts and core strengths – to paint a clear picture of where we think this crypto giant might be heading over the next 10 months.

Ethereum 2025 Price Prediction at a Glance

Short on time? Here’s a quick rundown of key factors influencing $ETH’s potential performance:

- Weekly chart looking strong, holding a key support zone – BULLISH

- Continually respecting the important $2K level and 200 EMA – BULLISH

- Current support zones show signs of significant accumulation – BULLISH

- Daily chart showing lower highs and lower lows – BEARISH

- Moving averages trending downwards on shorter timeframes – BEARISH

- Inclusion in Trump’s US Crypto Reserve – BULLISH

- Upcoming Pectra Upgrade – BULLISH

Taking everything into account, and remembering that longer-term trends generally outweigh short-term noise, and given the overwhelmingly positive market mood, the broad outlook for $ETH is definitely looking bright.

The general feeling is that once $ETH decisively breaks through and holds above a recent price peak, we could see it surge to new heights, potentially even reaching the $6,000 level within 2025.

Diving Deeper Into Ethereum’s Chart

When it comes to charting crypto like Ethereum, the best approach is to start with the big picture – the longer timeframes – and then zoom in. This way, we can really understand the underlying direction and see whether short-term blips are just temporary corrections or something more significant.

So, let’s kick things off with a look at Ethereum’s weekly chart.

The Larger Picture Is Extremely Bullish

First thing that jumps out is that Ethereum is currently sitting right at a major support zone, between $1.9K and $2.3K. This is exactly where it found its footing last November before that impressive jump up to $4K.

What’s also interesting? This support zone includes the $2,000 mark, a key psychological level. For those new to trading, round numbers like these often act as magnets for price action, becoming strong areas of support and resistance.

And the $2,000 level is no ordinary number; Ethereum has consistently reacted to it practically every time it’s been tested since way back in February 2021.

Another really encouraging sign? On the weekly chart, Ethereum is currently interacting with the 200 Exponential Moving Average (EMA), a really important indicator in the technical analysis toolkit.

Considering Bitcoin just bounced off its 200 EMA on the daily chart less than a week ago, there’s a good reason to expect Ethereum to follow suit.

Data from Glassnode, a respected blockchain analytics company, reinforces this. They point out that the $1.9K price is a significant accumulation zone, with long-term investors scooping up a massive 1.82M $ETH at this level since August 2023.

So, we’ve looked at several factors suggesting an upcoming upward move for Ethereum. Perhaps the clearest signal comes from a classic chart pattern: the rectangle. Essentially, Ethereum has been trading within a range, bouncing between $2,000 and $4,000.

And considering this pattern has held for almost a year, a break above the $4,000 resistance could launch Ethereum to a new peak, potentially by the height of the rectangle itself. With a $2,000 range in the rectangle, that means we could realistically see Ethereum soaring past $6,000 once it breaks that $4,000 barrier.

Lower Timeframes Suggest a Battle Against the Bears

While the weekly chart is the boss when it comes to long-term direction, the daily and 4-hour charts are super useful for getting a handle on what might happen in the shorter term.

However, looking at these shorter timeframes, we see a bit of a conflicting signal. Both the 50 EMA and 200 EMA are currently trending downwards. This might suggest that big institutional investors haven’t fully jumped into the market just yet.

But in the fast-moving world of crypto, things can flip in hours! A few big buying surges can create massive price spikes – those towering ‘candlesticks’ you see on charts – and just a couple of those could be enough to push Ethereum back above those EMAs.

Ethereum’s Market Sentiment

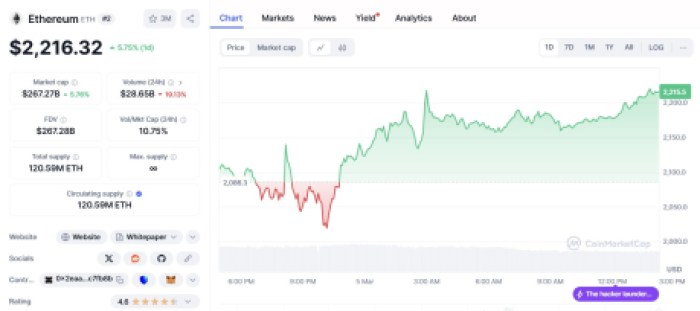

$ETH is currently riding a positive wave, up 5.75% today and trading around $2,200. This latest boost is likely linked to its inclusion in Donald Trump’s newly announced Crypto Strategic Reserve – it’s one of only five cryptos to make the cut!

Sticking with the Trump theme, it’s interesting to note that his crypto venture, World Liberty Financial (WLFI), is already holding a massive Ethereum position – over $200 million worth!

And it’s not just a small amount; Ethereum accounts for around 65% of their entire $300 million+ crypto portfolio! It’s pretty clear Trump is betting big on Ethereum’s success, which really strengthens the case for that $6,000 target.

Beyond Trump’s backing, Ethereum also boasts another major advantage: it’s only the second crypto, after Bitcoin, to have spot ETFs (exchange-traded funds). This is a huge deal for attracting wider investor participation in $ETH.

And let’s not forget that BlackRock, a massive player in asset management, also seems to be a fan. They launched a tokenized money market fund last year and chose Ethereum as the blockchain to power it.

Pectra Upgrade

Adding to the positive momentum, Ethereum is on the cusp of a significant upgrade – Pectra. It just successfully launched on the Sepolia testnet today, with the mainnet launch expected in April.

This upgrade is packed with 11 major improvements, all designed to make the Ethereum ecosystem more user-friendly, cheaper, and more efficient.

For example, the validator staking limit is getting a massive boost from 32 ETH to 2,048 ETH. This is a game-changer for validators, letting them really maximize their earnings, and it’s also expected to ease selling pressure over time.

Plus, expect a whole suite of wallet and security enhancements, including features like batched transactions, gas sponsorship, app-specific spending limits, and improved recovery options.

Ethereum’s a Good Investment, but $MEMEX Could Be a Better One

If Ethereum hits those predicted highs and potentially triples in value this year, it’s definitely shaping up to be a solid investment for traditional crypto traders. But for those looking for even bigger potential gains – and who are comfortable with higher risk – the Meme Index ($MEMEX) presale could be an even more exciting opportunity.

The $MEMEX presale is rapidly closing in on the $4 million mark, and tokens are still available for just $0.0166883. Want to be an early adopter? Here’s how to buy $MEMEX. Plus, you can also take advantage of an impressive 579% staking reward!

Finally, a quick disclaimer: While our analysis and experience suggest that both $ETH and $MEMEX are compelling crypto investments, remember this isn’t financial advice. Always do your own thorough research before making any investment decisions.