Xiaomi – China’s Nvidia Contender

The idea of a “Chinese century” has been discussed for a while, but it’s really gained momentum in the past year or so.

Despite some initial setbacks in early 2024, when the stock market in China took a tumble, leading some to believe things weren’t going well, and even though a much-awaited financial boost in October didn’t quite live up to expectations, things have since taken a decidedly positive turn.

And there are few companies that illustrate this shift better than Xiaomi (HKG: 1810). This is a company that’s been known for years for creating pretty advanced smartphones and selling them at surprisingly affordable prices.

If you look at the Hong Kong stock market, you’ll see that Xiaomi has seen incredible growth in recent years. Since stopping its stock decline in 2022, it’s shot up by a massive 523.28%, reaching a price of 54.35 HKD at the time of writing.

The last year has been especially good for this tech giant. Their stock is up 324.61% in that period, and an equally impressive 191.89% just in the last 6 months. While another Chinese company, Alibaba (NYSE: BABA), actually overtook Xiaomi in stock market gains in 2025, Xiaomi is still doing incredibly well, with a 59.85% climb so far this year.

Xiaomi’s achieves comparable stock market success to Nvidia

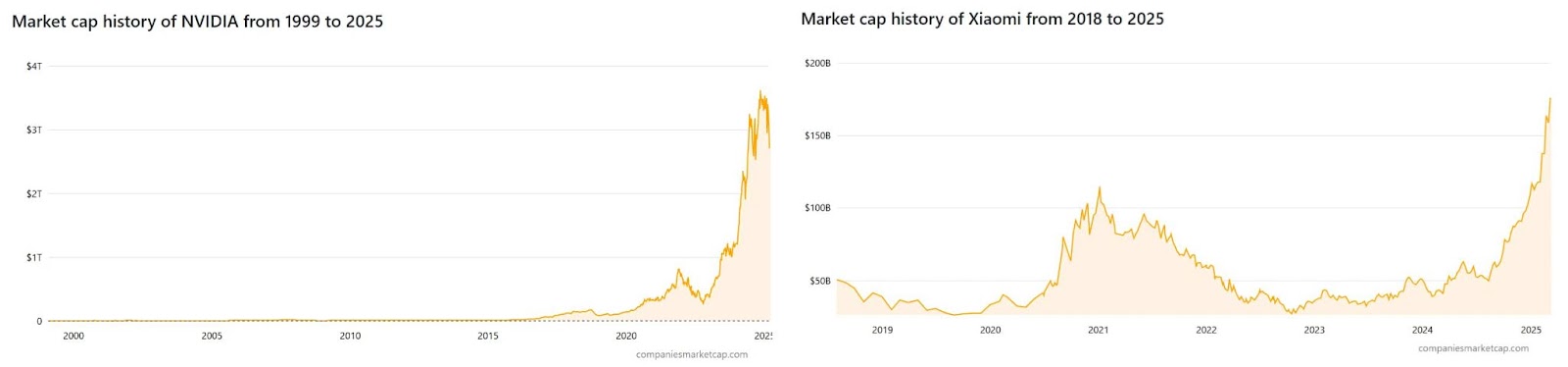

Now, while it’s true that neither the dollar amount nor the percentage increase in Xiaomi’s market value quite reach the heights of Nvidia’s (NASDAQ: NVDA) success, there are some striking similarities.

Both companies experienced big drops in their value back in 2022, but then both bounced back in a major way, rocketing upwards. Nvidia, for example, saw its market value jump by a massive 643.86%, from $364.18 billion at the end of 2022 to a whopping $2.709 trillion at the time of writing.

Xiaomi’s market value at the end of 2022 was $35.82 billion, and it then surged by 390.98% to reach $175.87 billion by March 7, 2025.

Why Xiaomi stock is soaring

One of the key moments for Xiaomi was when they revealed their very own electric car (EV) in early 2024. This was a pretty significant event, made even more so because it happened around the same time that Apple (NASDAQ: AAPL), the American tech giant, gave up on their own plans for an EV.

This achievement seemed to gain even more significance last October when the CEO of Ford (NYSE: F), a major car manufacturer, publicly praised Xiaomi’s new SU7 car.

Beyond just cars, Xiaomi has also jumped into the artificial intelligence (AI) wave. They even got a bit of an indirect boost from the release of DeepSeek – an AI platform that really shook things up in Silicon Valley, partly because it was reportedly developed at a low cost and partly because it was made open source.

Why Xiaomi’s rise might soon be halted

Despite all the positive news and the seemingly unstoppable rise, Xiaomi might face some challenges ahead. It might not be smooth sailing forever, and they could soon hit a bit of a roadblock. Even though they’ve branched out into lots of smart devices, they’re still mainly known for smartphones, and now they’re trying to break into the more expensive, high-end smartphone market.

The problem is, this high-end market is pretty crowded already, and the Android smartphone world is still dominated by Samsung (KRX: 005930), the tech giant from South Korea.

Finally, with other Chinese mobile phone companies catching up quickly, Xiaomi might find itself squeezed from all sides. However, looking at their past performance, investors shouldn’t completely rule out their potential for future growth. That said, it’s probably wise not to invest based only on current hype or just the amazing growth they’ve seen in the last year.