Bitcoin Volatility Spikes Amid Extreme Price Swings

Bitcoin Volatility Spikes Amid Extreme Price Swings

Let’s talk about realized volatility. Think of it as a way to look back and see just how bouncy an asset’s price has been. Basically, it measures past price swings. The typical way to calculate it is by checking the daily ups and downs (often using log returns – fancy math for price changes), figuring out the standard deviation, and then scaling it up to an annual number. It’s good to know that this is different from implied volatility, which is all about what the market *expects* for price swings in the future.

So why is realized volatility so important? Well, it gives investors a peek at the actual risk that’s been happening in the market. It helps them decide if those past price jitters fit with how much risk they’re comfortable with. Plus, when markets get stressed out, you’ll see it in realized volatility – big price swings always make it jump.

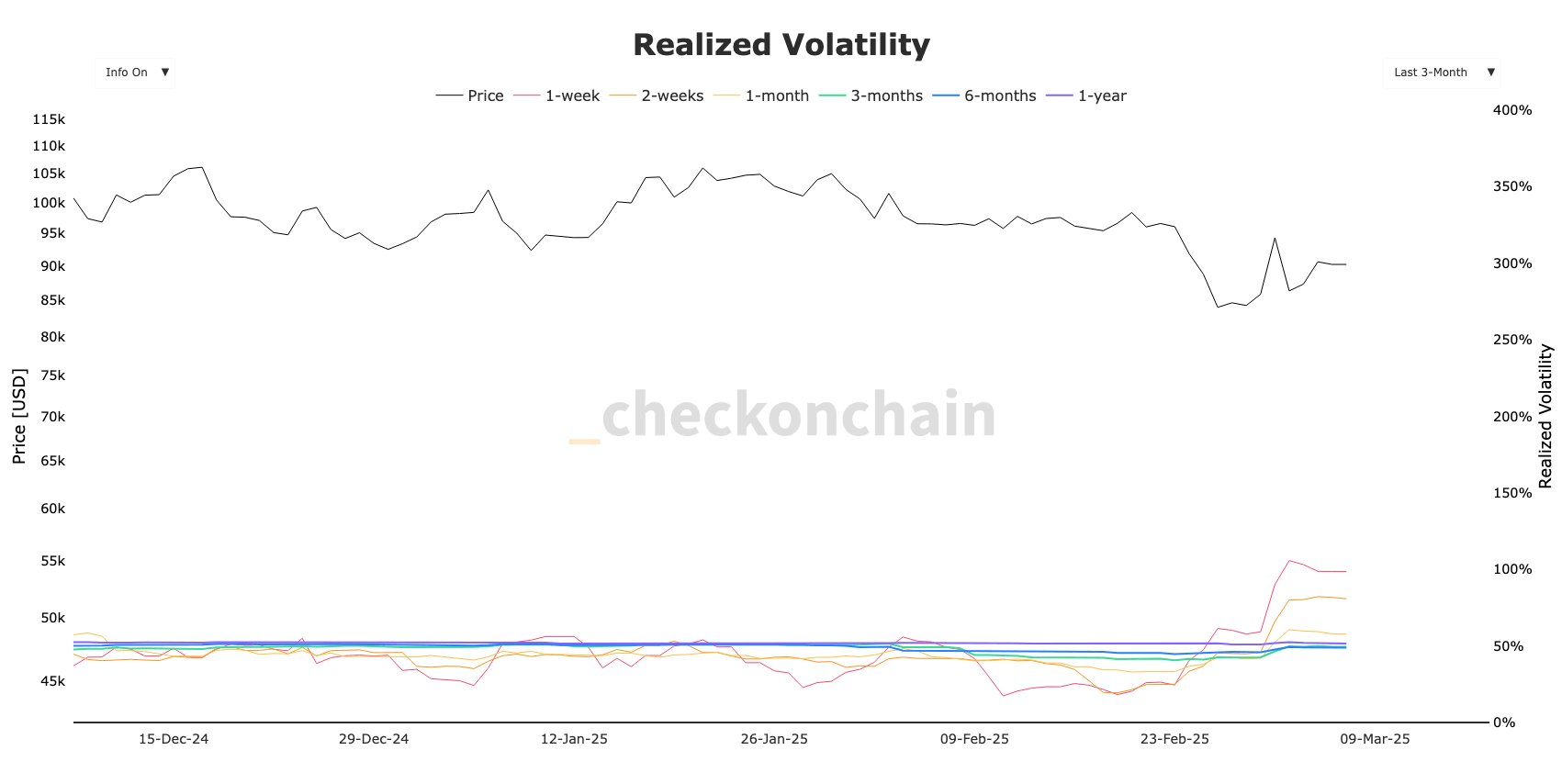

Take Bitcoin, for example. Starting in March, things got pretty wild. Coming off a tough drop in late February, Bitcoin went into March with rollercoaster price action. We saw a huge rally right at the beginning, but then just as quickly, the price pulled back hard. These sudden moves sent realized volatility soaring.

Those quick ups and downs in early March really lit a fire under Bitcoin’s one-week realized volatility. Traders were seeing some of the biggest single-day percentage changes in ages, pushing those short-term volatility numbers way higher than usual. And it wasn’t just a flash in the pan. As these big price swings kept happening, two-week and even one-month realized volatility measures started climbing too. Longer-term views captured both the February sell-off and March’s bounce-back, so they also got a boost upwards.

While the crazy volatility peaked in the first few days of March, it did start to calm down a bit as the market tried to find its footing. The one-week measure dipped slightly, hinting at less frantic price movement, but overall volatility was still hotter than it had been in previous months.

Bitcoin was showing a classic pattern called “volatility clustering” – it’s like things went quiet for a while, and then BAM, a storm hit. Before February’s crash, Bitcoin’s price had been pretty chill, with low volatility through January and early February. But that peace was shattered by the late-February plunge, which ushered in a period of high volatility that stuck around into March.

Historically, these calm spells with low volatility often come right before sharp spikes, not just in crypto but in regular markets too. In this case, weeks of calm consolidation were followed by the most volatile stretch in months, proving the point that sometimes calm waters can hide building pressure that’s just waiting to be released.

Because realized volatility is based on price movement, it’s no shocker that the spikes in volatility happened exactly when we saw those big daily price swings. But here’s an interesting thing: volatility jumped no matter whether the price was going up or down. In early March, both the massive rally one day and the steep drop the next day pumped up volatility. This just goes to show that realized volatility is about how *big* the moves are, not which direction they’re in.

During that week, Bitcoin’s surge upwards (March 1-2) and then its dive downwards (March 2-4) were both huge, and together they sent that 7-day volatility measure through the roof. Traders watching closely could see that those periods of high realized volatility lined up perfectly with the days of crazy trading and those big, noticeable price bars on the chart.

Whenever Bitcoin’s daily price bars got bigger (those long wicks or bodies showing wide intraday ranges), the realized volatility numbers followed right along. This close relationship was clear throughout March: when price movements calmed down, short-term volatility measures eased off too.

These wild swings were a sign of real market stress. As negative feelings and selling pressure piled up in late February, shorter-term realized volatility spiked upwards. This just hammered home the point that high volatility is usually a red flag for higher risk.

Concerns about new trade disputes were part of what triggered the late February dip, and they kept casting a shadow over the March markets. Investors got nervous and ran away from riskier stuff like Bitcoin, adding to the heightened volatility.

Adding to the mix, everyone was on edge about a White House summit on crypto and rumors about government actions on a potential crypto reserve. Bitcoin is super sensitive to any hints about regulation, so any possible shifts in government stance just fanned the flames of volatility.

Keeping an eye on realized volatility can give you an early heads-up about changing market conditions. In this case, the explosion of volatility confirmed a shift away from a calm bull market to a more chaotic correction. And another thing: comparing price action with realized volatility is really helpful for spotting unusual market moves.

In March, the fact that 1-week volatility shot past 100% wasn’t just saying prices were swinging a lot – it was saying these swings were historically large for Bitcoin. It also reminded everyone that Bitcoin doesn’t live in its own bubble. Things like policy changes, economic news, and global crises all directly feed into its volatility. March 2025’s volatility was a mix of crypto-specific stuff and wider shocks, like tariffs and regulatory changes.

The post Bitcoin’s realized volatility surges in as traders face extreme price swings appeared first on CryptoSlate.