Ethereum ETF Losses: $11.93M Outflow; ETHA Volume Leads

- Ethereum ETFs saw a slight dip with a net outflow of $11.93M, but overall net inflows remain strong at $2.71B.

- Grayscale’s ETHE leads in net assets with $2.68B, while ETHA is close behind, holding $2.79B.

- ETHA dominated trading volume with 13.18M shares, surpassing all other funds.

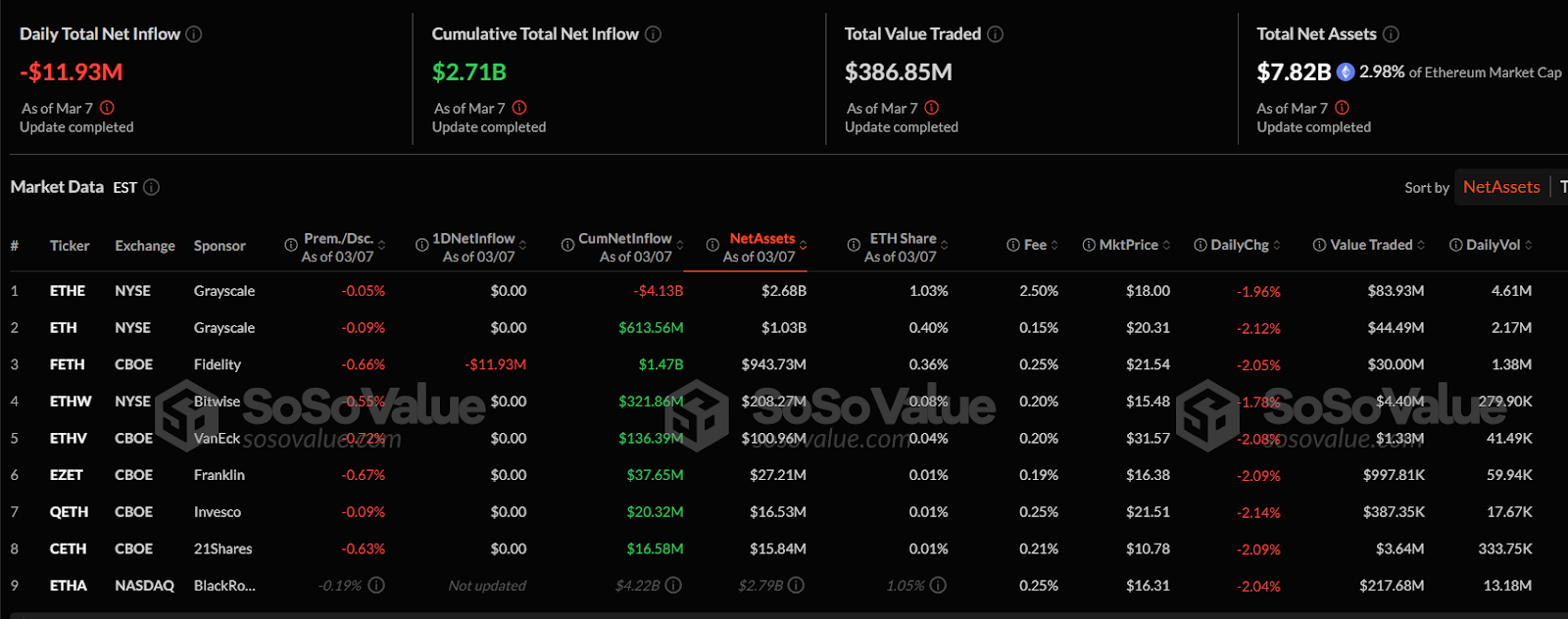

Let’s dive into the market movements of Ethereum-based exchange-traded funds (ETFs). On March 7th, these funds experienced a daily net outflow of $11.93 million. However, looking at the bigger picture, they still maintain an impressive cumulative net inflow of $2.71 billion. In total, Ethereum ETFs are managing $7.82 billion in net assets, representing about 2.98% of Ethereum’s total market capitalization. The total value of these ETFs traded on this particular day reached a robust $386.85 million.

Grayscale’s ETHE Takes the Lead in Ethereum ETFs with $2.68B in Assets

Recent updates from SoSoValue indicate that Grayscale’s ETHE is currently in the top spot, leading the Ethereum ETF pack with a substantial $2.68 billion in net assets. Coming in second is Grayscale’s ETH fund, holding $1.03 billion in net assets and showing a cumulative net inflow of $613.56 million. Fidelity’s FETH ETF follows closely, with $943.73 million in net assets and a cumulative inflow of $1.47 billion.

Further down the list, Bitwise’s ETHW ETF has accumulated $208.27 million in net assets, with a cumulative net inflow of $321.86 million. VanEck’s ETHV ETF reported $100.96 million in net assets and a cumulative net inflow of $136.39 million. Franklin’s EZET holds $27.21 million in net assets, while Invesco’s QETH manages $16.53 million. 21Shares’ CETH recorded $15.84 million in net assets, with a cumulative inflow of $16.58 million. Notably, BlackRock’s ETHA, which is listed on NASDAQ, boasts a significant $2.79 billion in net assets, although we’re still waiting for complete data updates for this fund.

ETHA Takes the Volume Crown with 13.18M Shares Traded

Looking at the daily percentage changes, it was a slightly down day for most funds. Grayscale’s ETHE experienced a decrease of 1.96%, settling at $18.00 per share, and their ETH fund declined by 2.12% to $20.31. Fidelity’s FETH also saw a dip of 2.05%, reaching $21.54, and VanEck’s ETHV dropped by 2.08% to $31.57. Similarly, Franklin’s EZET fell by 2.09% to $16.38, while Invesco’s QETH decreased by 2.14% to $21.51. 21Shares’ CETH showed a decline of 2.09%, ending at $10.78, and BlackRock’s ETHA went down by 2.04% to $16.31. However, Bitwise’s ETHW bucked the trend and actually increased by 1.78%, reaching $15.48.

Trading volumes were quite active across the board. Grayscale’s ETHE saw a substantial 4.61 million shares traded. Their ETH fund had a volume of 2.17 million shares, and Fidelity’s FETH saw 1.38 million shares change hands. Bitwise’s ETHW recorded 279.90K in volume, while VanEck’s ETHV had 41.49K shares traded. Franklin’s EZET saw 59.94K shares traded, Invesco’s QETH had 17.67K, and 21Shares’ CETH recorded 333.75K in trading volume. However, the standout performer in trading volume was BlackRock’s ETHA, which dominated with a whopping 13.18 million shares traded.