XRP Price: Legal Battles and Price Swings

- Dom Kwok from EasyA gets the XRP community talking with his optimistic take on the market.

- Digital Asset Investor brings up an old prediction suggesting XRP could rocket past $17.

- The big question circulating now: Could Ripple actually hit a trillion-dollar valuation?

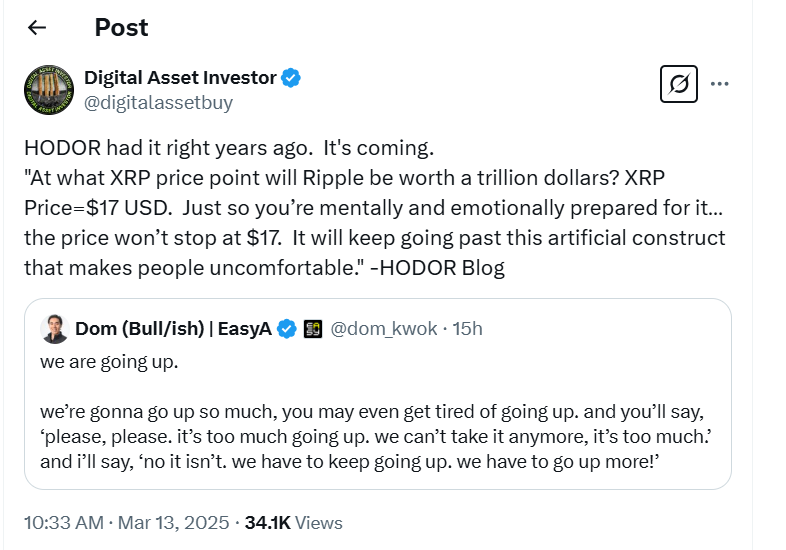

The XRP market is buzzing with renewed price speculation, all thanks to recent comments from Dom Kwok, co-founder of EasyA. In a tweet that got everyone’s attention, Kwok hinted at the potential for crypto prices to surge so dramatically that investors might just “get tired of going up.” These words have lit a fire under the XRP faithful, igniting fresh excitement about what’s next for the token.

Adding fuel to the speculative flames, Digital Asset Investor, a well-known XRP advocate, rekindled an old blog post by HODOR. This blast from the past suggested that if XRP were to hit $17, Ripple’s overall valuation could skyrocket to a staggering $1 trillion. Think about that for a second!

But the bullish talk didn’t stop there. The post went even further, painting a picture where $17 wouldn’t be the ceiling, suggesting XRP could keep climbing beyond those initial psychological barriers. The anticipation is definitely building!

Unsurprisingly, this kind of talk really got the optimistic side of the XRP community energized. One commenter, known as XRPJaws, chimed in with an even bolder prediction. They suggested that once Ripple potentially goes public with an IPO, it could catapult into the ranks of the top 10 biggest companies worldwide by market cap. And they didn’t stop there, declaring that even claiming the number one spot isn’t “impossible!”

This super-bullish outlook is definitely in line with those who are strong believers in XRP’s huge potential for the long haul. However, let’s be real—not everyone is buying into all the hype.

XRP: Bullish Dreams Clashing with a Dose of Reality?

Enter Graham Unsworth, a known skeptic, who voiced his frustration with these ultra-optimistic forecasts and many similar XRP price projections floating around the community. He’s clearly heard enough.

“I’m sick of hearing all these price forecasts,” Unsworth posted, getting straight to the point. “It’s only a few cents higher than it was back in November 2020, right before the SEC case even started,” he pointed out, bringing things back down to earth.

He makes a solid argument that any real price surge is unlikely until the ongoing legal battle with the SEC finally wraps up and there’s more clarity on regulations. In his view, all this current price talk is just “clickbait” to grab attention. As of right now, XRP is trading at $2.27, which is still a respectable 3.78% jump over the last day.

Related: XRP Soars 16% as Franklin Templeton Files for ETF, SEC Delays Weigh

Adding another layer of complexity to the XRP price puzzle, one more community member threw in a curveball. They argued that XRP’s main purpose – making cross-border payments smoother – could actually limit how high its price can go. Their reasoning? Lower XRP prices might actually be more beneficial for the big financial institutions using it.

However, this perspective definitely clashes with those who are betting on XRP reaching astronomical prices precisely *because* of massive institutional investment. It’s a real tug-of-war of ideas.

The Ripple-SEC Saga: Still Waiting for the Final Chapter

And let’s not forget the big, unresolved issue hanging over everything: the Ripple vs. SEC lawsuit. This legal drama is like the elephant in the room when talking about XRP’s future. But, according to financial journalist Eleanor Terrett, we might be getting closer to the end. She’s reporting that Ripple is currently in negotiations, trying to secure better settlement terms, which is causing the final resolution to take a bit longer. One of the sticking points seems to be the hefty $125 million fine and the proposed restrictions on XRP sales to big institutions.

Related: Settlement In Sight For Ripple vs. SEC Case, Though Final Terms Still Under Negotiation

Ripple’s argument is basically, “Hey, if the SEC is backing off in other crypto cases, why should we be penalized so heavily?” Accepting the current terms would almost be like admitting they did something wrong, and even the SEC seems unsure if that’s actually the case. Since there isn’t a clear rulebook for these situations, the negotiations are proving to be more drawn out than anyone expected.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.