Buy Signal: Rare Bitcoin Indicator Flashes – Rally Imminent?

Feeling a bit uneasy about Bitcoin lately? It’s been hitting some lower points recently, making many investors wonder if we’re heading into a full-blown bear market. But hold on—an interesting signal has popped up, linked to the US Dollar Strength Index (DXY). This is a pretty rare occurrence, having only flashed three times before in Bitcoin’s history, and it’s hinting that we might just see a bullish turnaround despite the current gloomy mood.

Want to dive deeper into this? There’s a great YouTube video that explains it all in detail. Check it out here:

Bitcoin: This Had Only Ever Happened 3x Before

BTC vs DXY Inverse Relationship

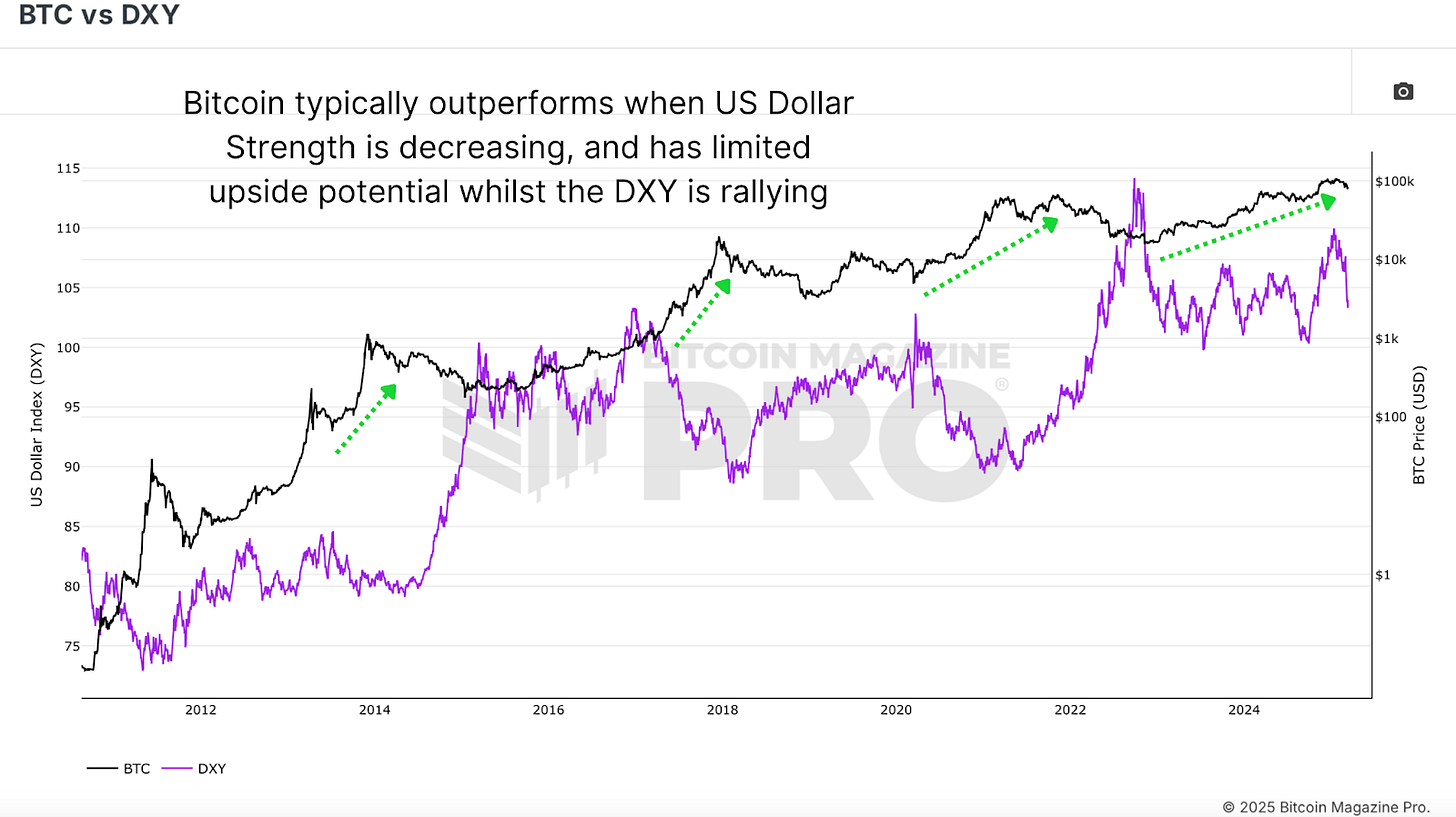

Here’s something to keep in mind: Bitcoin’s price and the US Dollar Strength Index (DXY) often act like financial opposites. Historically, when the DXY gets stronger, Bitcoin tends to face headwinds. On the flip side, when the DXY weakens, it often creates a more favorable backdrop for Bitcoin’s price to take off.

Now, even though a weaker dollar usually gives Bitcoin a boost, we’ve seen Bitcoin’s price take a bit of a tumble recently, dropping from over $100,000 down below $80,000. Despite this recent dip, history tells us something interesting: when the DXY retraces like this in a rare move, it could be a sign that a Bitcoin rebound is still in the cards, maybe just a bit delayed.

Bitcoin Buy Signal Historic Occurrences

Right now, the DXY is experiencing a rapid decline, a pretty significant drop of over 3.4% in just a single week. Believe it or not, this kind of sharp weekly drop in the DXY has only happened three times before in all of Bitcoin’s trading history – talk about rare!

To really grasp what this DXY signal could mean, let’s take a look back at the three previous times we saw this kind of sharp drop in the US dollar’s strength:

- 2015 Post-Bear Market Bottom

The first time this happened was after Bitcoin’s price had hit rock bottom in 2015. After a bit of sideways movement, Bitcoin’s price took off, surging upwards by over 200% in just a few months. Pretty impressive!

The second time was in early 2020, right after the market panic caused by the COVID-19 pandemic. Just like in 2015, Bitcoin initially saw some choppy trading action before a strong upward trend kicked in, leading to a rally that lasted for months.

- 2022 Bear Market Recovery

Most recently, we saw this at the end of the 2022 bear market. After Bitcoin’s price calmed down a bit and stabilized, it then started a sustained recovery, climbing to significantly higher levels and essentially starting the current bull run in the months that followed.

What’s interesting is that in each of these past cases, the sharp DXY drop was followed by a period of calmer trading before Bitcoin took off on a major bull run. If we overlay those historical price patterns onto what’s happening now, it could give us a hint of what might be coming soon.

Equity Markets Correlation

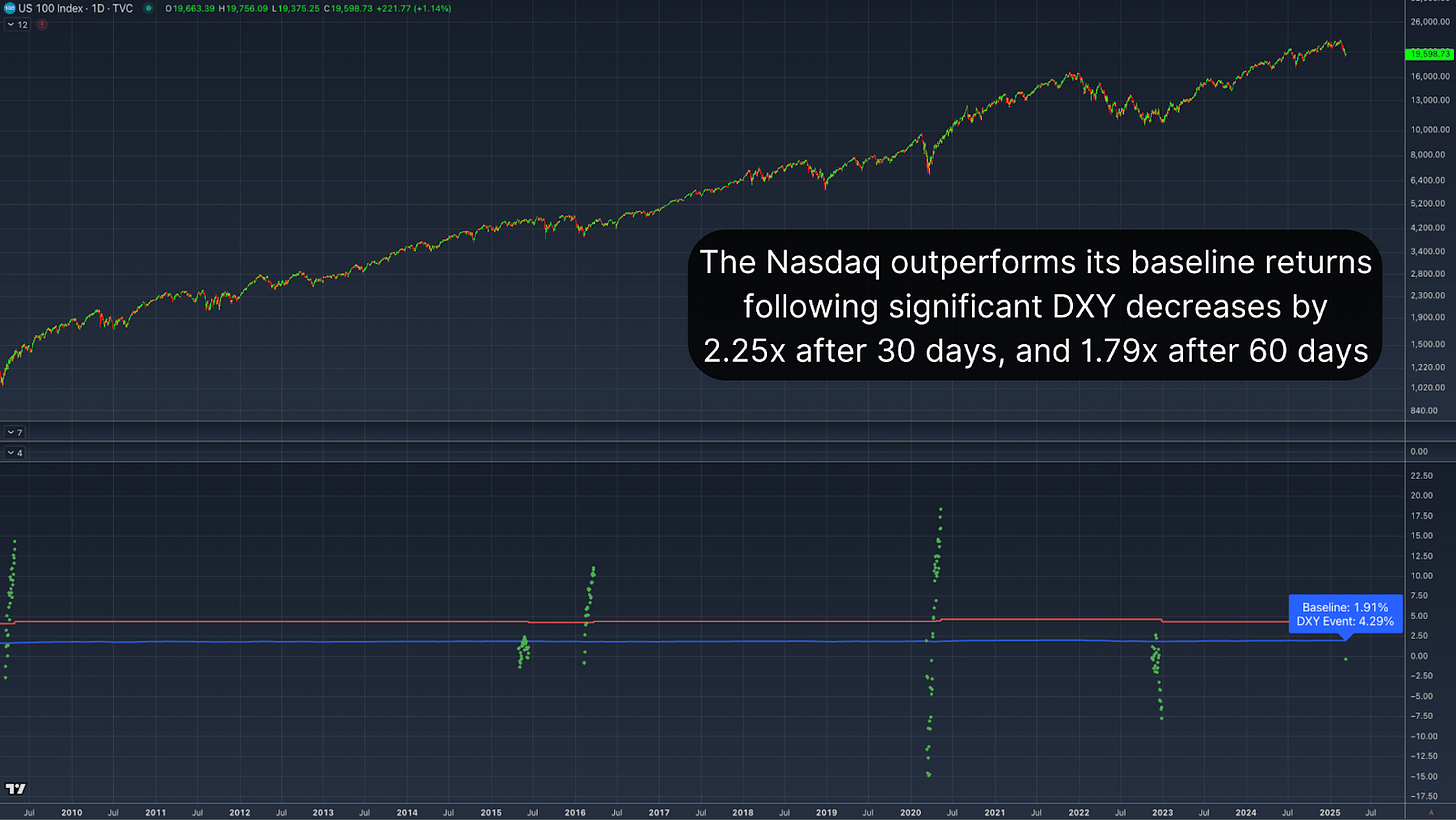

Here’s another interesting piece of the puzzle: this pattern doesn’t just seem to apply to Bitcoin. We see a similar thing happening in the stock market, especially with tech stocks on the Nasdaq and the broader S&P 500. Historically, when the DXY takes a sharp dip, these stock markets tend to do better than their usual average.

For example, looking at the Nasdaq, on average, in the 30 days following a similar DXY drop, it has returned 4.29% – that’s noticeably better than its typical 30-day average of 1.91%. If we extend our view to 60 days, the Nasdaq’s average return jumps to nearly 7%, almost double its usual 60-day performance of 3.88%. This connection suggests that Bitcoin’s reaction to a sharp DXY decline isn’t happening in isolation; it seems to fit into broader market trends, strengthening the idea that we might see a delayed, but positive, response from Bitcoin.

Conclusion

So, what’s the big takeaway? This recent drop in the US Dollar Strength Index is actually a pretty rare and historically encouraging sign for Bitcoin. Even though Bitcoin’s price is currently looking a bit weak, history suggests we’re likely to see a period of things settling down, followed by a significant rally. And when we see similar patterns in major indexes like the Nasdaq and S&P 500, it really reinforces the idea that the overall economic conditions are becoming quite favorable for Bitcoin.

Want to dig into the live data, charts, indicators, and in-depth research to get a jump on Bitcoin’s price movements? Head over to Bitcoin Magazine Pro.

Disclaimer: Just a friendly reminder, this is for informational purposes only and not financial advice. Always do your own homework before making any investment decisions.