Inverse Cramer Dusts S&P, Nasdaq, Dow

You know Jim Cramer, the host of Mad Money? He’s so well-known, and sometimes notorious, that he’s even inspired a trading strategy called ‘inverse Cramer.’ It’s become a bit of a joke because it seems like whenever Cramer recommends buying or selling a stock, the opposite often happens!

It might sound like just internet humor and memes, but the ‘inverse Cramer’ idea actually got serious. Tuttle Capital Management even launched an ETF based on it, called the Inverse Cramer ETF (SJIM). However, despite all the buzz, it only attracted around $2 million in investments and, surprisingly, it had to close down after less than a year – just 11 months, to be exact.

But here’s the really tricky part – the *how*. Tuttle’s method wasn’t very clear-cut. Their team had to constantly watch Cramer’s TV appearances and then try to figure out which of his stock picks they should bet against (or ‘short’). Given that Cramer talks about stocks on TV for his entire job, this was a really time-consuming process.

Now, there’s a different approach to this ‘inverse Cramer’ idea being used by a smartphone platform called Autopilot. Instead of just betting against the stocks Cramer recommends, they also invest in (go ‘long’ on) the stocks that Cramer actually dismisses or speaks negatively about.

And so far, this two-sided approach seems to be a much more successful way to profit from Cramer’s, shall we say, unique market timing. Let’s dig into the numbers and see exactly how well this strategy has been performing recently.

The Inverse Cramer Strategy is performing admirably — but can it stay consistent?

Looking at the performance from March 21, 2024, to March 21, 2025, the Inverse Cramer strategy achieved a pretty impressive 31.8% return, according to a recent update from the CramerTracker X account.

To put that in perspective, during that same year, the well-known S&P 500 index only grew by 8.28%. The tech-heavy Nasdaq composite performed similarly, with an 8.25% increase.

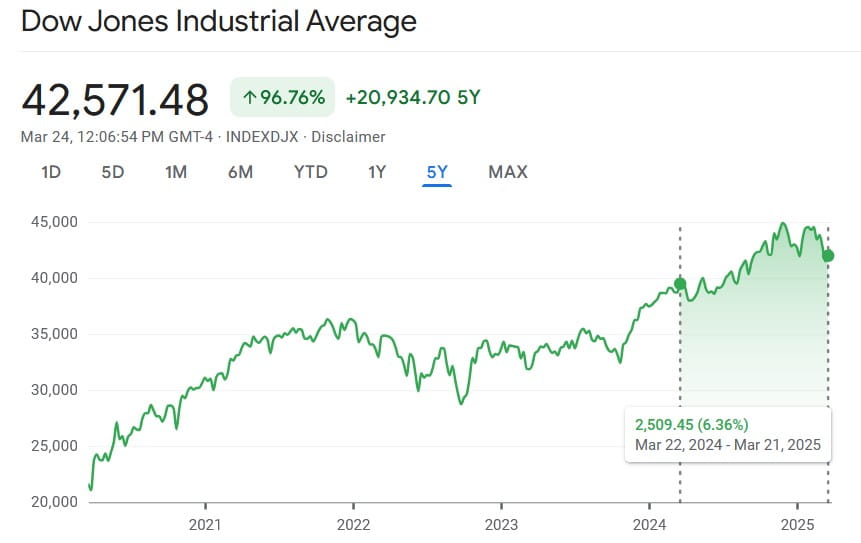

Even the Dow Jones Industrial Average (DJIA) saw a smaller increase in the same period, only rising by 6.36%.

So, what’s the magic behind the Inverse Cramer strategy’s success? Well, those market indices are broad – they track the overall performance of large parts of the market and the entire US economy. Jim Cramer, on the other hand, like many in financial media, tends to focus a lot of his attention on those exciting, high-growth tech stocks.

Simply put, while the Inverse Cramer strategy has outperformed the broader market recently, it’s also much less diversified. And while that narrower focus can be a good thing when the market is going up, it’s still unclear how this strategy will hold up if the market takes a downturn.

Featured image via Shutterstock