ATOM 6% Rally: $5 Support Key

Okay, here’s the rewritten content, aiming for natural and engaging language while preserving all HTML tags, original tone, style, and intent:

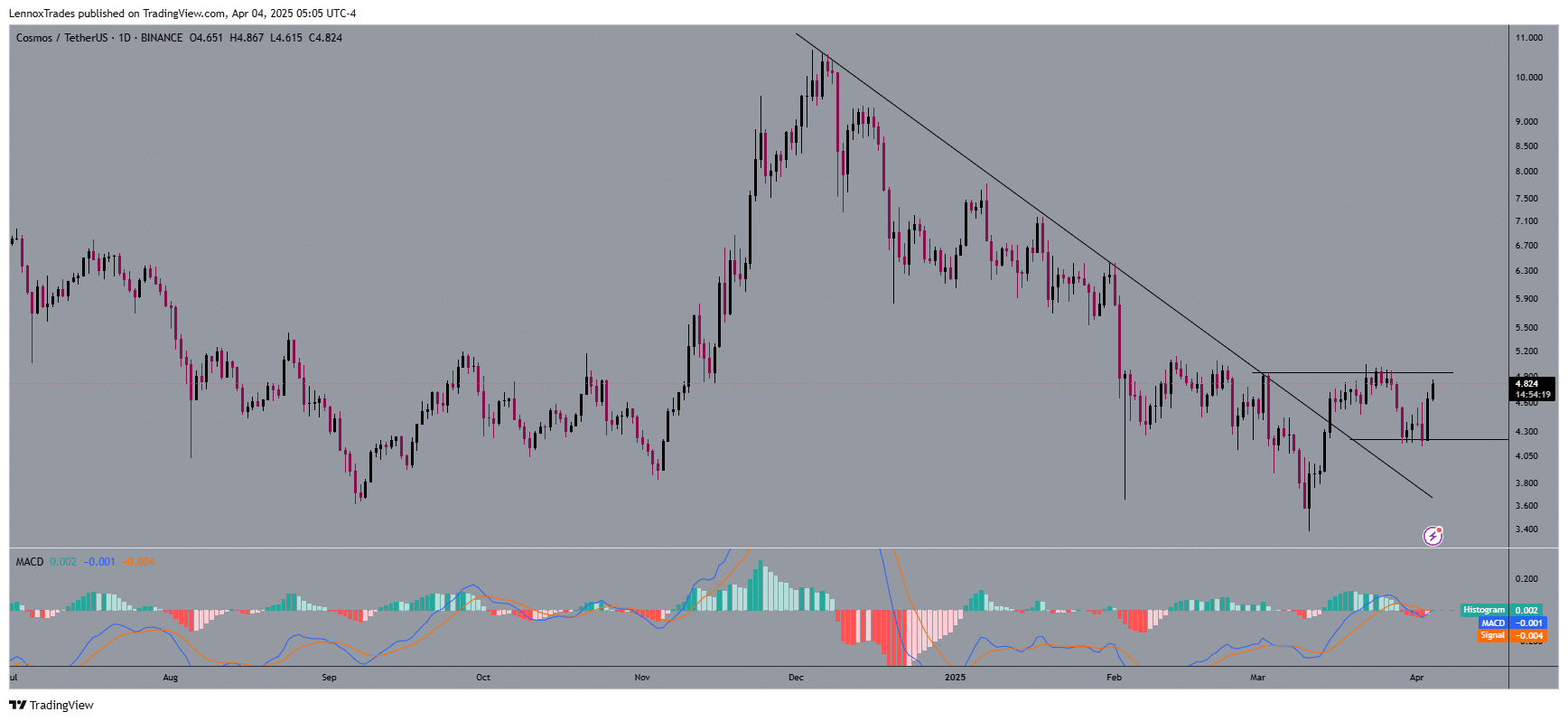

- ATOM crypto showed a positive move today, climbing 6% as it looks like it finally broke free from a downward trend on its price chart.

- Now, all eyes are on how it behaves around the $5 mark – that could be the key to whether it can keep this upward momentum going.

Cosmos [ATOM] had a good day, jumping up by 6% and breaking through that declining trendline we’ve been seeing on its daily price chart.

If the bulls keep up this energy, ATOM might just continue its climb, just like it has over the past couple of days, building on this positive movement.

ATOM got really close to that $5 resistance level, and breaking through it is going to be super important to confirm if this bullish trend is the real deal.

If ATOM can push past $5 and then establish itself above these current prices for a bit, we could be looking at a potential rally, possibly even reaching new resistance points further up.

However, if it can’t break through and stay above $5, this whole bullish setup might fizzle out, leading to a rejection at that price point and potentially sending the market downwards again.

If the price dips down to around $4.30, that might be an early warning sign of weakness for ATOM, and we could see it falling further towards support levels near $4.

Source: Trading View

Looking at the MACD indicator, it’s showing a slightly bullish lean – the histogram was a bit bearish before but is now hinting at bullish momentum.

Plus, with the MACD lines so close to the signal lines, it suggests we might see things stabilize for a bit before a clear trend really takes shape.

When ATOM broke above that descending trendline, it was a clear sign that market momentum is shifting.

What happens next with the price will likely depend on how Cosmos behaves as it trades between those important price points of $4.30 and $5.

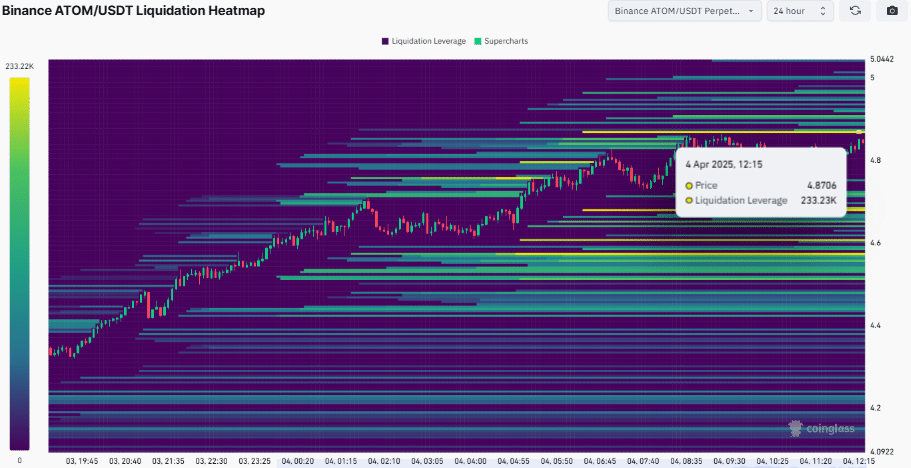

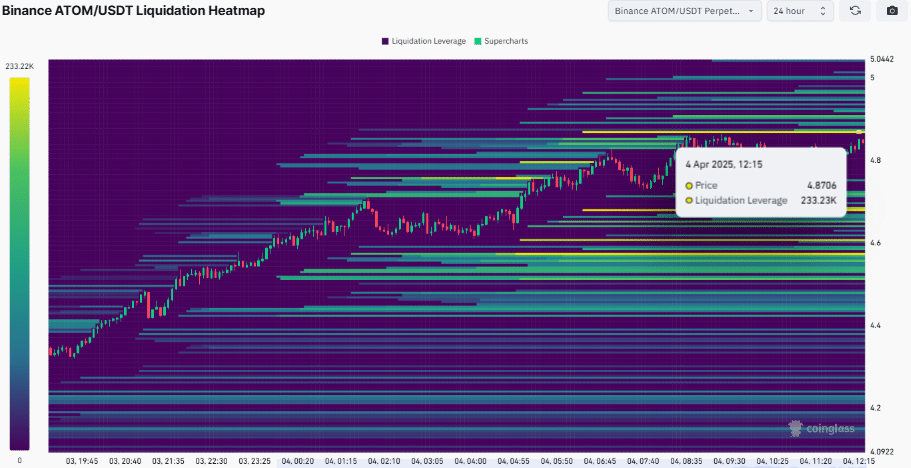

ATOM’s liquidation levels

Digging deeper into the analysis, the heat map from Binance highlights a lot of activity around the $4.87 level, with a liquidation leverage of $233.23K.

These hotspots of liquidation activity are really important areas to keep an eye on.

The recent daily gains have created larger liquidations around $4.87 and $5, suggesting that these zones could act as price resistance.

On the flip side, we can see long liquidation zones forming at $4.68 and $4.57, pointing to key support levels where buyers might step in.

If ATOM can’t hold above these resistance levels, we’re likely to see long liquidations triggered, which could make the market even more volatile.

On the other hand, if prices go higher, we’d expect to see more short positions get wiped out.

Source: Coinglass

For ATOM to really make a move upwards, it needs to solidify its position at both $4.87 and $5. These levels are crucial for deciding if an uptrend can take hold.

If the price gets pushed back down near $5, we could see a correction. But, if it manages to break decisively through this level, it could pave the way for more price increases.

Volume and netflow of spot trades

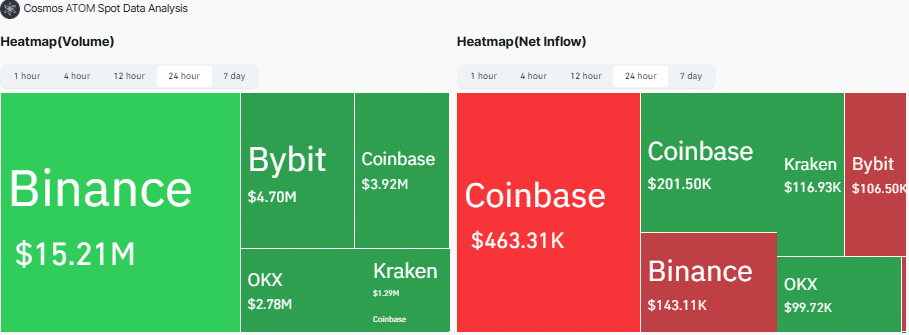

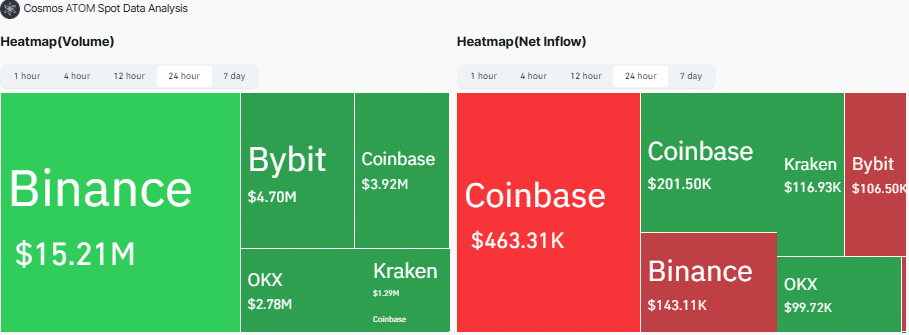

In terms of trading volume, Binance is still leading the pack for ATOM spot trades with $15.21M, followed by Bybit at $4.70M and Coinbase at $3.92M. OKX and Kraken are also in the mix, with $2.78M and $1.29M in exchange pairs respectively.

Interestingly, while Coinbase’s main account saw an outflow of $463.31K, Coinbase overall, along with Kraken and OKX, showed positive inflows, bringing in a total of $201.50K, $116.93K, and $99.72K, respectively.

On the flip side, Binance and Bybit both experienced withdrawals, with $143.11K and $106.50K moving out of their platforms, respectively.

Source: Coinglass

These withdrawals could mean investors are taking profits or moving their funds around, while the inflows suggest that these exchanges are still attracting new capital.

The increase in assets on some exchanges might be a positive sign that ATOM could keep going up in value. However, if we see a consistent drain of assets from these platforms, it might put some temporary downward pressure on ATOM and other cryptocurrencies.