Dogecoin $1 Target: Analyst Price Predictions

Dogecoin experienced an exciting surge in price during the last quarter of 2024. It was a period of rapid growth for DOGE, jumping from $0.11 to $0.46 in just a few weeks! This impressive rally ignited hopes within the Dogecoin community, with many dreaming of DOGE hitting the coveted $1 mark in 2025. However, the momentum has faced headwinds. Factors like ongoing tariff tensions, Dogecoin’s limited real-world uses, and even Elon Musk’s recent quietness on the topic have put a damper on the rally. Now, market analysts are offering their perspectives, suggesting that reaching that $1 target might be tougher than initially hoped, at least in the short term.

Analysts Speculate Whether Dogecoin Price Will Reach $1

The Dogecoin community is still buzzing with anticipation, holding onto the dream of DOGE one day reaching $1. But, let’s get real – experienced crypto market analysts have stepped in to offer a dose of reality. They’ve laid out several compelling arguments explaining why this beloved meme coin might not hit that dollar milestone anytime soon.

These analysts shared their insights in response to a thought-provoking post on X (formerly Twitter) by Michael Gayed. Gayed sparked the conversation by expressing his long-standing question: why hasn’t Dogecoin, a consistent top-ten crypto, ever broken through the $1 barrier?

Weighing in on the conversation, analyst DerektheCleric offered a rather blunt perspective. He suggested it’s “basically impossible” for Dogecoin to reach $1, pointing to its tokenomics as the core issue. He highlighted a key difference from Bitcoin – Dogecoin has no limit on the total number of coins that can be created. elaborating further he noted:

“You can produce it like fiat. Its price will always relate to its production cost.”

Another factor raised by commentators is the behavior of long-time Dogecoin holders. Many of these investors acquired their DOGE at much lower prices. So, whenever Dogecoin’s price starts to climb toward that magical $1 level, these holders often take profits, selling off their coins. This selling pressure, in turn, can actually push the price back down, making it harder to break through.

And then there’s the “Elon factor.” Some analysts even pointed to Tesla’s CEO, Elon Musk, as a potential hurdle in Dogecoin’s journey to $1. They’ve noticed Musk has been unusually quiet about DOGE recently. This observation echoes a previous article on Coingape that suggested Musk’s fluctuating involvement with Dogecoin might actually be diminishing its once-explosive popularity.

Key Factors That Could Drive Dogecoin to $1

Okay, it’s not all doom and gloom! There are definitely factors that could still propel Dogecoin to $1. A major one on everyone’s radar is the potential approval of a spot DOGE ETF (Exchange Traded Fund). Big players in asset management like Bitwise and Grayscale have already thrown their hats in the ring, filing applications for these ETFs. If approved, these would open up Dogecoin investment to larger institutions.

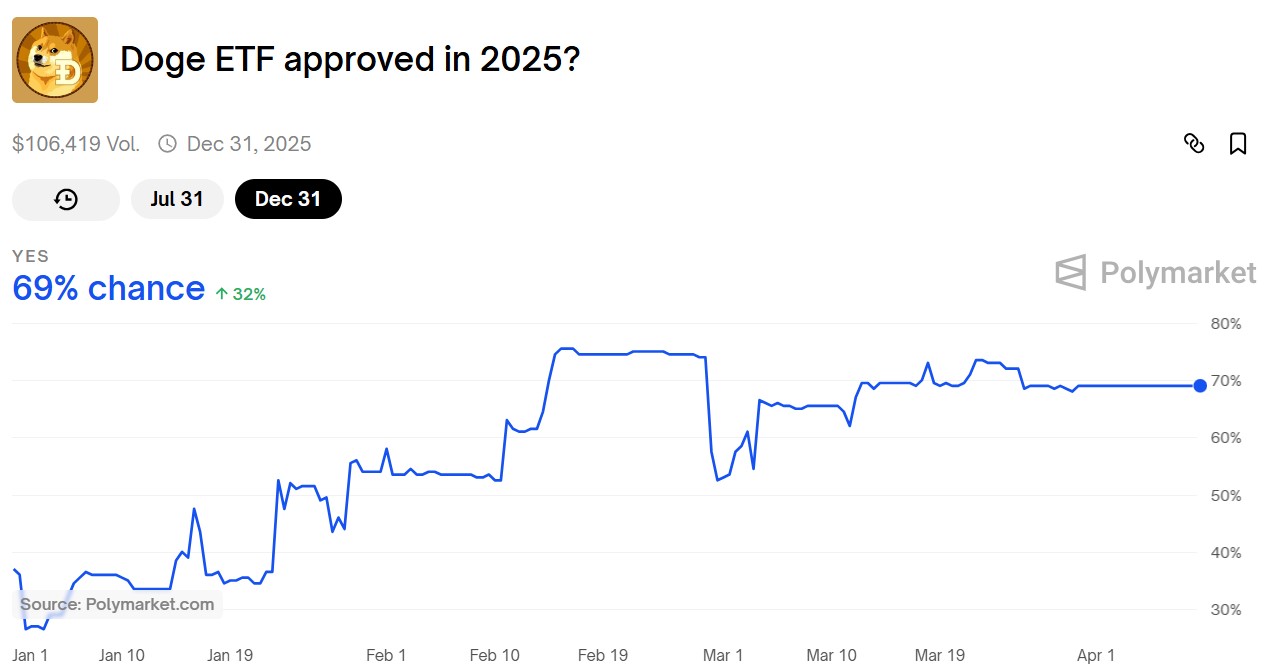

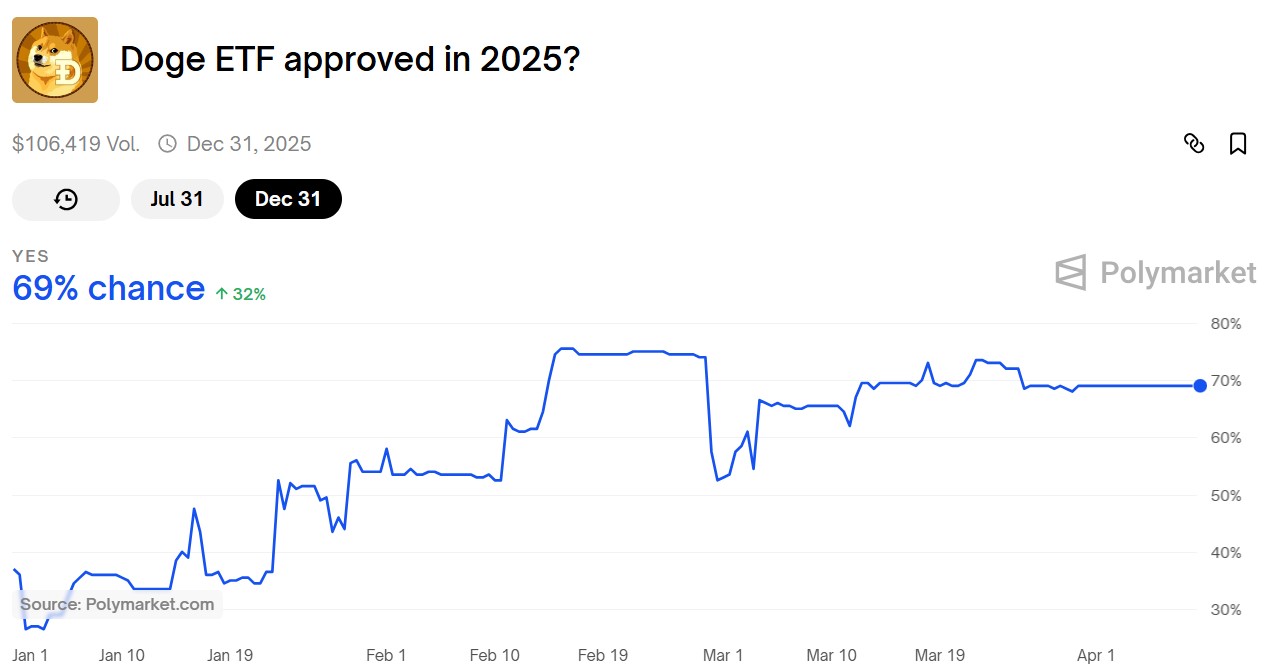

Interestingly, on Polymarket, a prediction market platform, the betting odds for the SEC approving a spot DOGE ETF in 2025 have jumped to a significant 69%! If this actually happens, many believe it could be *the* major spark that ignites Dogecoin’s journey to $1.

Beyond ETFs, growing real-world utility could also be a powerful driver. Dogecoin already has some traction as a payment method, accepted by giants like Tesla and Twitch. Imagine if more major companies started embracing DOGE for payments! That increased adoption could act as major fuel for a price surge towards $1.

And let’s not forget about the Dogecoin blockchain itself. Increased adoption of the blockchain network would be another huge tailwind. Wider use of the Dogecoin blockchain would naturally translate to greater utility for the DOGE coin, ultimately boosting its price.

Dogecoin Technical Analysis as Buy Signal Emerges

While analysts are offering a somewhat cautious Dogecoin price forecast, questioning the $1 dream, let’s turn to the charts! Technical analysis, specifically looking at shorter timeframes, is actually suggesting a potential recovery might be in the works.

Here’s why: the MACD (Moving Average Convergence Divergence) line has just crossed *above* the signal line. Traders often see this as a classic “buy signal.” Interestingly, Dogecoin has already shown signs of responding to this, bouncing back from a low point it hadn’t seen in months right after this signal appeared. If this buying interest continues, it could be just the push DOGE needs to climb.

Adding to the bullish picture, the Awesome Oscillator (AO) histogram is showing a bullish divergence. Technical analysts are watching to see if buyers can drive Dogecoin up to the 78.6% Fibonacci retracement level, around $0.18. If that happens, it could pave the way for further gains, potentially reaching the 123.6% Fibonacci level around $0.22.

So, the million-dollar question: will Dogecoin reach $1 in 2025? It’s a tough climb, and analysts suggest it might not happen without some major catalysts like widespread adoption and a green light from the SEC for a spot DOGE ETF. However, there’s a glimmer of hope! The four-hour chart is currently showing a “buy signal,” hinting at a potential rally, maybe even up to $0.22 in the near term.

Frequently Asked Questions (FAQs)

Analysts believe Dogecoin price will face major hurdles on its path to $1. The meme coin’s uncapped supply and low utility might hinder these gains.

A spot Dogecoin ETF approval might be on the horizon in 2025, thanks to the evolving regulatory landscape in the US. Polymarket currently places the chances of approval at 69%.

Dogecoin’s four-hour price chart is flashing a potential buy signal, suggesting now could be an opportune time to buy DOGE after the MACD indicator turned bullish.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.