Bitcoin: Open Interest Predicts a Significant Price Move

Reason to trust

We adhere to a strict editorial policy, ensuring everything we publish is accurate, relevant, and unbiased.

Our content is created by experts in the field and goes through a detailed review process to ensure quality.

We are committed to upholding the highest standards in both our reporting and publishing practices.

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

Bitcoin’s price has bounced back to $80,000, recovering from a sharp dip that was initially sparked by concerns surrounding US President Donald Trump’s tariff policies. The cryptocurrency market experienced a wave of selling pressure over the last 12 hours as wider economic worries spread across different sectors.

Related Reading

Market Cap Holds Strong at $1.5 Trillion While Bitcoin Dominance Increases

Despite the recent price volatility, Bitcoin’s market capitalization is currently holding firm at $1.5 trillion, according to market data. Although Bitcoin, the leading cryptocurrency, has shown signs of recovery, many altcoins are still facing significant losses.

Interestingly, Bitcoin’s dominance within the broader crypto market has climbed to 60%. This suggests that investors may be seeking the relative safety of the largest digital asset during these uncertain economic times.

Market analysts are indicating that the current market reaction is more connected to widespread economic anxieties rather than specific issues within the crypto space itself.

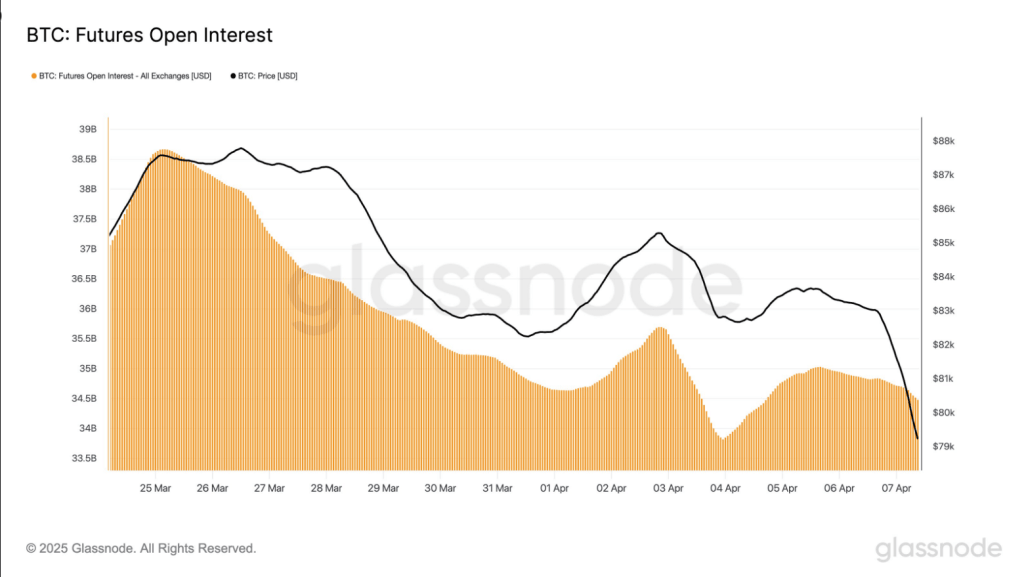

$BTC futures open interest sits at $34.5B. While there was a brief recovery from the $33.8B low on April 3, the broader downtrend remains intact. Futures exposure continues to unwind as traders reduce risk in response to declining price momentum. pic.twitter.com/ZX06yOCtsA

— glassnode (@glassnode) April 7, 2025

Futures Market Demonstrates Surprising Resilience

Data from Glassnode reveals that Bitcoin futures open interest has decreased to $34.5 billion. While this represents a slight recovery from the $33.8 billion low seen on April 3rd, it still points to a general downward trend. The reduction in futures exposure indicates that traders are lessening their risk in response to the slowing price momentum of Bitcoin.

Looking back to March 25th, we can see that cash-margined open interest has fallen from $30 billion to $27 billion. Simultaneously, crypto-margined open interest decreased from $7.5 billion to $6.9 billion during the same period. However, more recent data suggests a shift, with crypto-margined open interest starting to edge upwards again, possibly indicating that some traders are beginning to take on riskier positions once more.

The proportion of crypto-collateralized futures contracts has increased to 21% of the total open interest, up from 19% on April 5th. This change could make the market more sensitive to price fluctuations, potentially leading to higher volatility in the coming days.

Liquidations Remain Limited, Suggesting Controlled Selling

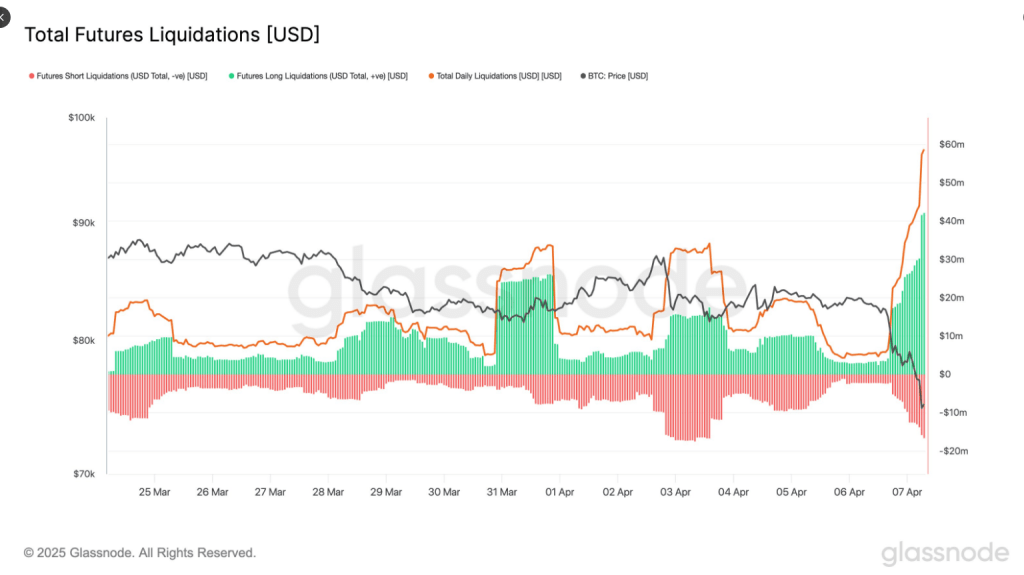

In the past 24 hours, Bitcoin futures liquidations totaled $58 million, with long positions accounting for $42 million and short positions for $16.6 million. Market observers have noted that this level of liquidation is surprisingly low, particularly considering the 10% drop in Bitcoin’s price.

Total $BTC futures liquidations hit $58.8M over the past 24h. Longs took the heavier hit with $42.1M wiped out vs. $16.6M in shorts. Despite the price dropping 10%, this liquidation size is relatively modest, suggesting limited leverage chasing upside. pic.twitter.com/104kM2XQoF

— glassnode (@glassnode) April 7, 2025

The relatively small number of liquidations suggests that the market wasn’t excessively leveraged leading up to the recent sell-off. Long liquidations made up approximately 73% of the total futures liquidations, which may indicate a slightly optimistic market sentiment just before the correction occurred.

Related Reading

These current liquidation figures are significantly lower compared to previous market events in February and March, when daily liquidations exceeded $140 million. The present trend points towards a more structured price decrease, primarily driven by spot selling rather than a cascade of liquidations caused by over-leveraged positions.

Institutional Investors Show Continued Interest in Entering the Market

Interestingly, despite the recent market swings, there are reports indicating increased demand from institutional investors. Recent data reveals that 76 new institutions, each holding over 1,000 BTC, have joined the network in the last couple of months. This represents a 4.5% increase in the number of large Bitcoin holders, suggesting ongoing institutional adoption.

Featured image from Gemini Imagen, chart from TradingView