Crypto Gems: Early Discovery Secrets

Remember the old crypto market playbook? Bitcoin would surge, and then, BAM! Altcoins followed, with pretty much everything going up. Well, those days of easy, across-the-board altcoin gains might be changing. New trends are suggesting it’s not quite the same altcoin party it used to be.

Experts are now saying we’re heading into a more discerning altcoin phase. Forget about “everything pumping” – it’s just not the reality anymore. Hitesh Malviya, the brains behind the crypto analysis tool DYOR, told BeInCrypto that if you’re a retail investor trying to find the next crypto gem, you need to adapt to these market shifts.

Cracking the Code: Finding Winning Altcoins in Today’s Tricky Market

Altcoin season used to be pretty straightforward: Bitcoin chills out, its dominance drops, and most altcoins rocket. That broad, rising-tide scenario? It might be on its way out.

“If you’re imagining a full-blown alt season based on how things went in the past, you might be disappointed. What we’ve seen with altcoins lately? It looks more like a bubble that inflated and then deflated over a couple of bull and bear market cycles,” Malviya explained to BeInCrypto.

Market watchers are anticipating a more selective environment. Only the strongest projects are likely to flourish. Think of it less like a rising tide lifting every boat, and more like a discerning wave that favors quality – projects with real-world use and actual revenue – over just sheer quantity of tokens.

Smart investors should be zeroing in on the fundamentals: things like real usage, solid revenue streams, and a growing community. The market is rewarding substance now, not just hype. Take meme coins, for example. Interest in those purely speculative plays has really cooled off since early 2025.

“Crypto adoption is taking a new upwards trajectory, while the hype-driven side of things is losing its appeal. This is leading to lower market volatility, more stable returns, and crypto becoming less tied to stock market moves. This shift is creating a distinct asset class in crypto, primarily with two main types: tokenized equities with strong cash flow – think AAVE – and store-of-value assets like BTC and ETH,” Malviya continued.

So, what’s behind this shifting altcoin landscape? A big part of it is that liquidity now moves around between different “narratives.”

Think of it as money chasing stories. We’ve seen these mini-cycles where certain themes get hot – remember the meme coin craze? Then AI tokens took off, then DeFi projects, metaverse gaming, and so on. Money flows into whatever story is grabbing attention, then it’s onto the next.

Sharp investors are keeping an eye on social media buzz, developer activity, and the latest news to spot these emerging narratives early – trying to get in before everyone else piles in.

“Liquidity will always gravitate towards different narratives at different times. Crypto’s like the stock market in this way – you’ve got different sectors, and some always perform better than others. We’re going to see similar market dynamics play out in crypto,” Malviya pointed out.

How to Spot a Potential Altcoin Season Winner? Look for Strength When Things Dip

Malviya suggests keeping an eye out for altcoins that show strength when the market is down. If an altcoin manages to hold steady or even climb a bit while Bitcoin is falling, that’s a strong signal of demand – possibly smart money accumulating before the next rally.

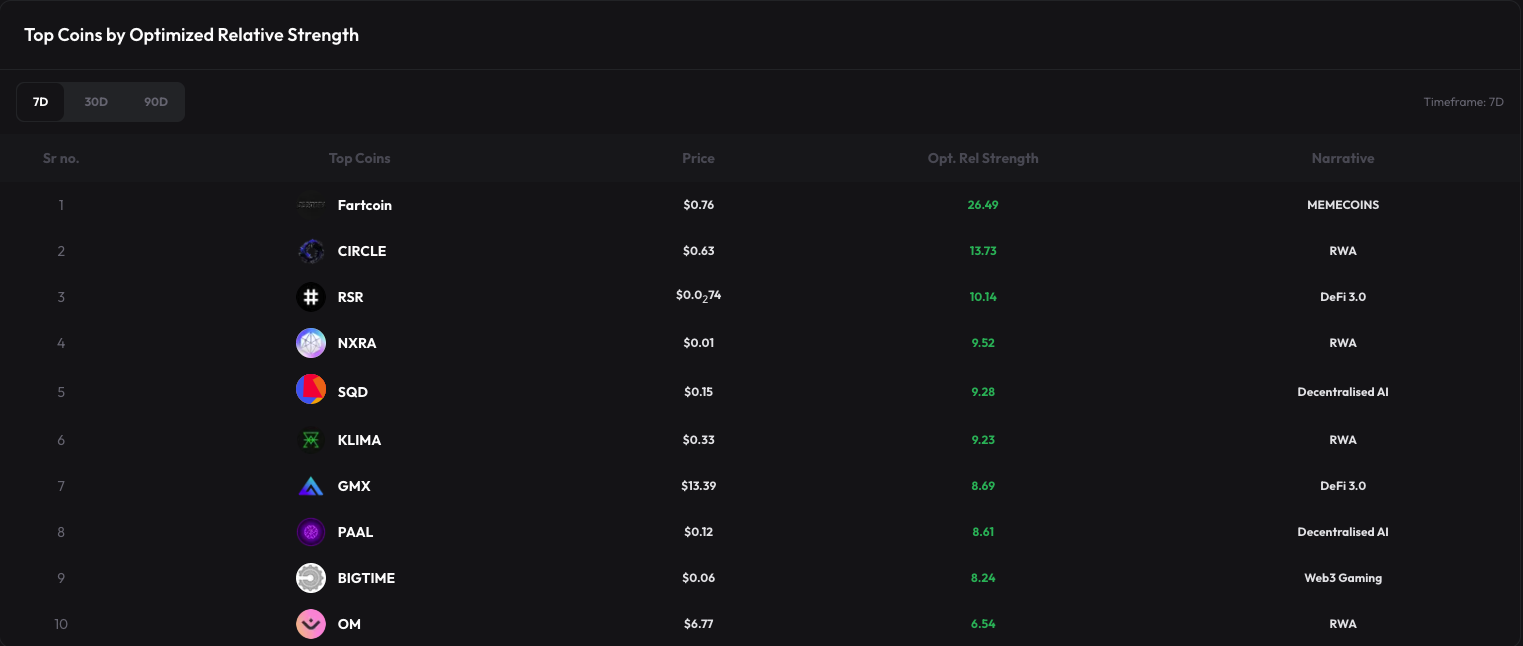

“At DYOR, we have a metric called Optimised Relative Strength. It helps you track coins and narratives that have shown the most resilience over the past week, month, and three months. Coins that have outperformed the broader market in the last month have a really good shot at surging when the market bottoms out and starts to climb again,” Malviya explained.

Beyond relative strength, Malviya highlighted some other key fundamental metrics to track. These include:

- DEX Volume: A jump in trading volume on decentralized exchanges can often push the prices of their native tokens higher.

- Total Value Locked (TVL): When deposits and TVL grow, it usually signals user confidence – which is a good sign for the lending protocol’s token.

- Derivatives Volume: More on-chain trading activity means more traders and more fees, which supports the exchange’s token.

- Oracle Total Value Secured (TVS): As the total value secured by an oracle like Chainlink increases, it shows greater reliance on that oracle, and that’s bullish for its token.

- DePIN Revenue: Real, actual revenue from a DePIN project (you know, a real-world service) is a strong indicator of a sustainable business model, not just hype.

Furthermore, Malviya stressed the importance of a crypto project’s tokenomics. He believes even a fantastic project can stumble if its token design is flawed.

Tokenomics – the way a token’s supply and incentives are structured – can make or break an altcoin. Good tokenomics (fair distribution, real utility) build lasting demand. Bad tokenomics (too much inflation or constant insider unlocks)? That can often spell doom for a project.

“Ideally, the community and ecosystem fund should hold at least 60% of the token supply. This is crucial for generating genuine demand by incentivizing developers and users through planned token releases. Tokens are really there to drive user demand for the product. Think of them as incentives to grab user attention. But since these incentives are also tradable, things can get tricky. Retail sentiment often blurs the line between the product and the token, and in many cases, the token’s price ends up influencing how much the product gets adopted. That can lead to problems if not handled well,” Malviya explained in detail.

Finally, he shared some helpful tools that can potentially help users find the next altcoin season star.

- DYOR – You can use DYOR to access relative strength data on over 200 coins, in-depth tokenomics data for over 70, fundamental data on 65+, and comprehensive research reports on leading projects.

- DeFiLlama – Great for tracking DeFi data across multiple blockchains, like TVL and trading volumes.

- Dune Analytics – A community-powered platform that offers customizable dashboards for on-chain data.

“The crypto community should get comfortable using DeFiLlama and DUNE dashboards to uncover potential opportunities. Most on-chain data is tracked on these platforms. You just need to find the right dashboards, keep an eye on interesting growth metrics, and build your investment ideas using that data – it’s all about doing your homework,” Malviya concluded.

In short, those who do their research and come prepared have the best shot at catching the next winning altcoin during altcoin season.

Disclaimer

Staying true to the Trust Project’s principles, BeInCrypto is dedicated to providing fair and open reporting. This article is intended to deliver accurate, up-to-date information. However, we encourage readers to double-check information independently and seek advice from a qualified professional before making any decisions based on this content. Please be aware that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.