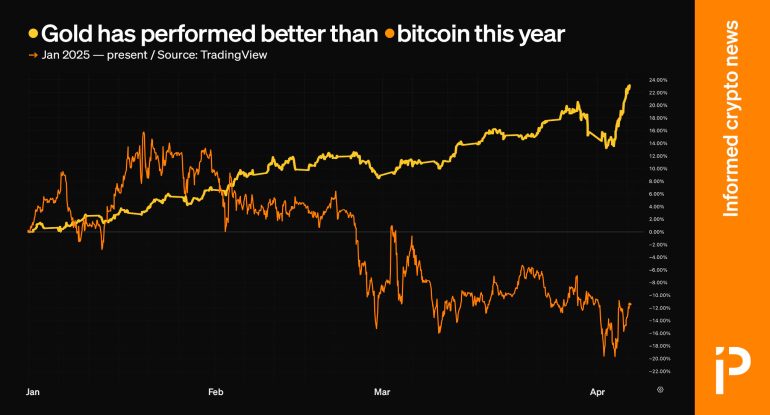

Gold outperforms bitcoin by 40% this year

If you’re looking for a chart that might make the crypto world blush, consider this: the performance of real gold versus its digital counterpart. Since the start of the year, gold has surged by 23%, meanwhile Bitcoin (BTC) has dropped by 12%.

And it’s not just that gold’s price has outperformed Bitcoin – the scale of this outperformance is even more striking when you consider the sheer size of the gold market. We’re talking about at least $21 trillion worth of mined gold globally, compared to a mere $1.6 trillion for Bitcoin.

And that $21 trillion figure is actually considered a conservative estimate, especially when you factor in just how long humans have been accumulating and storing gold.

For instance, Simon Hunt suggests China alone might secretly hold 40,000 tonnes of gold – that’s five times more than the US! He also estimates Russia holds over 11,000 tonnes. Other research points to even more varied figures, with some estimates for total gold value going as high as $100 trillion.

Regardless of the precise figure for gold’s market value, one thing is clear: it takes considerably more capital to shift the price of gold compared to Bitcoin.

Read more: Michael Saylor copies Grayscale, tells US to crash gold for BTC

According to Credit Suisse (now UBS), which regularly tracks global non-governmental wealth, net private wealth worldwide reached **$454 trillion by the end of 2022** and remains at least $432 trillion.

Even using that lower $21 trillion valuation for gold, it would still require a substantial shift – a 200 basis point reduction in global wealth – just to nudge its price by 5%.

Got a tip? Send us an email or ProtonMail. For more informed news, follow us on X, Instagram, Bluesky, and Google News, or subscribe to our YouTube channel.