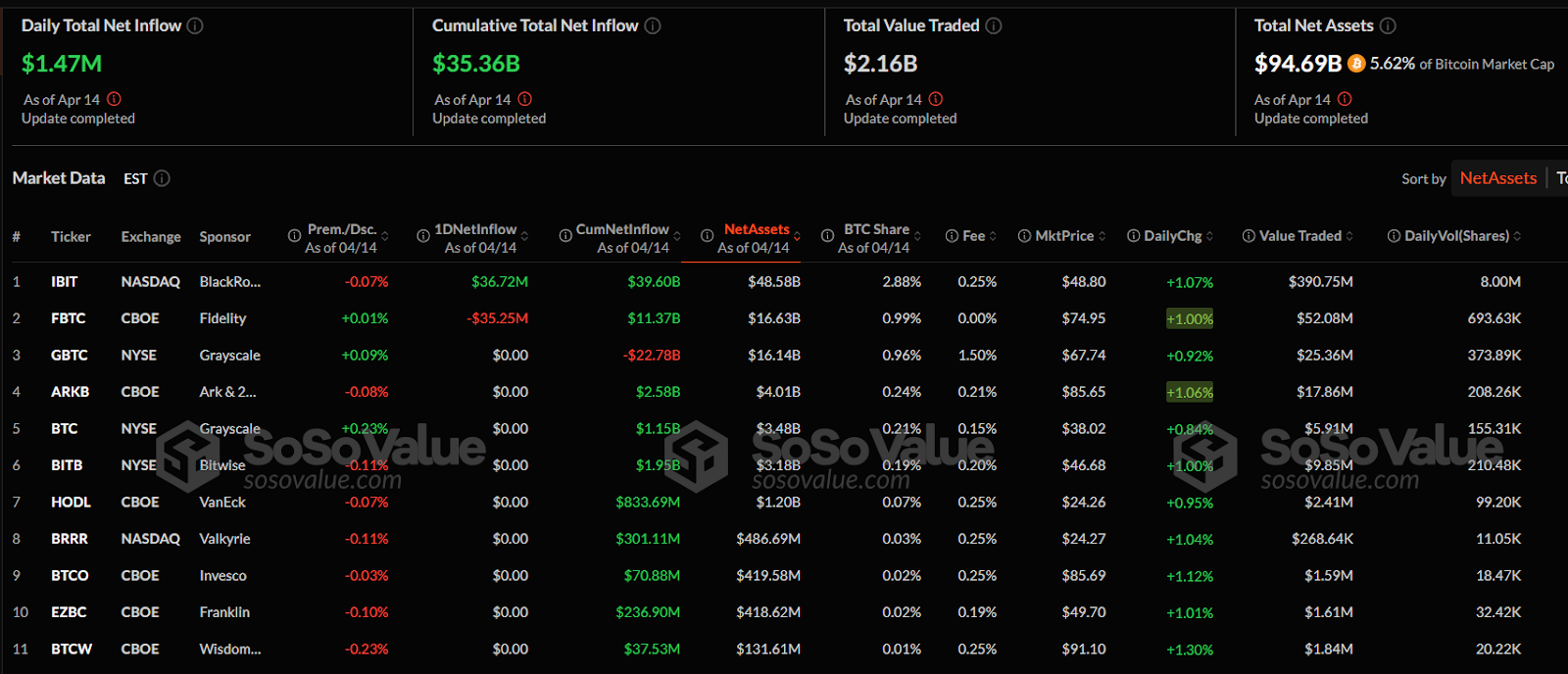

ETFs: $1.47M Daily Inflow, $35.36B Cumulative Total

- Let’s take a quick peek at some key figures: IBIT saw a daily inflow of $36.72M and boasts a net asset value of $48.58B.

- For FBTC, there’s a 1% daily change, and it holds a Bitcoin share of 0.99%.

- Interestingly, GBTC is showing a positive daily change of 0.92%, even with its cumulative inflow being negative.

Recent data from SoSoValue on Bitcoin ETFs, updated as of April 14, gives us a snapshot of the market. We’re seeing a total daily net inflow of $1.47M flowing into these ETFs, which adds to a substantial cumulative total of $35.36B. Looking at trading activity, a significant $2.16B in value has been traded across these assets. And the total net asset value? A hefty $94.69B, representing about 5.62% of the entire Bitcoin market cap.

IBIT and FBTC Experience Positive Inflows

When we dive into the specifics, the ETF landscape includes key players like IBIT, FBTC, and GBTC, among others. Starting with IBIT, which is traded on the NASDAQ and backed by BlackRock, we observe a healthy daily net inflow of $36.72M. Zooming out to the bigger picture, IBIT’s cumulative net inflow reaches $39.60B, and its net assets are currently at $48.58B. In terms of Bitcoin holdings, IBIT accounts for 2.88% of the total share. Daily value changes for IBIT are around 1.07%, and the value traded for the day amounts to $390.75M.

Turning our attention to FBTC, trading on the CBOE and supported by Fidelity, we see a robust net inflow of $11.37B. Looking at daily movement, FBTC experienced a daily net inflow of $35.25M, showing some daily volatility. FBTC’s Bitcoin share sits at 0.99%, and it also saw a daily change of 1%. For those tracking prices, FBTC’s market price is $74.95, and the value traded for the day reached $52.08M.

GBTC Reports $16.14B in Net Assets, Despite Negative $22.78B Cumulative Inflow

Now, let’s examine GBTC, which is traded on the NYSE and backed by Grayscale. GBTC’s net asset value is reported at $16.14B, making it a significant asset in this space. It also holds a notable Bitcoin share of 0.96%. Interestingly, despite a cumulative net outflow of -$22.78B, GBTC still managed a positive daily change of 0.92%. The total value traded for GBTC on this day was $25.36M.

Looking at another asset, simply labeled ‘BTC’ and also listed on the NYSE under Grayscale’s sponsorship, we find a Bitcoin share of 0.24%. This ‘BTC’ asset is showing a daily value increase of 1.06%, and its net asset value reaches $4.01B. The market price for this asset is $85.65, and it saw $17.86M in trading value.

Bitwise also stands out as a significant player, holding a 0.15% Bitcoin share and demonstrating a daily change of 0.84%. Bitwise is trading at a market price of $38.02, with a daily traded value of $5.91M. Beyond these key assets, others like HODL, BRRR, and BTCW are also experiencing their own movements in net inflows and market values. In fact, across the board, many of these Bitcoin ETFs are seeing minor daily gains, with BTCW standing out with a 1.30% increase. Overall, the market sentiment on April 14 appears to be positive, as most assets are trending slightly upwards in value, suggesting a healthy and active market, especially when we consider the performance of leading ETFs such as IBIT, FBTC, and GBTC.