Gold Tops Bitcoin in Trump’s Second Term

You know BlackRock, right? They’re a huge name in asset management, handling tons of different ETFs and trusts. Interestingly, that includes both gold and what some call “digital gold”—Bitcoin (BTC).

Let’s look at their iShares Gold Trust ($IAU) for a second. Right now, it’s trading around $61 a share and holds a hefty $36 billion in net assets.

Now, check out their iShares Bitcoin Trust ETF (IBIT). This one’s currently priced near $48 and incredibly, it’s already amassed about $48 billion in net assets.

Read more: CHART: Wasn’t Trump supposed to be good for crypto?

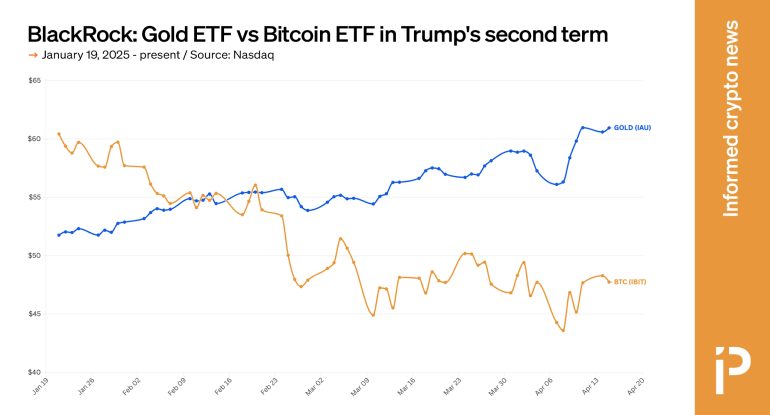

Many thought Donald Trump’s presidency would be a boon for Bitcoin’s value. However, it turns out gold has actually outperformed the leading crypto since he took office.

The price of the iShares Gold Trust has climbed from roughly $51 to $61 – that’s a nearly 20% increase!

On the flip side, their iShares Bitcoin Trust has seen a dip from about $60 to $48, marking a decrease of about 20%.

Both gold and Bitcoin are often touted as “safe-haven” assets, especially when things get shaky. And let’s face it, recent shifts in global trade have definitely stirred up economic uncertainty.

Yet, despite this increased instability, and even with open support for BTC from the White House, it’s only the gold trust that has continued to see its value go up.

Got a tip? Send us an email securely via Protos Leaks. For more informed news, follow us on X, Bluesky, and Google News, or subscribe to our YouTube channel.