Jupiter LP, Combining both strategies “HODL” and DEFI compounding yield interest, a savings strategy to lock in the bull run profits.

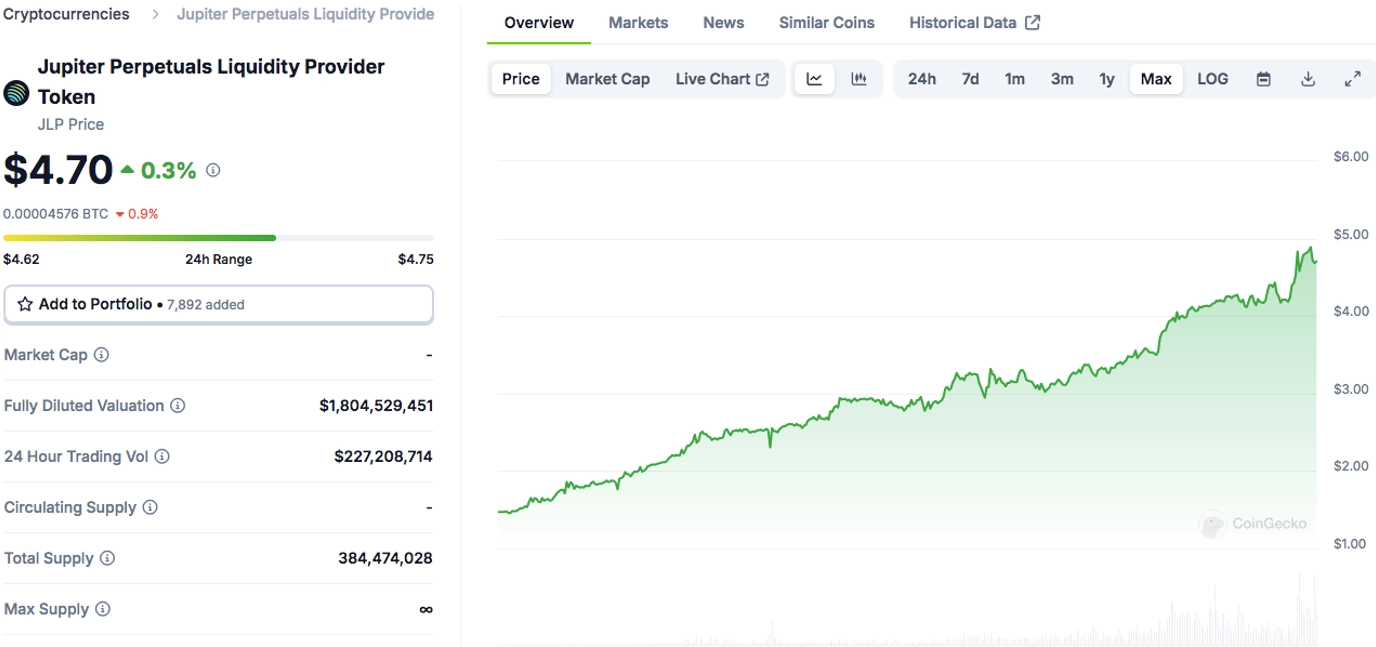

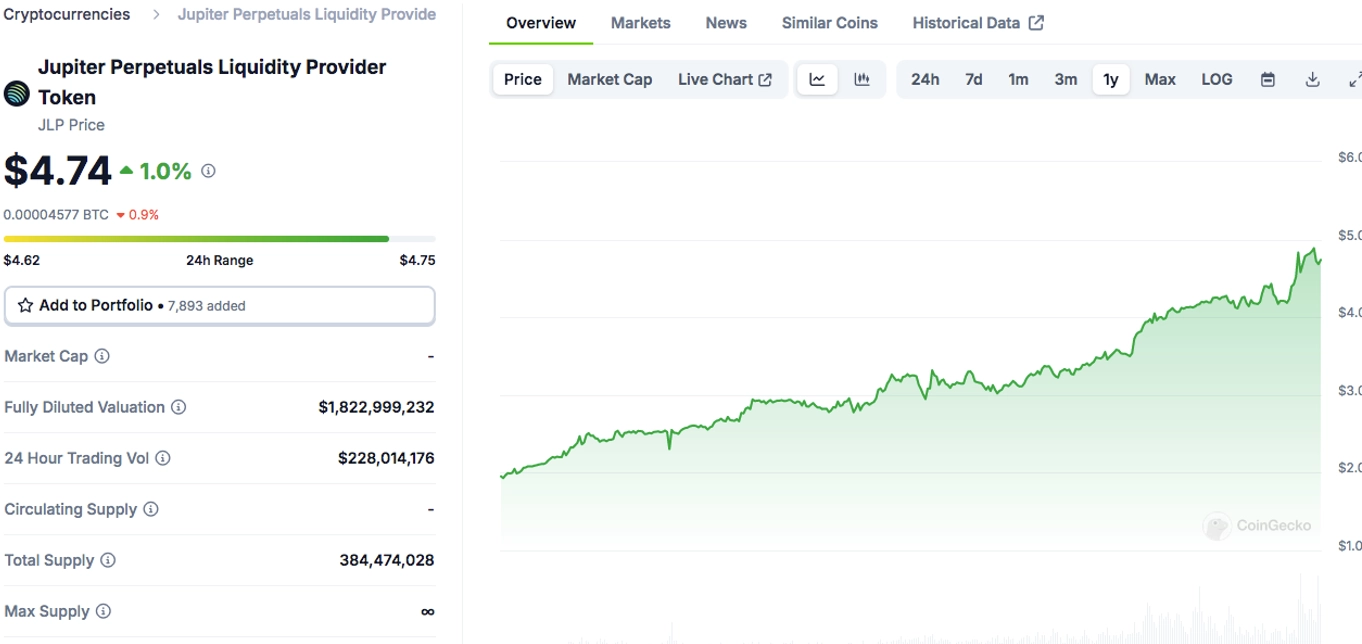

JLP, or Jupiter Perps LP, represents an interesting investment opportunity within the cryptocurrency market, its chart shows the impressive performance in 2024 and is very likely that it will continue with its tendency in 2025.

JLP is a token associated with the Jupiter Perpetuals exchange within the Solana blockchain ecosystem.

Its CA (contact address) is: 27G8MtK7VtTcCHkpASjSDdkWWYfoqT6ggEuKidVJidD4

It acts as a counterparty to traders who will borrow funds from the pool when leveraging.

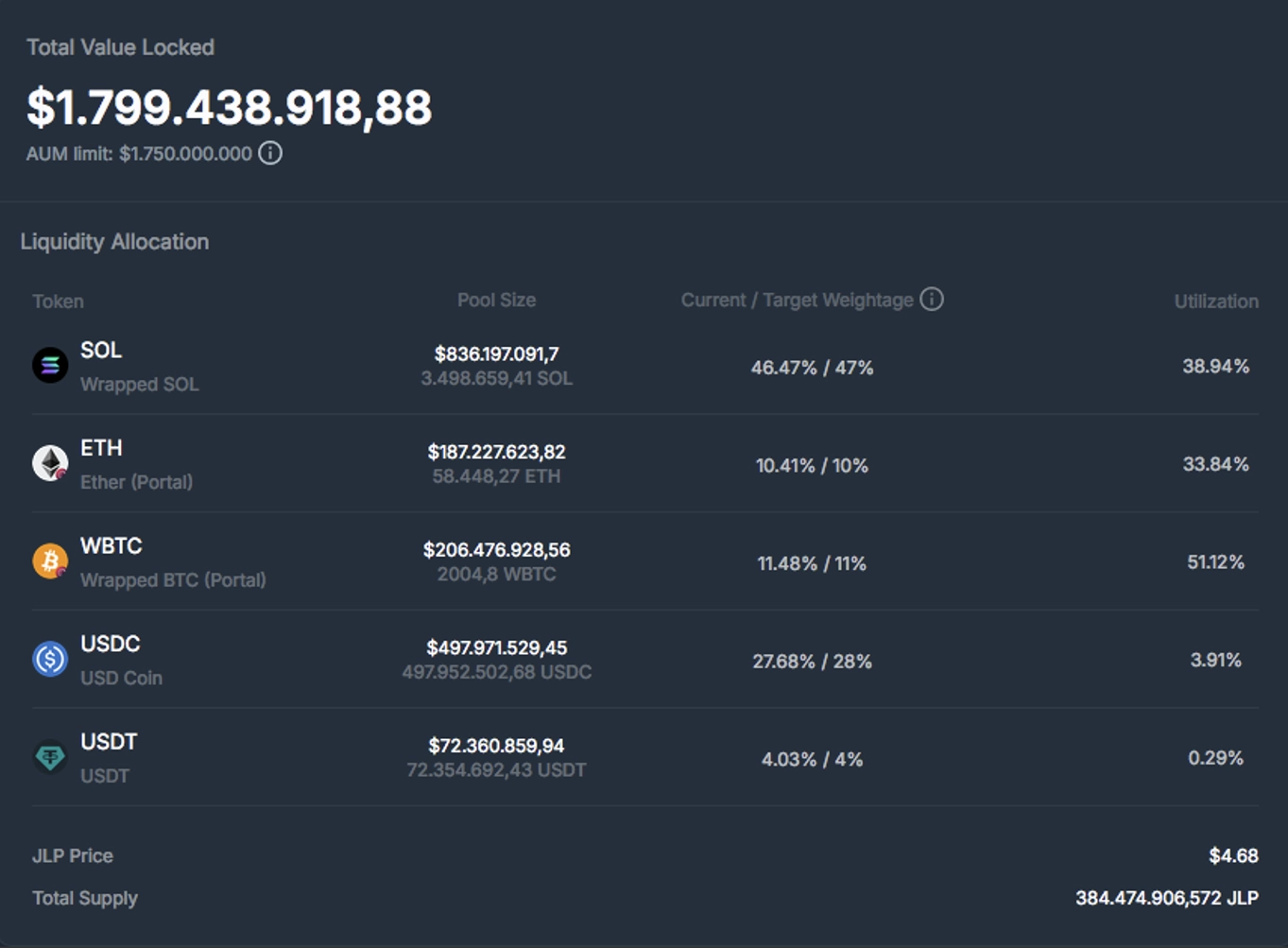

It is sort of a basket of 5 assets:

• Solana

• Ethereum

• WBTC

• USDC

• USDT

In addition to the current value of these tokens, the value of JLP is also derived from the trader’s profit & loss and 75% of generated fees such as opening or closing position fees. Here it is important to acknowledge that in the long run, 95% of traders lose money. This fact, among others, is one that I believe makes JLP a good investment in the long run.

These fees are redistributed back to JLP holders creating a changing APY that is compounded every hour by redepositing the fees into the pool. This creates a “snowball effect” that increases the value of your investment reflected in the Jupiter price or at least your drawdown will be much lower in the case of bear market conditions making JLP a very good choice for your crypto portfolio acting as a safe haven, knowing of course that in crypto there´s always high risk and volatility involved.

This picture shows the composition of the coins that are contained in the JLP liquidity pool, The weightage and utilization will change depending on which assets the traders are favoring.

Price Development

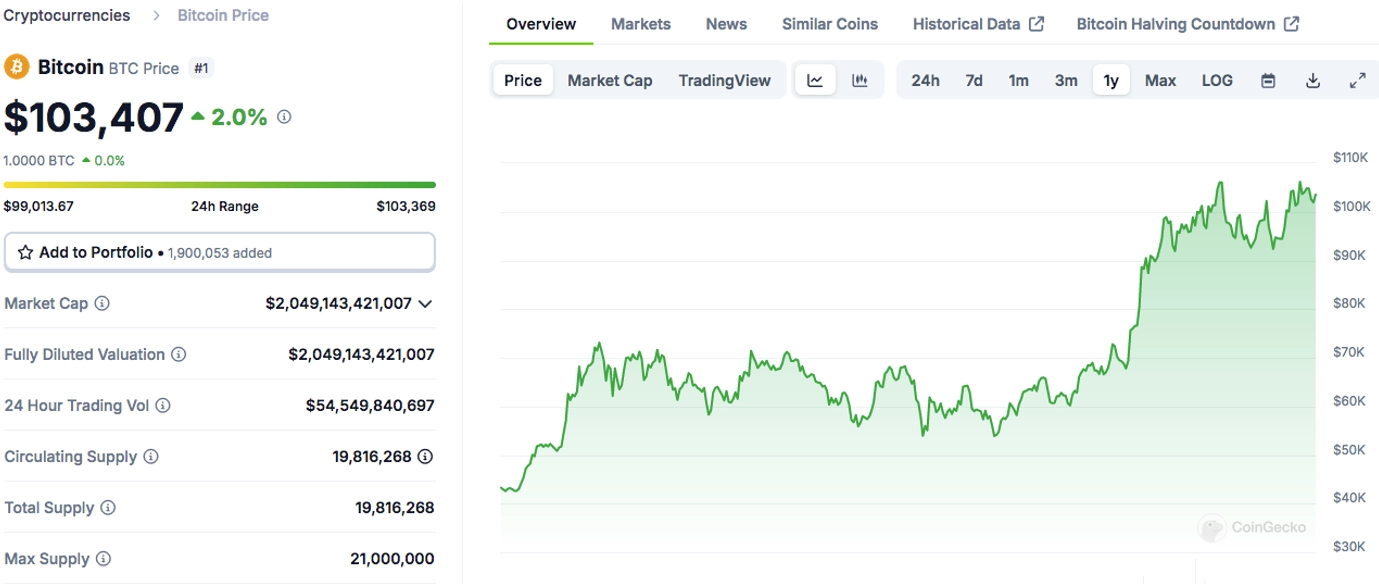

Obviously, the JLP price will dip if the three blue chips dip, and as we know, when the BTC price drops, the others follow. However, Jupiter will hold stronger since it also consists of stablecoins that will balance the price.

Also, because of that stablecoin exposure, the Jupiter price won’t be making radical surges; instead, it draws a slow and steady graph of upward movement.

For example, here we can see BTC price on a 1-year scale and below that, JLP price on that same scale.

As we can observe; the JLP chart is way much smoother than the BTC chart making it more appropriate for those who do not tolerate much volatility.

Strategy

The yield that is hourly injected into JLP is making it appreciate in value over time creating this a somewhat safe savings option for both bull and bear markets.

I look at Jupiter Liquidity Provider as an option between volatile crypto assets and stablecoin positions.

The performance of JLP and once you understand its mechanism makes it a really good choice to start accumulating it. In fact, large number of successful Solana traders lock in their trade profits in JLP.

Another interesting feature of this coin is that in the case of bear market condition it allows you to continue accumulating yield and prepare your portfolio for the next bull run while reducing your drawdown because JPL contains approximately 20% in stable coins denominated in USD.

All these mentioned features above make JLP an interesting investment opportunity for the long run.

Conclusion

Here are some summarizing points that resume the sentiment and how the investors see JLP as a long run investment

JLP as a long-term investment option: Some users in the Solana community consider JLP to be less volatile and a good option for long-term holding due to its structure of generating yield through trading fees.

Performance and utility: Jupiter is designed to incentivize participation and maintain a balanced ecosystem. JLP holders can engage in activities like staking, yield farming, and governance, giving the token multifaceted utility. Moreover, the redistribution of 75% of the trading fees generated by Jupiter Perps activities to liquidity providers (JLP holders) can offer an attractive source of passive income.

Value growth: The value of the JLP token is tied to the market capitalization of the $JLP currency, which can increase due to the reinvestment of generated fees. This creates a valuation mechanism where the token’s price can appreciate over time as more investors participate and more fees are generated.

Yield strategies: It’s been noted that using JLP to participate in the liquidity pool can be beneficial, as it acts like a kind of index fund including SOL, ETH, WBTC, USDC, and USDT, with the possibility of earning on the price movements of these underlying assets and the trading fees.

Remember that these points represent opinions and analyses from the community, and the performance of cryptocurrencies can vary significantly. Investing in cryptocurrencies always involves risks, and it’s important to do your own research before making investment decisions.