Whales Threaten ETH Price Stability?

Ethereum (ETH) is still finding it tough to climb back above $2,000 – a price point it hasn’t seen since March 28th. Bearish vibes are hanging around, according to both technical charts and on-chain data. Even though there have been attempts to steady the ship, recent figures show that more and more ETH is being held by big players, or “whale” wallets. At the same time, trend indicators like EMA lines are still looking weak.

Meanwhile, it seems like smaller investors and those in the middle are gradually letting go of their ETH, meaning the big whales are becoming even more dominant. This combo – fewer everyday folks holding ETH and more power concentrated with the big guys – could make ETH prices swing wildly if the overall mood shifts.

ETH Whales are Stockpiling Like Never Before (Since 2015!), Sparking Centralization Worries

Get this: the amount of ETH stashed away in whale addresses – those digital wallets holding over 1% of all ETH in circulation – has jumped to a level not seen since 2015, hitting a whopping 46%.

This is a pretty big deal in terms of who owns Ethereum. Back on March 10th, whales actually overtook retail investors in ETH holdings and they’ve been increasing their share ever since. Think about it: regular investor wallets (holding between 0.1% and 1% of the supply) and your average retail wallets (under 0.1%) have both seen their slice of the ETH pie shrink.

The leap from 43% to 46% in just a few months shows whales are on a serious buying spree, suggesting ETH is becoming more and more concentrated in fewer and fewer hands.

Whales are usually the big guns – think institutional investors, funds, or folks who got in early. What they do can really shake up the price because they trade in such large volumes. Investor-level addresses often belong to wealthier individuals or smaller institutions, while retail addresses are your everyday traders and holders.

Now, some might see whales loading up on ETH as a good sign – like they’re confident in the future. But there’s a flip side: it also makes things riskier if these big holders decide to sell off a chunk of their stash suddenly.

With fewer retail and smaller investors in the game, the market might get a bit wobbly and more prone to those sudden, unexpected price drops caused by just a few powerful players.

Whales with 1,000 to 100,000 ETH Now Control a Staggering $59 Billion

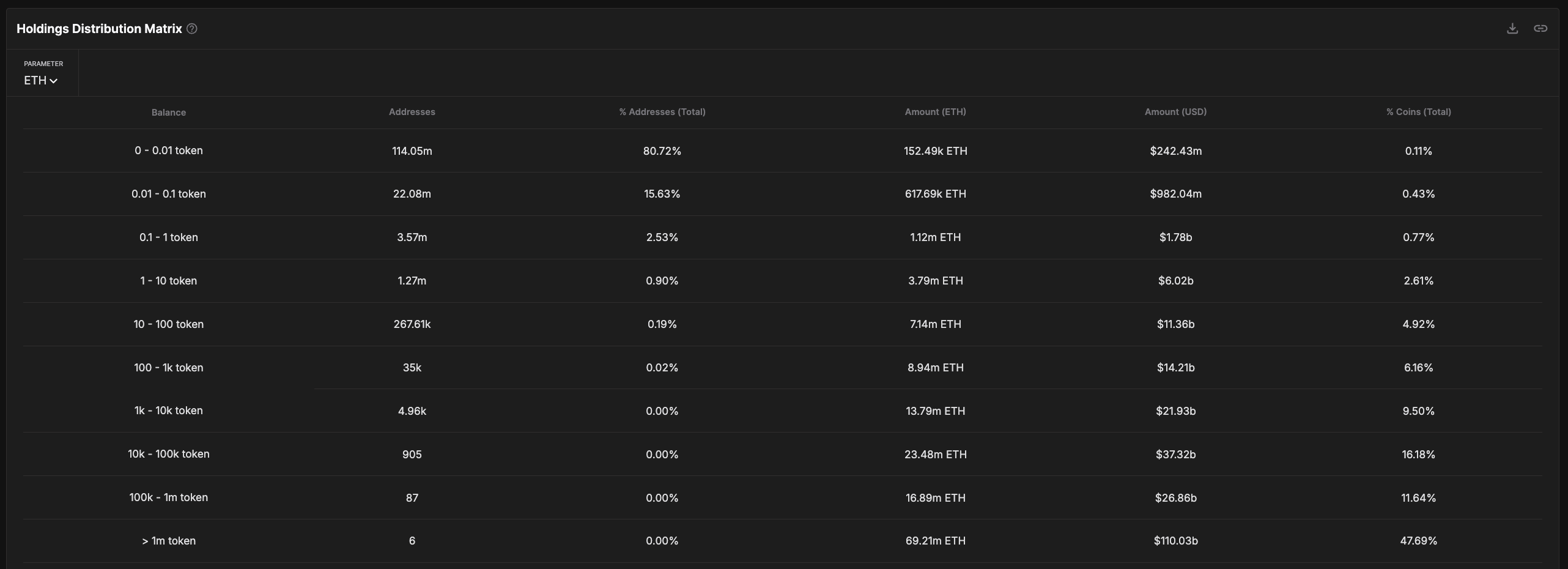

Taking a closer look at how ETH is distributed reveals some concerning trends that point to even greater concentration.

If we ignore the really massive addresses (over 100,000 ETH, which are usually linked to big exchanges), we find that whale wallets holding between 1,000 and 100,000 ETH now control about $59 billion worth of ETH. That’s roughly 25.5% of all the ETH floating around!

This group has been steadily increasing their ETH stash, showing a clear power shift toward large players who aren’t exchanges but still wield massive influence. Just recently, Galaxy Digital moved a cool $100 million in Ethereum, and people are wondering if it’s a strategic move or a sign they might be selling off.

While some might see this trend as smart money positioning themselves for gains, it also makes Ethereum more vulnerable to big drops.

When over a quarter of the ETH supply is held by these whales, any kind of coordinated selling – or even just panic selling – could set off sharp price plunges, especially since fewer regular investors are participating.

Instead of being a sign of long-term stability, this level of concentration might actually make the ETH market more fragile and prone to sudden ups and downs if these big holders decide to move their money elsewhere.

Bearish EMA Structure Continues to Weigh Down ETH

Ethereum’s EMA lines – those trend-following indicators – are still giving off bearish signals. Short-term averages are still below the long-term ones, which basically means the downward trend is still in charge.

If another price correction happens, Ethereum might first test a support level around $1,535. If it falls below that, it could drop further towards $1,412 or even $1,385.

And if those support levels also fail to hold, Ethereum could get dangerously close to the $1,000 mark – a level some analysts are earmarking as a potential bottom if the market takes a bigger tumble.

Still, it’s not all doom and gloom for the bulls! If buyers come back and Ethereum picks up some short-term momentum, it could try to break through resistance around $1,669.

Busting through that level would be a solid positive sign technically, and could potentially push Ethereum’s price up towards $1,749, and maybe even $1,954.

However, with those EMAs still pointing downwards, the bulls have their work cut out for them to prove the momentum is truly shifting in their favor.

Disclaimer

Just a heads-up based on our Trust Project commitment: this price analysis is for informational purposes only, not financial or investment advice. We at BeInCrypto strive for accuracy and unbiased reporting, but the crypto market is a wild ride and things can change fast. Always do your own digging and chat with a professional before making any big financial moves. Also, please take a moment to check out our updated Terms and Conditions, Privacy Policy, and Disclaimers.