Move: Ethereum Price Tight Range – Breakout Looms

Reason to trust

We maintain a strict editorial policy focused on delivering information that is accurate, relevant, and unbiased.

Our content is created by industry veterans and undergoes thorough review for quality and accuracy.

We adhere to the highest standards in both our reporting and publishing processes.

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

This article is also available in Spanish.

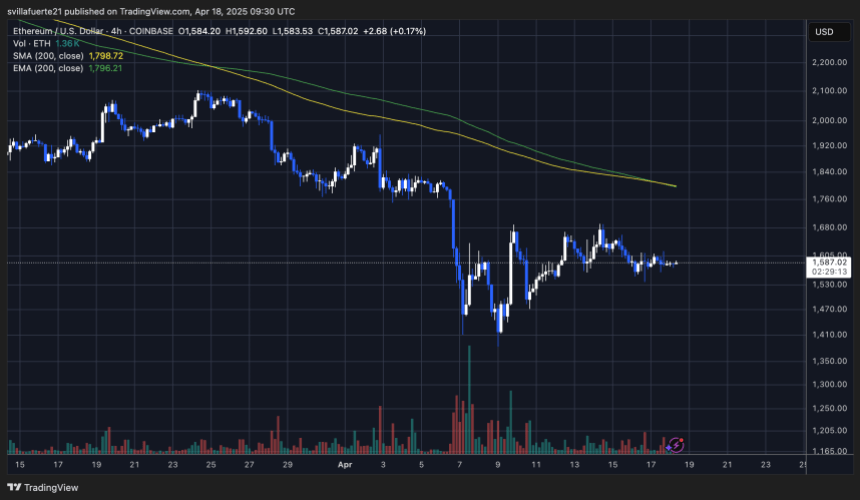

Ethereum finds itself at a crucial juncture after weeks of consistent selling pressure. Since dropping below the significant $2,000 threshold, this major cryptocurrency hasn’t been able to effectively bounce back. Currently down 21% from that prior level, ETH is lingering around $1,580, indicating a standoff between buyers and sellers unsure of the next move.

Related Reading

The market is currently experiencing a phase of extreme uncertainty. According to prominent analyst Daan, Ethereum’s price movement has become remarkably constricted, barely fluctuating over the past couple of days. This kind of tight consolidation is frequently a precursor to significant price shifts in either direction, and traders are keenly observing for signals of an impending breakout or breakdown.

Broader economic concerns continue to weigh on investor confidence. Factors like global trade tensions and worries about monetary policy are applying pressure to riskier assets like Ethereum. For the moment, for bullish sentiment to return, buyers need to push past the $1,850 resistance level. Conversely, if the price falls below $1,500, it could pave the way for even deeper price declines.

As underlying volatility builds, this period of compression could be the stillness before a significant move – setting the stage for Ethereum’s next big swing. Will it surge upwards, or are we headed for further declines?

Ethereum Compression Points to Potential Breakout Amidst Macroeconomic Pressures

Ethereum is undergoing a critical test, trading at compressed levels following a sustained period of selling. The wider cryptocurrency market remains under pressure as global uncertainties intensify. Notably, US President Donald Trump’s trade disputes with China continue to heavily influence the macroeconomic outlook, making investors cautious across higher-risk asset categories.

Even with last week’s announcement of a 90-day tariff reprieve for all nations except China, significant uncertainty persists. The unresolved status of trade relations between the US and China is still casting a shadow over markets and is a key reason behind the current hesitancy in price action. For Ethereum specifically, this has manifested as exceptionally low volatility and a stalled price pattern.

Analyst Daan recently pointed out that Ethereum’s price has become “extremely compressed” and has shown virtually no significant movement for nearly two days. Daan suggests that this type of price compression typically precedes a major breakout, although the direction of that breakout is still uncertain.

Both investors and traders are paying close attention to this situation, as compressed price action typically leads to significant, momentum-driven price movements. Given the ongoing broader macroeconomic risks, Ethereum’s forthcoming move could dictate the short-term direction and set the overall market tone for the weeks ahead.

Related Reading

ETH Bulls Seek To Regain Upper Hand

Ethereum is currently trading at $1,590 after several days of sideways movement, fluctuating between a support level at $1,550 and resistance near $1,700. Despite holding above the lower boundary of this range, ETH is struggling to gather the necessary momentum to break out upwards and signal a short-term recovery.

For buyers to strengthen their position, ETH needs to break above both the 4-hour 200-day moving average (MA) and the exponential moving average (EMA), both of which are currently acting as dynamic resistance. A successful move above these technical indicators could reignite trader interest and signal the start of a recovery.

However, the real challenge lies at the $2,000 mark – a significant level of psychological and technical resistance. Recapturing this level would represent a change in overall market sentiment and open up possibilities for targeting higher price points.

Related Reading

On the other hand, if it fails to advance beyond the current range and falls below $1,550, ETH could quickly descend below $1,500, increasing the chance of a more substantial correction. Currently, Ethereum is in a consolidation phase, and its next significant movement will likely determine whether buyers can regain control or if sellers will drive prices down towards lower demand zones.

Featured image from Dall-E, chart from TradingView