Bitcoin Dominance: 64% Fuels Altcoin Season Speculation

- Get ready, altcoins might just be on the verge of a breakout! It looks like Bitcoin’s dominance in the market might be pushing its limits.

- This whole situation feels strangely familiar, almost like a replay of the 2021 cycle — could history be getting ready to repeat itself?

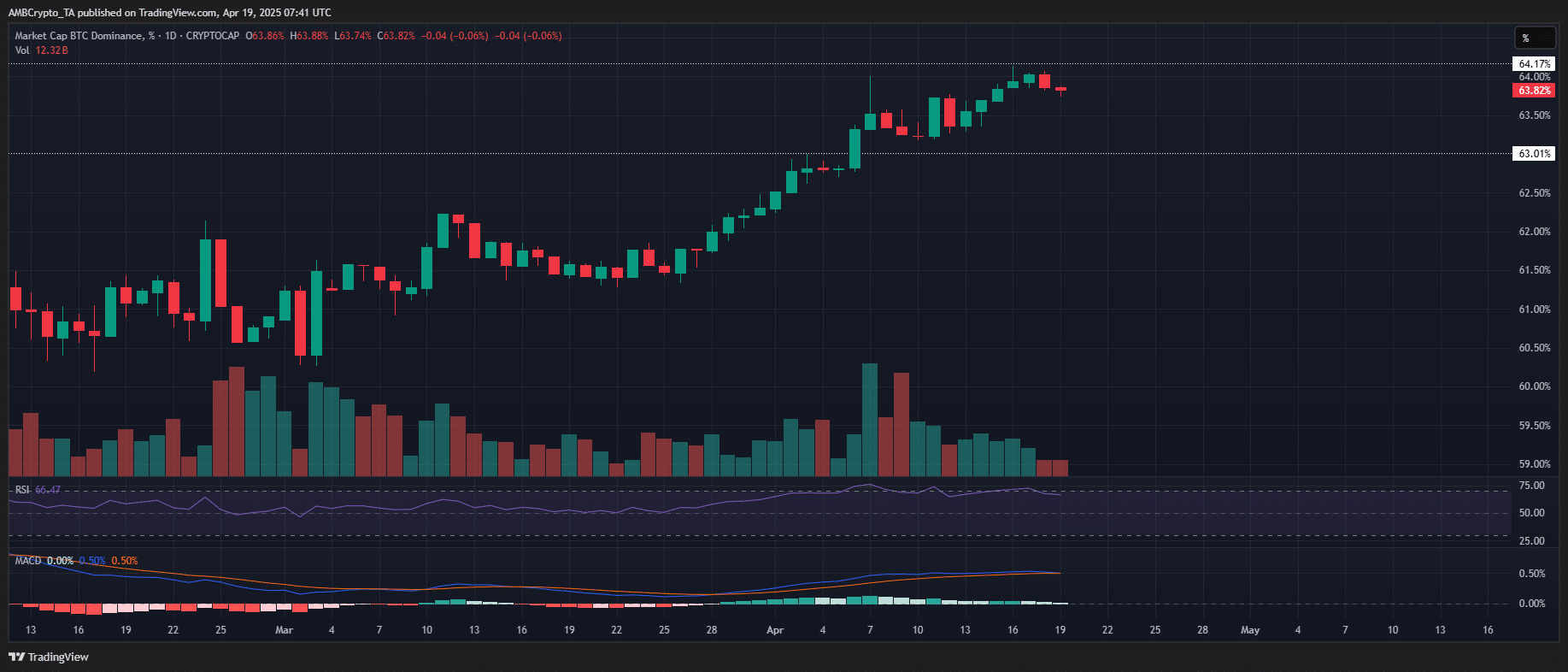

Bitcoin Dominance (that’s BTC.D for short) has just bulldozed through a really important level, shooting past 64% for the first time in over four years.

Now, while this jump might seem like a good thing for Bitcoin, technically speaking, there’s a catch. The Relative Strength Index (RSI) – think of it as a market thermometer – is flashing bright red, deep into overbought territory.

What this could be telling us? Bitcoin’s amazing run might be running out of steam, at least compared to the rest of the crypto market.

Source: TradingView (BTC.D)

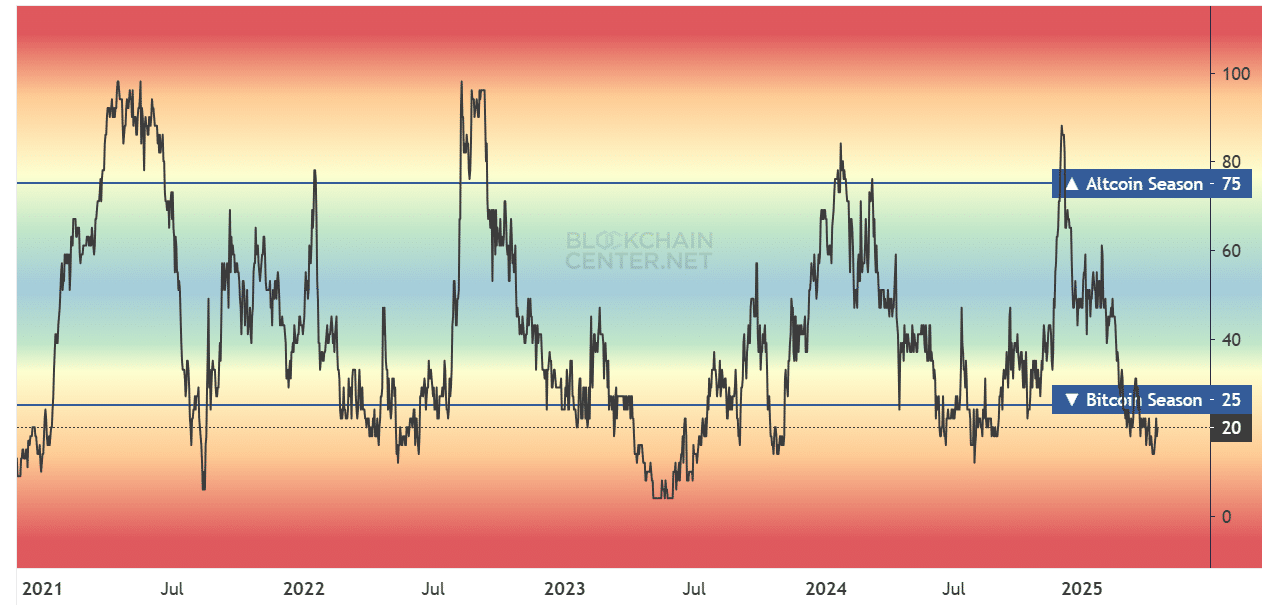

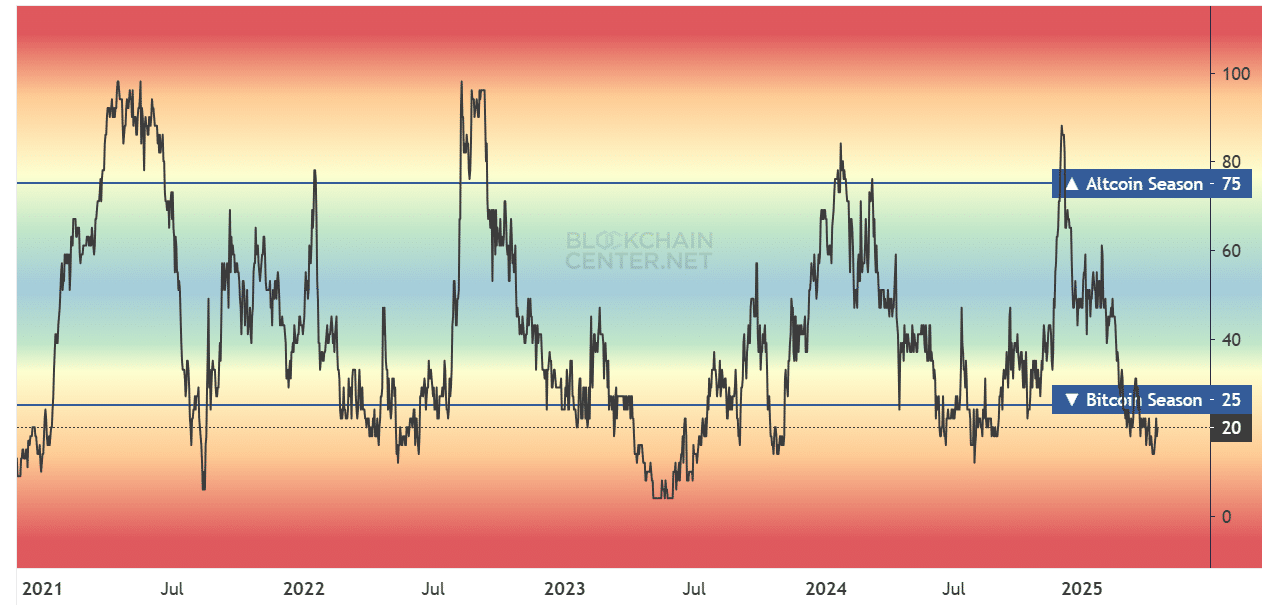

Interestingly, the current market picture is quite similar to what we saw back in 2021. Back then, Bitcoin Dominance seemed to hit a ceiling just as the Altcoin Market Index was hitting rock bottom, below 10. What followed? A huge wave of money flowed out of Bitcoin and into altcoins.

Fast forward to early 2022, and the altcoin index had exploded past 75! This jump signaled a real power shift in the market, confirming that alt season was officially in full swing.

So, considering all of this, what’s happening now could very well be the early stages of a similar shift. Are we on the cusp of another altcoin boom?

Bitcoin’s strength tested at the top

Looking at recent activity, we’ve seen a significant $42 billion pour into the total crypto market *excluding* Bitcoin over the past week.

This is a pretty strong signal that as Bitcoin dominance reached a peak, altcoins started looking very attractive, drawing in substantial investments.

Among the big altcoins, Solana [SOL] is really turning heads, posting a double-digit percentage jump on its weekly charts.

And it’s not just Solana. The overall altcoin market index has bounced back sharply, climbing from 13 up to 20.

This kind of price action is echoing what we saw in 2024. Back then, the index dipped to similar lows in the third quarter before roaring back up to 87 by the start of December.

Source: BlockChainCenter.Net

To sum it up, both technical analysis and looking back at how prices have moved historically are pointing towards a possible repeat of the 2021 market cycle.

If Bitcoin is indeed hitting a peak and its dominance is showing signs of weakening, then Solana’s impressive 11% jump could be the first glimpse of capital starting to flow towards altcoins.

Putting it all together, we might just be heading into a full-blown altcoin season, possibly as soon as late Q3 or early Q4.

Altcoins set to exploit BTC’s fatigue?

Our own analysis at AMBCrypto of BTC.D highlights a really important turning point in the market’s structure.

Back on April 7th, BTC.D closed at a significant 64%, breaking through a resistance level that’s held for years. This marked the highest Bitcoin dominance we’ve seen since early 2021.

At the same time, the RSI indicator was screaming ‘overbought,’ printing above 80. This suggested that Bitcoin’s outperformance might be running on fumes.

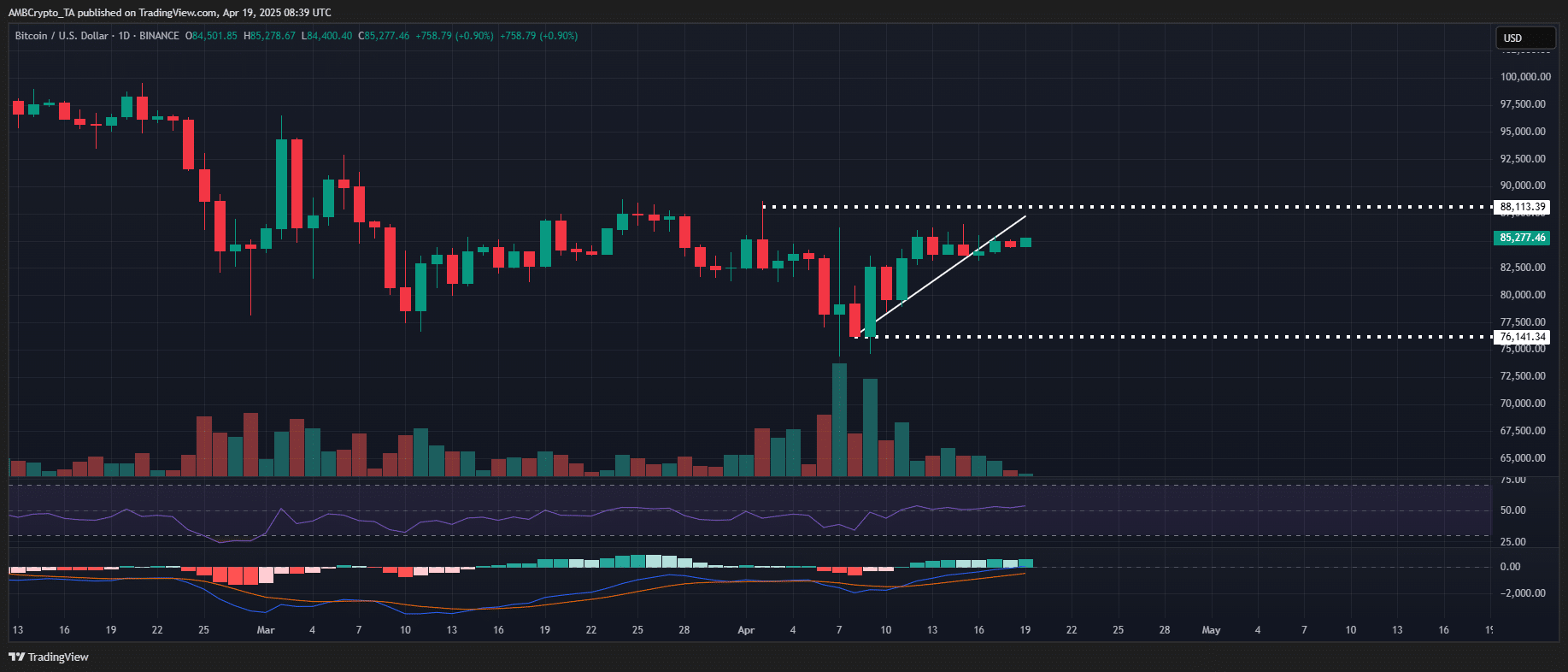

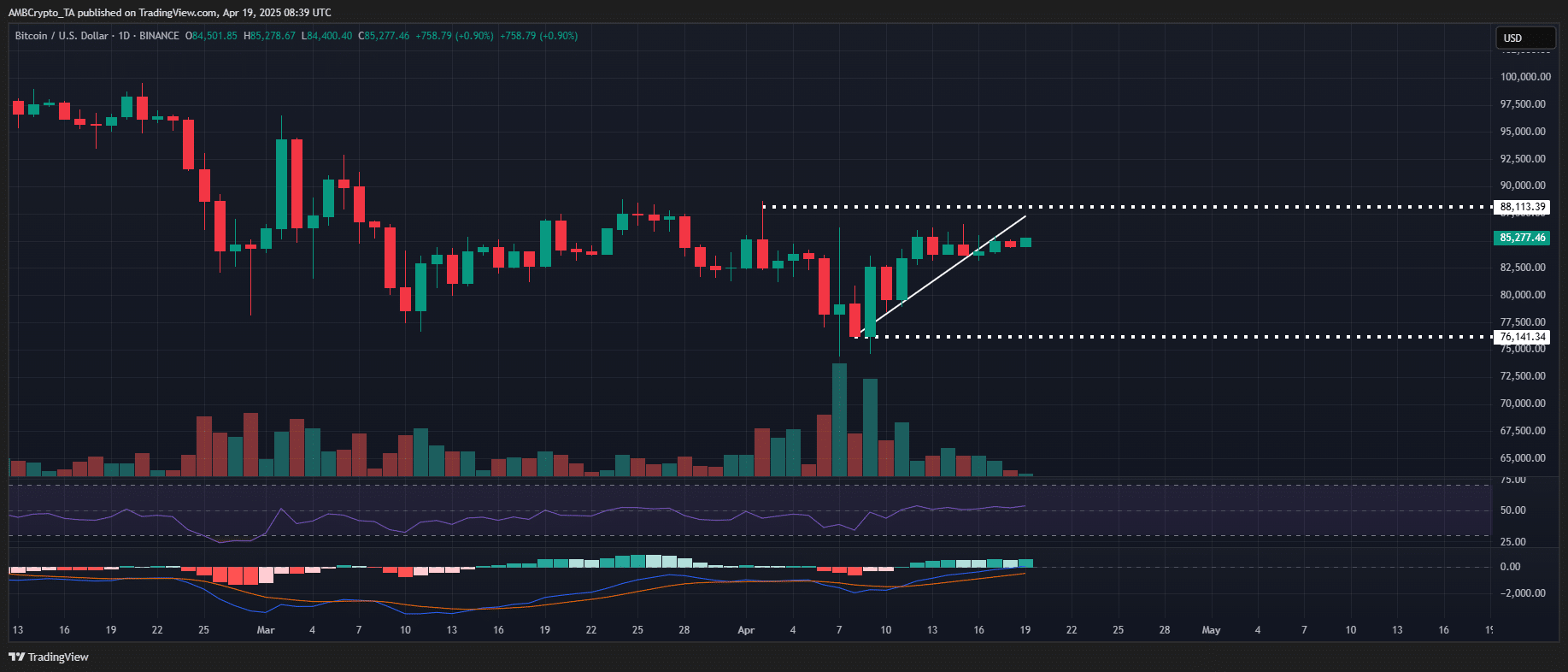

This technical signal seemed to be confirmed on April 8th. Bitcoin saw a 3.65% drop, suggesting a natural pullback from those overheated levels.

Source: TradingView (BTS/USDT)

According to our analysis at AMBCrypto, the combination of BTC.D soaring into a long-term resistance area and Bitcoin facing rejection around the $86k supply zone seemed like the perfect setup for money to rotate into altcoins.

However, despite all the signs, it seems like big investors weren’t quite ready to jump in headfirst.

After a brief dip in BTC.D for three days in a row, the metric actually bounced back, climbing above 64% again within the next week.

This rebound basically strengthened Bitcoin’s hold on market dominance.

This change in market behavior is a key lesson: Just because BTC.D is high, it doesn’t automatically mean altcoins are about to take off.

So, even with the technical indicators, historical trends, and money flowing in, the chances of an altcoin season happening right now seem to have pretty much disappeared.