MELANIA: All-Time Low Approval Amid Market Crash

- MELANIA memecoin plummets a staggering 97%, hitting rock bottom on the charts

- Insiders cash out big as the memecoin team reportedly offloads $14.7 million in tokens

It’s been a bumpy ride for MELANIA since its launch three months ago, consistently trending downwards in a descending channel. But this downward spiral has now reached a dramatic new low. Over the past day, the Official Melania Meme [MELANIA] token has crashed to an all-time low of just $0.36, a shocking 97% drop from its peak value just three short months earlier.

As of now, the memecoin is hovering around $0.38. This represents a further 5.79% decrease in just the last 24 hours alone, painting a bleak picture on the daily charts.

This latest plunge in the memecoin’s price has naturally sparked questions about what’s behind the sudden downturn. However, one thing is becoming increasingly clear: significant selling pressure is mounting.

According to crypto insights platform Chain Brief, the very team behind the MELANIA memecoin appears to be fueling this sell-off with aggressive token dumping. They’ve reportedly sold off a massive 23.4 million tokens, worth a staggering $14.7 million, over the last month in what many suspect is a classic “slow rug pull” – sparking serious alarm bells for investors.

Adding fuel to the fire, blockchain analysis firm EmberCN has also confirmed the suspected slow rug pull, detailing how the team has been strategically selling tokens through various methods. For instance, they reportedly dumped 2.95 million tokens by injecting one-sided liquidity into the market.

Furthermore, the $MELANIA project continued to move a hefty 7.643 million $MELANIA tokens ($3.21M value) from liquidity and community-designated wallets. These tokens were then funneled into the MELANIA/SOL liquidity pool on Meteora, where they were sold for SOL tokens within a pre-set price range.

Source: Coinglass

Further evidence of this increased selling pressure can be seen in spot netflows, which have remained positive for the last four days. Positive netflows indicate that cryptocurrency exchanges are seeing more tokens deposited than withdrawn. This is often interpreted as a strong signal of widespread selling activity across the market.

Given these significant selling activities, a crucial question emerges: Is MELANIA destined for even more losses?

Is the memecoin poised for further losses?

According to AMBCrypto’s analysis, the memecoin is indeed facing strong downward momentum, fueled by growing bearish sentiment within the market.

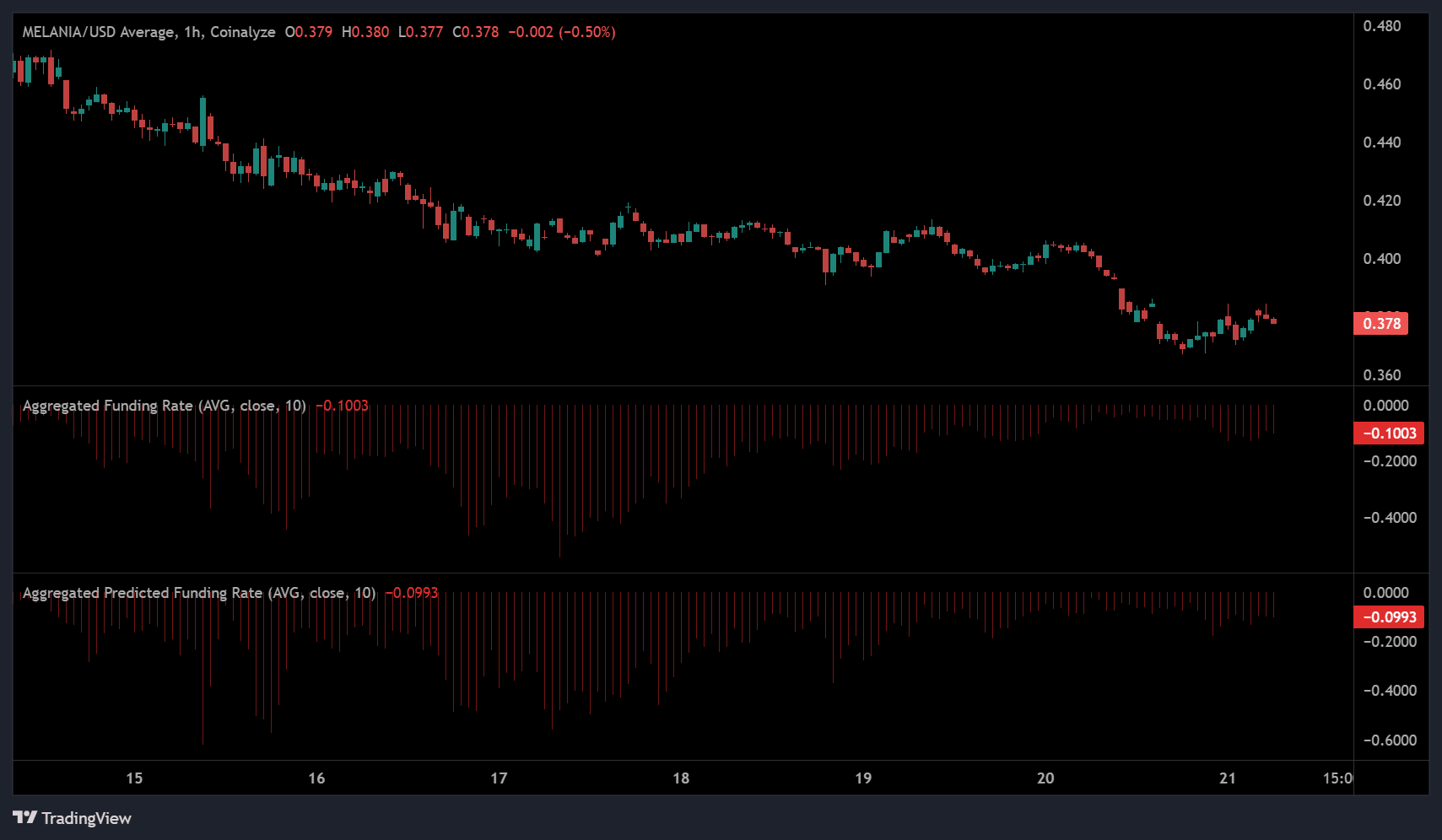

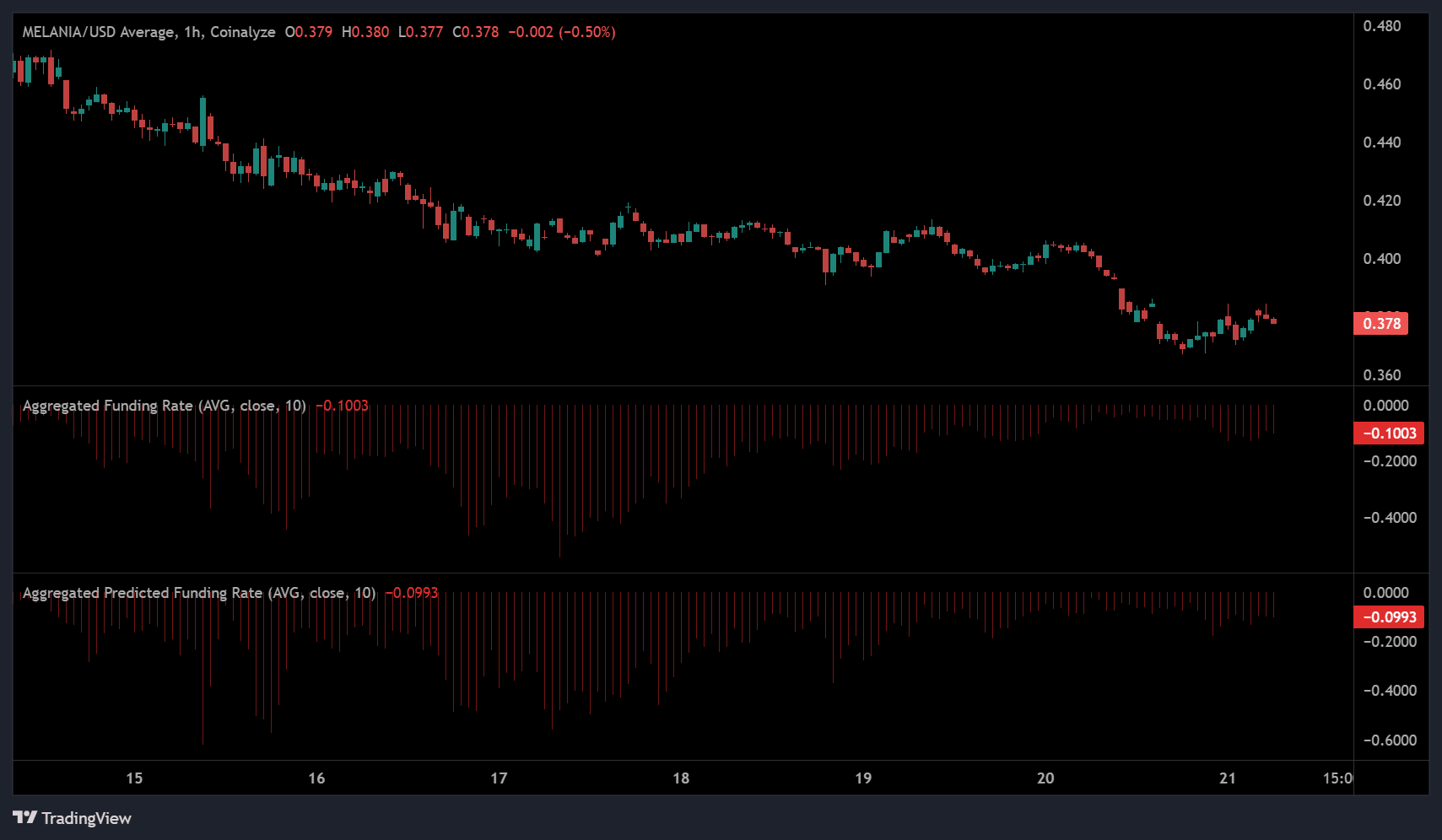

One of the clearest indicators of this bearish outlook is the preference of investors for short positions. In fact, the aggregated funding rate has been consistently negative for the past week.

A negative funding rate essentially means that those betting against the price (shorts) are paying those betting on it to rise (longs). This current negative rate signals a higher demand for short positions within the market, as traders broadly anticipate further price declines – a distinctly bearish signal.

Source: Coinalyze

Adding to these bearish signs, the memecoin’s Open Interest-weighted funding rate has also remained negative for the last three months. This further reinforces the observation that a significant portion of investors are betting against MELANIA, anticipating even further price drops.

Finally, if we look at MELANIA’s price charts, the Relative Strength Index (RSI) has plummeted, hitting a low of 15 within the oversold territory. Such a deep drop in RSI strongly indicates that sellers are overwhelmingly in control, clearly demonstrating intense selling pressure.

Source: Coinglass

In simple terms, if the current market trends persist, it looks like the memecoin could be heading for even deeper losses on its price charts.

We might even see MELANIA slump to a new all-time low around $0.34. However, if buyers decide to step back in, there’s a chance they could push the memecoin’s price back up towards $0.42.