Dogecoin Price Breakout: Pundit Forecasts $0.19 Target

Dogecoin’s price is currently in an interesting spot – it’s been consolidating within a symmetrical triangle pattern. One analyst is keeping a close eye on this, suggesting we could see either a breakout upwards or a dip downwards in the coming days.

After a bit of a lull since mid-April, Dogecoin (DOGE) has been showing some encouraging signs of picking up momentum. For most of the week, it was hanging around the $0.15 mark, but recently, it jumped up to $0.16 – its highest point since April 14th!

Even with this positive bump, Dogecoin hasn’t quite managed to build strong upward momentum. Now, a keen-eyed analyst over on TradingView is digging into technical patterns to try and figure out what might be next for this popular meme coin.

Symmetrical Triangle Pointing to a Potential Breakout

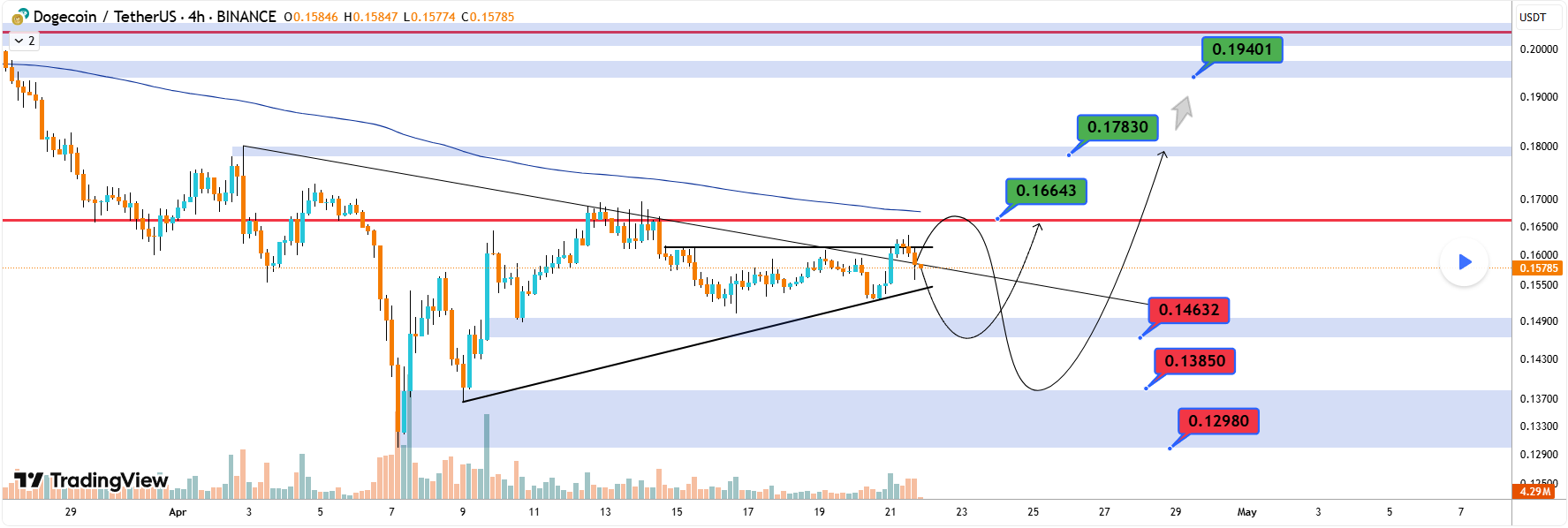

Ehsan Zeydabadi, a chart watcher on TradingView, has highlighted that Dogecoin is forming a symmetrical triangle on its 4-hour chart. Think of it like this: the price is getting squeezed between converging lines.

This kind of pattern usually means the price is taking a breather, bouncing between these trendlines. As Dogecoin gets closer to the pointy end of the triangle, the anticipation builds – we could be seeing a breakout move in the next few days!

When Zeydabadi looked at the charts, Dogecoin was trading around $0.15785. It had recently tested both the top and bottom lines of the triangle, making it seem like a breakout was just around the corner.

Interestingly, Dogecoin has bumped into resistance near the top of this triangle several times – back on April 2nd and April 14th at $0.166, and again on April 21st at $0.162. The analyst points to $0.166 as a crucial resistance level to keep an eye on, especially after the price briefly broke out of the triangle on April 21st.

What Could Happen Next for Dogecoin’s Price?

If Dogecoin can manage to push past that $0.166 resistance, Zeydabadi thinks we could see a rally up towards $0.17830, and maybe even as high as $0.19401. On the flip side, if sellers step in and drag the price down below key support, Dogecoin could slide further. He’s watching support levels at $0.14632 and $0.13850, and in a deeper drop, we might even see it testing $0.12980.

In the meantime, another analyst, CryptosRus, has mentioned a different angle: Dogecoin’s price moves could be following a pattern similar to parallel channels we’ve seen before, like back in 2017 and 2021.

Historically, these parallel channels have been a heads-up for big price swings. Take 2021, for example – Dogecoin rocketed from just $0.002 all the way to around $0.7! If history rhymes, we could be in for another major surge. This analyst even wonders if this pattern could propel DOGE all the way up to a target near $12!

Is a Cup and Handle Pattern Brewing?

Zooming out to the bigger picture, and looking at Dogecoin’s long-term chart, analyst CobraVanguard has spotted a possible monthly cup and handle pattern. The cup started with that massive jump to $0.80, and then we saw a long period of price correction.

After hitting a low around $0.0468, DOGE gradually started to build the right side of the cup. This analyst is predicting that if this cup and handle pattern fully forms, it could set the stage for a substantial price pump, possibly reaching towards $0.88.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.