ADA $3 Target Fueled by Massive Withdrawal

- Over the past week, a significant 133.92M ADA has been pulled from exchanges, hinting at strong accumulation.

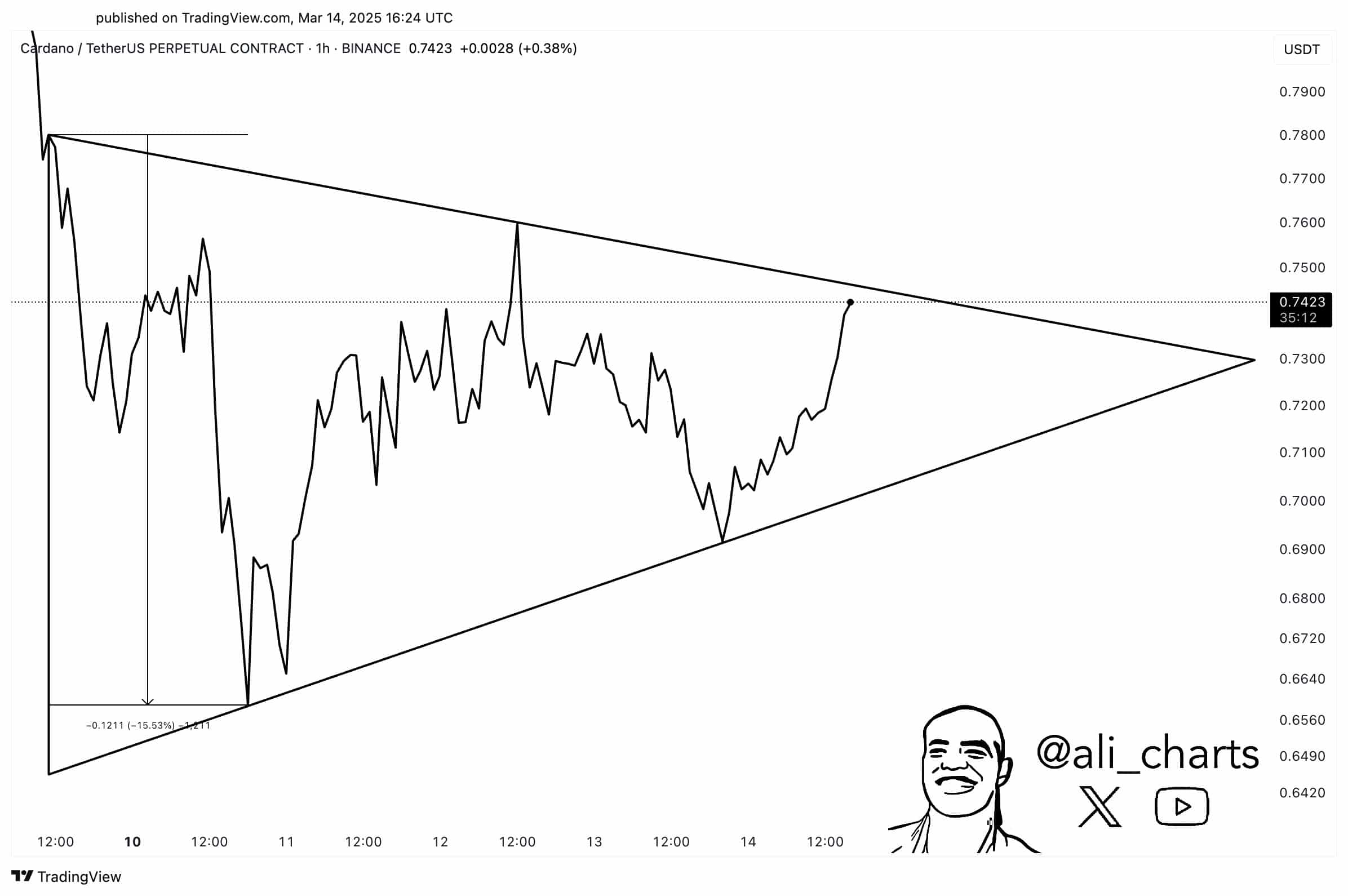

- Keep an eye on Cardano: if it breaks out of this symmetrical triangle, we could see a 15% price jump.

Looking at Cardano’s [ADA] spot market activity and how balances are shifting on exchanges, we’ve noticed something interesting: there’s been a major surge in net withdrawals. Actually, the numbers have shot up to match the previous all-time high (ATH)!

In the past week alone, over 133.92 million ADA have been withdrawn from exchanges. This outflow is particularly noteworthy because accumulation has ramped up to levels not seen since its recent peak.

Big withdrawals like these often act as a potential nudge for prices. When fewer coins are on exchanges, it can reduce supply and potentially drive prices upwards. Right now, the price of ADA is still below its ATH territory – hinting that there might be room for it to climb even higher!

Source: Coinglass

These strong withdrawals, coupled with how Cardano has performed in the past, really suggest it could be aiming for new all-time highs. Especially if the demand keeps up and the overall market stays supportive.

Price accumulating in a symmetrical triangle

This buildup is happening as Cardano is consolidating within a symmetrical triangle pattern, where trendlines are narrowing towards each other. Currently, ADA’s price is seeing resistance around $0.74 and support around $0.68.

If the price breaks through $0.74, we could see a 15% jump, potentially pushing ADA towards $0.85. To confirm this bullish move, strong trading volume will likely be key.

On the flip side, if the price can’t hold above $0.74, or if it falls below $0.68, ADA could slide down to $0.60 or even lower. This kind of drop would likely cancel out the current bullish outlook.

Source: X

If ADA consistently trades above $0.72 within this pattern, it might just flip the overall market mood from bearish to bullish.

Where ADA goes next really depends on whether we see a confirmed breakout. A move above $0.74 could signal the current trend is strong, but if it can’t break through, we might see further price drops.

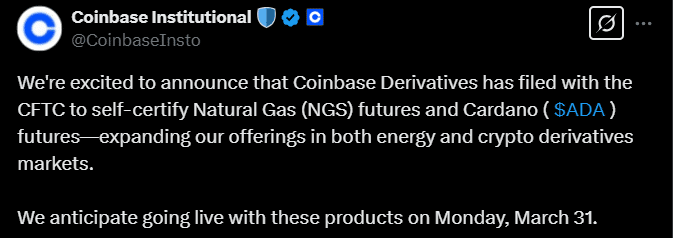

How Cardano might benefit from Coinbase derivatives filing

And there’s more good news for ADA! Coinbase Derivatives is planning to launch Cardano Futures contracts, potentially reaching a massive audience of around 100 million users.

Coinbase has already filed for certification with the CFTC for these USD-settled ADA Futures contracts. They’re aiming for a potential launch date of March 31, 2025, according to their announcement.

This move could bring significant benefits to ADA, making it easier for both big institutions and individual investors to trade with more liquidity. It also unlocks the door to more complex trading strategies, like leveraging and hedging.

Source: X

With this increased access, we might see demand for ADA rise, potentially driving its price up. Coupled with the recent surge in exchange withdrawals suggesting accumulation, all these factors together could very well propel ADA back to its all-time high.

Of course, the launch of ADA Futures contracts also comes with potential risks, like shorting and market manipulation. So, it will be important to keep a close eye on things after they launch.