Amboss CEO on Bitcoin Lightning Growth & USDT Adoption

Jesse Shrader believes 2025 will be a significant year for the Lightning Network.

He posits that rising Bitcoin prices and the introduction of Tether (USDT) on Lightning will drive increased adoption of Lightning for payments by businesses and institutions.

Shrader’s company, Amboss, aims to facilitate this vision.

“We want to expand Bitcoin as a payment system and leverage Lightning to achieve that,” Shrader told Bitcoin Magazine. “Our goal is to make Lightning a highly efficient and performant system.”

Amboss provides a suite of tools and services designed to onboard institutional users to the Lightning Network, particularly with the arrival of USDT.

What Amboss Does

Amboss’s primary focus is delivering intelligent payment infrastructure for digital payments using the Lightning Network.

“We provide users with insights to optimize payment efficiency on the network,” Shrader explained.

To achieve this, Amboss offers several products and services, including:

Amboss Space: A Lightning Network explorer utilizing machine learning to assist users in finding information or connecting to any network node.

Beyond analytics, Amboss offers tools and services to improve liquidity on Lightning.

Magma Marketplace: A platform for users to buy and sell Lightning Network liquidity, enabling liquidity provision for yield without relinquishing Bitcoin custody.

Hydro: An extension of Magma that automates liquidity purchases to enhance payment success rates.

Reflex: A compliance suite designed for businesses needing AML (Anti-Money Laundering) reporting capabilities.

Amboss’s tools are designed for high-volume transactions, increasingly viable on Lightning.

“We simulate and assess businesses’ payment capabilities across the network,” Shrader stated. “We help businesses understand their payment reach within the network.”

The State Of Lightning

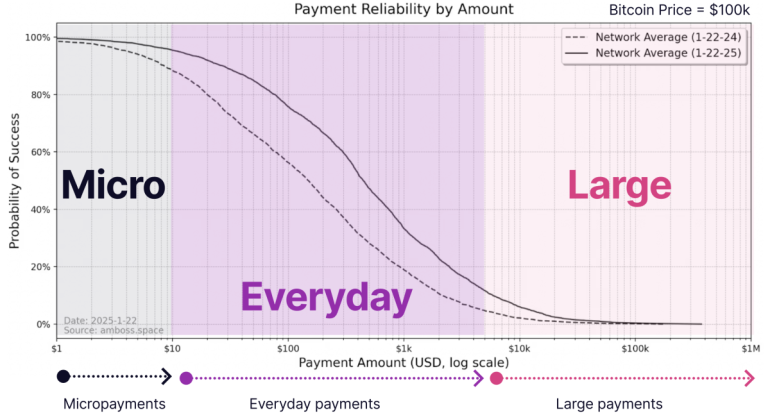

Shrader expresses optimism regarding Lightning growth, noting its expanding use beyond micropayments.

“We are successfully processing everyday payments on Lightning, ranging from $10 to $4,000,” Shrader said. “We are actively enhancing the network’s capabilities, with a focus on decentralization.”

Payments exceeding $4,000 remain challenging due to the need for more capital to facilitate larger transactions.

However, the recent surge in Bitcoin’s price has eased the processing of larger payments.

“The Bitcoin price increase has expanded settlement capacity across Lightning channels,” Shrader explained. “Since channels are bitcoin-denominated, it’s like we’ve increased bandwidth.”

While optimistic about increased throughput due to larger channels, Shrader also believes Tether (USDT)’s integration with Lightning will further boost network liquidity.

Tether (USDT) On Lightning

Last month, Lightning Labs announced USDT’s arrival to Bitcoin and Lightning via the Taproot Assets protocol.

This update simplifies USDT integration and acceptance for Bitcoin service providers, which Shrader anticipates will benefit Lightning.

“Tether has undeniable product-market fit,” Shrader asserted.

“Last year, Tether processed $10 trillion in payments, surpassing Visa and MasterCard,” he added.

“The global demand for U.S. dollars is clear.”

Shrader, acknowledging concerns from Bitcoin purists regarding USDT on Bitcoin and Lightning, understands their appreciation for Bitcoin’s sound money principles.

However, he believes the advantages of USDT on Lightning outweigh the disadvantages, especially given that many are still unfamiliar with Bitcoin or hesitant due to its volatility.

“Many are yet to grasp the benefits of bitcoin,” he explained.

“Bitcoin is a powerful tool I want to make accessible to more people. Traditional payments have numerous issues, and Bitcoin offers a secure, auditable system that I want to scale globally,” he added.

“While Bitcoin’s price appreciation is beneficial, many are volatility-averse. USDT, with its low volatility on secure and trustless Bitcoin rails, presents a significant advantage.”

The Problem That USDT On Lightning Solves

Shrader recounted MicroStrategy’s “Lightning for Corporations” conference, which initially promoted paying employees in Bitcoin via Lightning, overlooking subsequent challenges.

“Employers realized that issuing 1099 forms and navigating regulatory overhead was cumbersome,” Shrader stated.

Shrader highlights that using USDT on Lightning can alleviate accounting and regulatory complexities, while also reducing counterparty risk associated with banks – a risk Shrader knows firsthand.

“Our payroll used to be processed through Silicon Valley Bank,” Shrader shared.

“At one point, our payroll provider requested a mid-month payroll resend after my initial staff payment attempt due to Silicon Valley Bank’s insolvency. This cost me half a month’s operating funds,” he added.

“By transitioning to Bitcoin and Lightning, we can mitigate counterparty risk in the traditional financial system, placing us in a much more secure position.”

[Author’s note: It’s important to acknowledge that counterparty risk isn’t entirely eliminated with USDT, as trust in Tether’s USD reserves remains.]

The Risks

Shrader addressed potential risks of USDT on Bitcoin and Lightning but seemed unconcerned.

“MEV risks can arise when non-native assets are traded on-chain,” Shrader mentioned. “However, Bitcoin already has Ordinals, which create other assets, so this issue is pre-existing.”

He dismissed concerns about Bitcoin forks rendering USDT on a chain worthless, and the risk of major Bitcoin entities supporting a “Tether fork” potentially detrimental to Bitcoin in the long term.

“Bitcoin consensus isn’t dictated by Bitcoin custody. While influential entities like Coinbase might advocate for certain changes, it doesn’t guarantee protocol modifications,” Shrader clarified.

Instead of emphasizing risks, Shrader emphasizes opportunities presented by USDT on Bitcoin.

“The more compelling aspect is the arbitrage opportunities on Bitcoin itself,” Shrader stated.

“Since every node can transact in both USDT and Bitcoin and natively exchange between them on Lightning, Bitcoin can be sent from one channel and USDT received in another,” he added.

“This allows simple rebalancing of holdings by generating a USDT invoice and paying with BTC, instantly.”

2025: The Year Of Lightning

In his concluding remarks, Shrader outlined two key reasons for his prediction that 2025 will be Lightning’s breakthrough year.

Firstly, Bitcoin ownership is no longer a prerequisite for Lightning usage.

“Previously, adopting Lightning required Bitcoin ownership, a significant barrier,” Shrader explained. (He added that USDT access is relatively সহজ and common outside the U.S.).

“The Bitcoin-only payment processing market is limited. Removing this barrier by allowing USDT payments opens a large existing market,” he added.

(Shrader also pointed out that Bitcoin still benefits from USDT on Lightning, as USDT is converted to Bitcoin during Lightning transactions. He added that “the increased Bitcoin movement on Lightning enhances the rewards of running a Lightning node.”)

Secondly, Lightning users will experience significantly lower transaction fees compared to traditional financial systems.

“We provide liquidity at under 0.5%,” Shrader stated.

“Using traditional payment card networks involves fees around 4%, with delayed settlement. ” he added.

“Lightning can reduce payment processing fees by almost tenfold.”

Based on Shrader’s points, 2025 indeed appears poised to be a pivotal year for the Lightning Network.