Asia Crypto: Scam Alert & Japan Stablecoin News

China’s crypto ban didn’t stop this ridiculous scheme

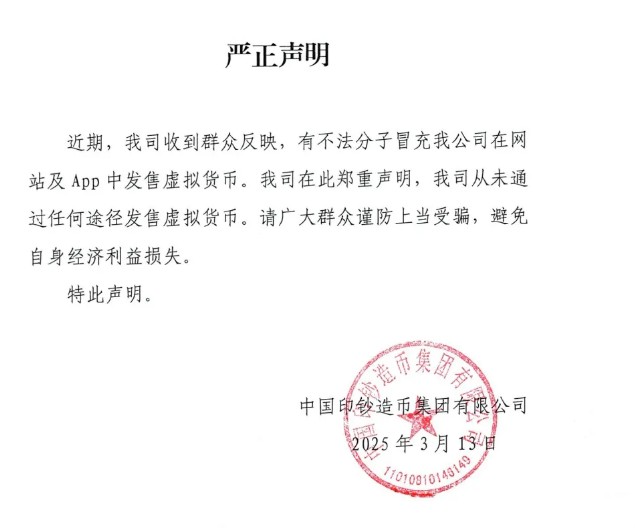

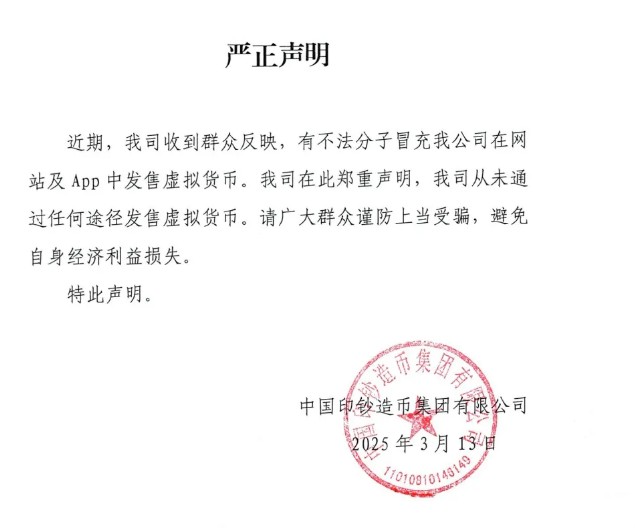

Even with China’s strict stance against crypto, a bizarre new scam has emerged. Criminals are pretending to be from the official China Banknote Printing and Minting Corporation (CBPMC), and they’re trying to sell cryptocurrency through fake websites and apps!

If you know anything about China’s crypto rules, this scam probably sounds totally absurd. They’ve clamped down hard on all sorts of crypto activities, like trading and mining, and only the renminbi is officially legal tender. So, the idea that the *very* government agency in charge of printing their money would suddenly start selling crypto? It just makes the whole scam even weirder.

Naturally, CBPMC quickly responded, posting a public warning on their official WeChat. They made it clear they’ve *never* sold any digital currencies on *any* platform. Their message to everyone: “Be careful out there and don’t get tricked by these scams!”

And it’s not just China! Elsewhere, scammers have been busy hacking official X (formerly Twitter) accounts of government people and agencies to push fake meme tokens. To make things even *more* confusing for people, some presidents – even Donald Trump! – have actually launched their own memecoins lately. Suddenly, this whole “government crypto” idea doesn’t seem quite so crazy anymore, does it?

Just to remind you, CBPMC is part of the People’s Bank of China, and they’re the ones who actually print all of China’s cash, coins, and important documents. The PBOC itself has been very loud about *not* liking cryptocurrencies, and instead, they’re putting all their energy into their own digital currency, the digital yuan. They think one of the best things about this digital yuan is that it can fight fraud, kind of like how companies that issue stablecoins, like Tether, can freeze wallets linked to bad stuff.

But here’s the twist – even the digital yuan itself is being used *in* scams! Back in February 2024, the Chinese government warned about fake digital yuan apps popping up that looked almost exactly like the real thing. This has been going on since 2021. And get this: a report from local news in December 2024 said these scams are getting *really* clever. Now, the scammers are pretending to be banks and even government officials to trick people into downloading fake apps and falling for bogus investments.

Japan’s bet on stablecoins may unlock $14 trillion in household savings

Let’s switch gears to Japan! They’re really pushing forward with stablecoins. A new report from Yuri Group, a research and consulting company, says that Progmat is becoming a major player in Japan’s world of regulated digital assets.

Yuri Group’s report also says that the Japanese government sees stablecoins as a way to tap into the *huge* $14 trillion sitting in household savings. Japan used to be a leader in crypto, but their excitement dropped off after some security problems and market crashes. Now, they’re hoping stablecoins, which are seen as more stable financially, can rebuild trust and get people interested in digital assets again.

Progmat has some serious heavy hitters backing it – a bunch of big Japanese banks and tech companies. Looking at who owns them, you can see names like Mitsubishi UFJ (MUFG), the *biggest* bank in Japan with a 49% share, and SBI PTS Holdings (part of the SBI Group) with 5%, plus other big names in Japan. And here’s another interesting point: SBI’s crypto division, SBI VC Trade, just said they’re planning to be one of the first places in Japan to let people trade crypto in USDC!

Big news for Progmat came in February when Toyota said they’d issue their first security token bond using the platform! Progmat has also teamed up with Wealth Realty Management, who’s planning to use it for digital securities backed by real estate. Apparently, real estate is huge in Japan’s security token world – Yuri Group says it makes up 89% of the market!

Progmat’s stablecoin system is built to follow Japan’s rules, which say that stablecoins need to be backed 1-to-1 with reserves. Unlike some of the decentralized stablecoins out there, these newer approaches are all about working together – private companies and trusted banks. This way, they can make sure the reserves are safe and reduce risks for customers. Basically, this whole system keeps Japan’s biggest banks right in the middle of the digital finance revolution.

Japan was actually one of the first to make rules for stablecoins way back in 2022, but things kind of slowed down, and you couldn’t really buy stablecoins until late 2024. Now, Progmat is trying to fix that. They want to offer a safe, regulated place to deal with stablecoins, especially since this industry has had a history of hacks and scams.

Read also

Features

Bitcoin gets physical: Art or digital heresy?

Features

Crypto scoring big with European football

Former Bithumb chairman walks free

Big news out of South Korea – the Supreme Court has *confirmed* that former Bithumb chairman, Lee Jung-hoon, is not guilty! They threw out the prosecution’s appeal on those fraud charges worth about 110 billion won (that’s around $75.5 million!).

This Supreme Court decision means the earlier rulings – from the first trial and the appeal – all stand. He was found not guilty all the way through!

The Supreme Court announced their decision on March 13th, saying there just wasn’t enough proof to convict Lee. The whole case was about claims that back in 2018, Lee tricked Kim Byung-gun, the chairman of BK Medical Group. Allegedly, Lee promised to list Bithumb’s own crypto, BXA, as part of a deal where BK Medical would take over and jointly manage Bithumb.

Lee was officially charged in July 2021 by prosecutors in Seoul, but he wasn’t arrested. From the beginning, all the courts that looked at the case sided with Lee, saying there wasn’t solid proof. Lee actually left his job at Bithumb before the trial even started. And here’s a really dark detail: in December 2022, Park Mo, who was the biggest shareholder at Bithumb, was found dead after facing accusations of stealing money and messing with stock prices.

Read also

Features

As Ethereum phishing gets harder, drainers move to TON and Bitcoin

Features

Decentralized identity: Proving it’s really you in the 21st Century

Cebu Pacific takes off on Algorand

Ready for some travel news? Cebu Pacific Air, which is the biggest airline in the Philippines when it comes to passengers, is going to use blockchain tech in their business! They’re teaming up with TravelX, a blockchain platform that’s built on Algorand.

TravelX is all about using blockchain to help airlines. They do things like NFT airline tickets and seat management systems powered by blockchain. They’ve already partnered with a bunch of budget airlines, like Flybondi from Argentina and Viva and Volaris from Mexico.

Cebu Pacific is a *major* budget airline and the king of domestic flights in the Philippines, which, by the way, is made up of over 7,000 islands! This new partnership with TravelX is expected to kick off in the second quarter of 2025. The Algorand Foundation says they’ll be focusing on how to make more money *after* you’ve booked your flight.

And just how popular is Cebu Pacific? Well, in 2024, they flew *more* passengers than they did *before* the pandemic – a whopping 24.5 million! That’s more than any other airline in the Philippines, according to the Civil Aeronautics Board.

Subscribe

The most engaging reads in blockchain. Delivered once a

week.

Yohan Yun

Yohan Yun is a multimedia journalist covering blockchain since 2017. He has contributed to crypto media outlet Forkast as an editor and has covered Asian tech stories as an assistant reporter for Bloomberg BNA and Forbes. He spends his free time cooking, and experimenting with new recipes.

Read also

Hodler’s Digest

‘Make or break’ for Bitcoin, Binance under pressure, Strike attacks Coinbase: Hodler’s Digest, June 27–July 3

Editorial Staff

7 min

July 3, 2021

The best (and worst) quotes, adoption and regulation highlights, leading coins, predictions and much more — one week on Cointelegraph in one link!

Read more

Columns

District 9 director’s shooter, Decentraland red-light district battle: Web3 Gamer

Callan Quinn

9 min

April 24, 2023

Trouble in Decentraland’s red light district, “no mercy” for Vulcan Forged autoclickers, District 9 director’s immersive blockchain shooter.

Read more