AVAX Plunge to $14: $3.9M Outflow Fueling Decline

- It’s been a bumpy ride for AVAX lately, as it recently fell below a crucial support level. Now, there’s concern it might be heading even lower, potentially establishing new lows.

- Adding fuel to the fire, we witnessed a significant AVAX sell-off in the last 24 hours, which really accelerated the downward trend.

Avalanche [AVAX] has already dropped by 7.16% over the past week, and unfortunately, the bearish signs on the price charts, coupled with substantial amounts of money flowing out, suggest this decline could continue.

Over the last day, the altcoin has seen a 4.60% decrease. However, analysts are suggesting this might be just a temporary pause, a brief breather before another move downwards.

With sellers gaining momentum, AMBCrypto is digging deeper to analyze where AVAX’s price might be heading next and what the overall trend could look like.

Liquidity Dries Up, Raising Red Flags for AVAX

Currently, we’re observing a major drain of liquidity from the AVAX network. Investor sentiment has shifted to a negative outlook, which is quite the opposite of the once optimistic predictions for the project.

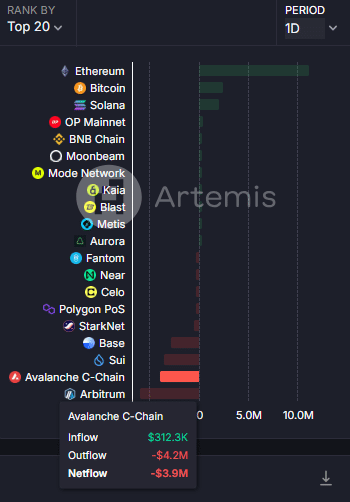

Recent data from Artemis reveals a hefty $3.9 million in net outflows within the past 24 hours. This figure paints a clear picture of just how much AVAX has been pulled out of the ecosystem.

Source: Artemis

These kinds of liquidity withdrawals often signal that investors are seeking safer havens for their crypto, like stablecoins, hoping to shield themselves from further potential losses.

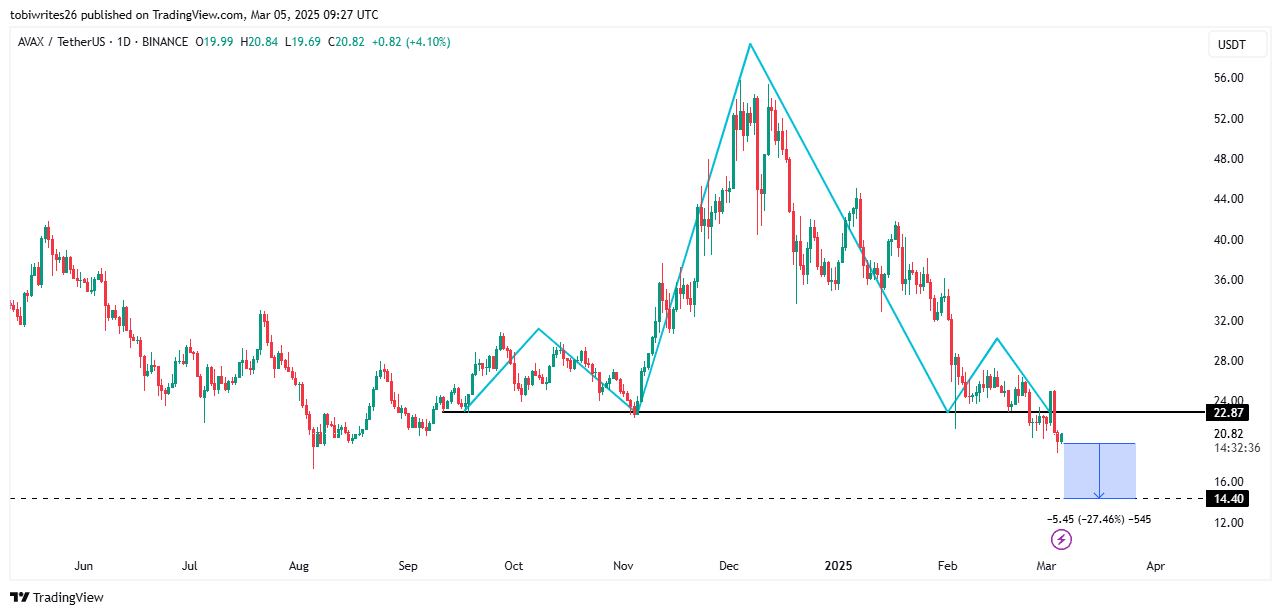

This outflow is happening at the same time as AVAX broke through a crucial support level around $22.87. This level was initially anticipated to be a stepping stone for a significant price surge. Instead, failing to hold, AVAX has unfortunately carved out a classic bearish head and shoulders pattern.

Historically, this pattern is a strong indicator of a substantial price drop once that support is broken – and AVAX seems to be playing this scenario out to the letter.

Current analysis suggests AVAX could potentially slide down to the next support area around $14.40. That would represent a significant 27.46% decrease from its current price.

Source: TradingView

Despite a slight upward tick in AVAX’s price over the last 24 hours, AMBCrypto is taking a closer look to figure out if this is a temporary reprieve or if we should brace for further bearish action.

Brace for Further Downward Pressure

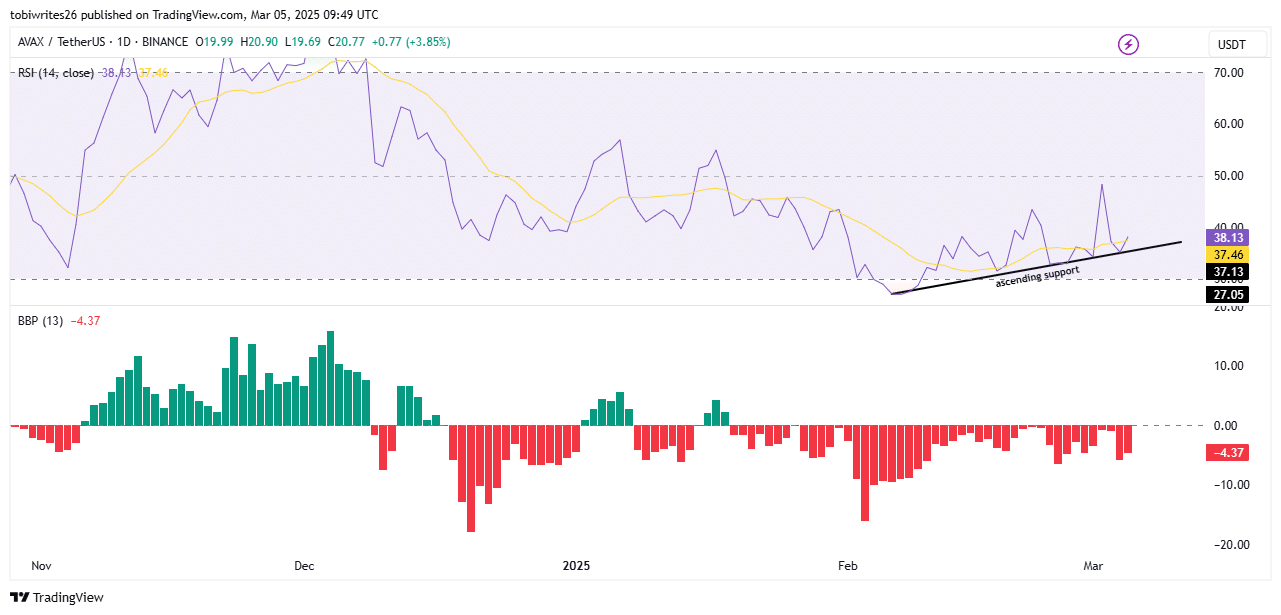

By examining technical indicators like the Relative Strength Index (RSI) and Bull Bear Power (BBP), AMBCrypto’s analysis points towards a continuation of the bearish trend as the more probable scenario.

Looking at the RSI at the time of this analysis, it appears to be forming gradual peaks along an upward trending line. This kind of pattern often foreshadows an upcoming breakdown. Should this breakdown occur, it would likely push the price even further down.

Source: TradingView

Further supporting the potential for a downturn, AMBCrypto’s analysis of the Bull Bear Power indicator highlighted the development of a bearish histogram. This clearly suggests that sellers, or bears, are currently dominating the market.

This disagreement, or divergence, between the RSI and BBP further strengthens the case for an expected price decrease, particularly if this bearish control continues to hold strong.