Bitcoin: 114-Week Buy Signal Under Threat?

Reason to trust

We adhere to a strict editorial policy that puts accuracy, relevance, and impartiality first.

Our content is created by industry experts and undergoes meticulous review to ensure quality.

We maintain the highest standards in both our reporting and publishing processes.

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

This article is also available in Español.

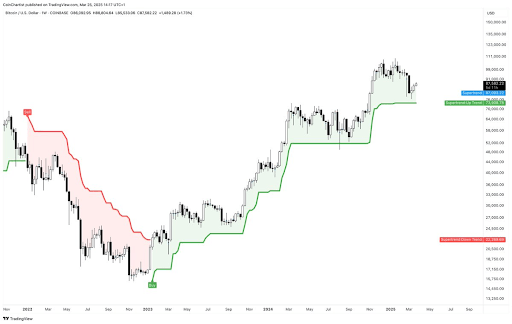

Crypto analyst Tony Severino has recently shared his latest thoughts on Bitcoin’s price movements. Bitcoin is currently hinting at a potential bullish comeback, but Severino cautions that there are still scenarios that could derail BTC and potentially signal the end of the current bull market.

Bitcoin’s Buy Signal Remains Strong for 114 Weeks

In a recent post on X, Severino pointed out that Bitcoin is maintaining an active buy signal based on the SuperTrend weekly indicator. He highlighted that this buy signal has been in place for an impressive 114 weeks, which translates to roughly 800 days. This is definitely encouraging news for Bitcoin, particularly as it sets its sights on reclaiming the key psychological level of $90,000 and potentially launching towards new record highs.

Related Reading

However, Severino also issued a warning: a sell signal could be a strong indication that the bull run is losing steam. Looking at his chart, a sell signal could trigger a Supertrend Downtrend for BTC, potentially pushing the price down to as low as $22,000 – a level that could mark the bottom of a significant bear market.

Meanwhile, another crypto analyst, PlanB, recently reiterated his belief that the bear market is not upon us yet. He argues that Bitcoin is still firmly in a sustainable upward trend and even predicts that Bitcoin’s price has the potential to double within this year. This surge could propel BTC into a parabolic rally, potentially reaching as high as $180,000. Financial institutions like Standard Chartered have also echoed this bullish sentiment, suggesting that a $200,000 price target this year is a realistic possibility.

Looking ahead, a key factor to watch will be how Bitcoin’s price responds to Donald Trump’s recently announced reciprocal tariffs, set to take effect on April 2nd. The previous round of tariffs triggered significant sell-offs, driving BTC down to around $77,000. However, there’s also a chance that the market has already anticipated these new tariffs, meaning Bitcoin might sidestep further price drops when they are implemented on April 2nd.

Could We See a New ATH This Year?

Adding to the optimistic outlook, crypto analyst Titan of Crypto has also expressed confidence that Bitcoin could reach a new all-time high (ATH) before the end of the year. This prediction comes from his observation that Bitcoin’s upward trajectory remains solid, with the price showing strong resilience around the weekly 50-day Exponential Moving Average (EMA). According to his accompanying chart analysis, Bitcoin could potentially surge to a new ATH of $121,000 before the year concludes.

Related Reading

In another post on X, Titan of Crypto further reinforced his $121,000 target, highlighting a ‘Bump and Run’ pattern forming for Bitcoin. He confidently stated that the subsequent upward movement will be “epic.” Adding to the positive momentum, data indicates that large investors, or whales, are actively accumulating Bitcoin. Crypto analyst Ali Martinez reported that over 22,000 Bitcoins have been withdrawn from exchanges in just the past week, signaling strong buying pressure from these major players.

As of now, the Bitcoin price is hovering around $87,500, showing positive movement in the last 24 hours, according to data from CoinMarketCap.

Featured image from Unsplash, chart from Tradingview.com