Bitcoin $87,000: Key to Unlocking Price Loop

Reason to trust

We adhere to a strict editorial policy that prioritizes accuracy, relevance, and impartiality.

Our content is created by industry experts and undergoes meticulous review processes.

We maintain the highest standards in both reporting and publishing practices.

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

This article is also available in Spanish.

Bitcoin has seen some choppy waters lately, struggling to build consistent upward momentum to recapture its previous high valuations from weeks past. After dipping to just over $81,000 on Tuesday, March 18th, Bitcoin made a push towards $87,000, only to encounter significant resistance.

Let’s dive into why this $87,000 price point could be a critical juncture for Bitcoin’s long-term price health.

5.58 Million BTC Addresses ‘Sitting On A Hot Potato’

In a recent post on X (formerly Twitter) on March 21st, crypto analyst Maartunn pointed out the importance of the $87,000 level for Bitcoin’s future price direction. His analysis centers around the average on-chain cost basis for a large number of Bitcoin investors.

Related Reading

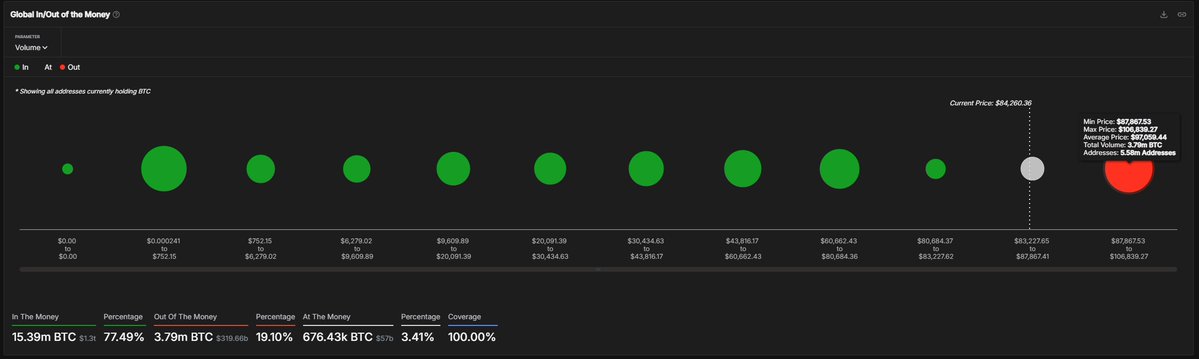

Cost-basis analysis helps us understand potential price resistance or support by looking at the total amount of Bitcoin bought at or around certain price levels. As you can see in the chart below, the size of each dot represents the volume of coins purchased within a specific price range, indicating the potential strength of support or resistance in that area.

According to Maartunn’s data, around 5.58 million addresses acquired a substantial 3.79 million BTC—valued at $367 billion at an average of $97,059 per coin—within the $87,867 to $106,839 price range. He highlights that these investors are currently “sitting on a hot potato,” meaning they are in a loss because their purchase price is significantly higher than the current market value.

Typically, this $87,867 – $106,839 zone is expected to act as a significant resistance level. As Bitcoin’s price potentially returns to their initial investment level, these investors are likely to sell to break even. This selling pressure could then push the price of Bitcoin downwards, making it harder for upward momentum to continue.

Furthermore, Maartunn identifies these investors within the $87,867 – $106,839 range as short-term holders. This group is known to be more “fragile” and prone to reacting strongly to even minor market fluctuations. The analyst suggests this creates a potentially precarious situation, especially if the market faces another wave of bearish sentiment.

Historically, short-term holders have played a role in significant sell-offs when reacting to price changes. This ultimately means that the Bitcoin market could be vulnerable to a sharp downturn if these short-term investors in the $87,867 – $106,839 bracket decide to cut their losses.

Bitcoin Price At A Glance

As of now, the price of BTC is hovering around $84,000, showing little change over the last 24 hours.

Related Reading

Featured image from iStock, chart from TradingView