Bitcoin ETF Flow: 40% Better Returns Than Buy & Hold – Simple

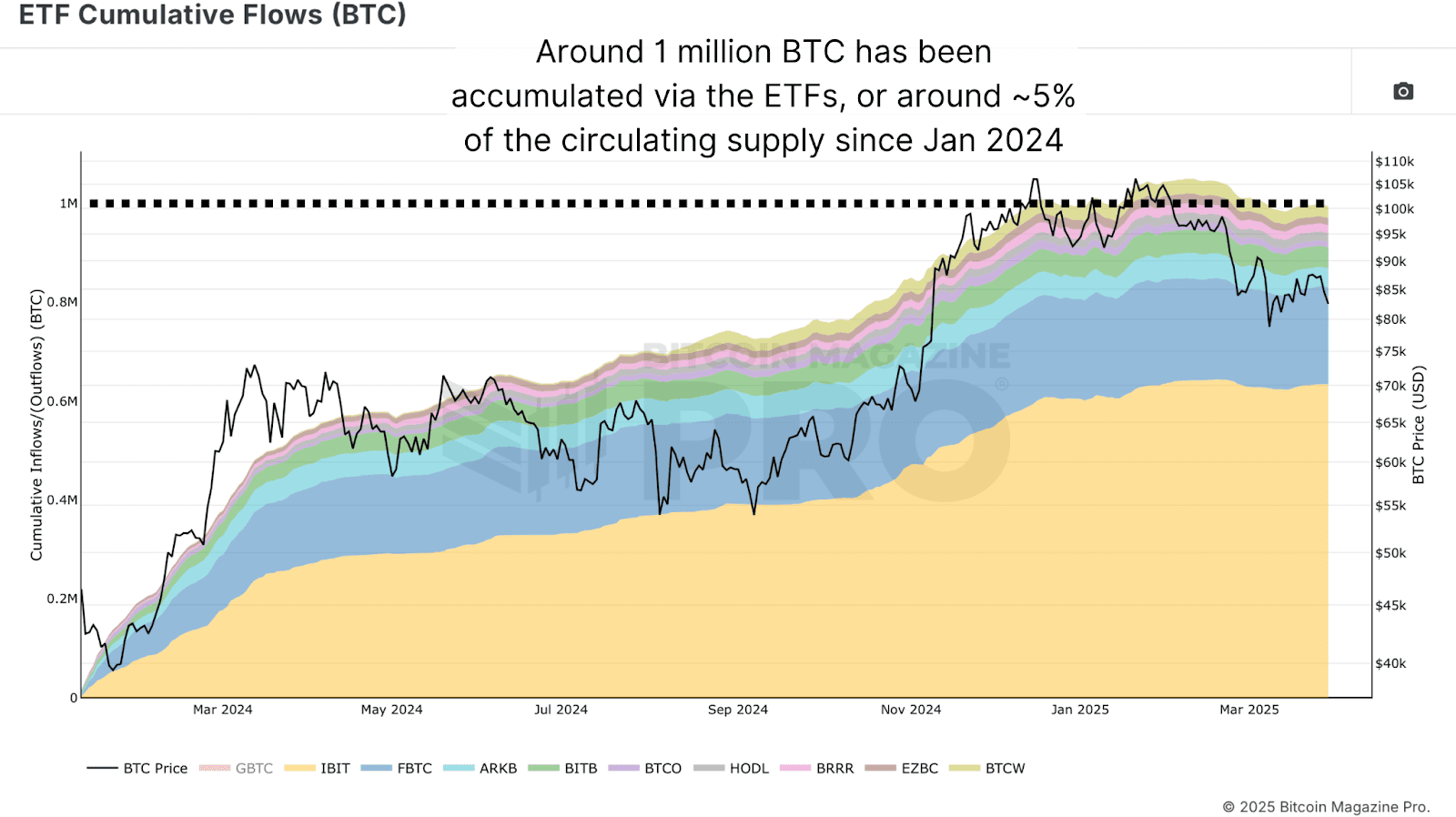

Get this: Bitcoin is experiencing a massive wave of institutional money, unlike anything we’ve seen before! Billions are pouring into Bitcoin ETFs, completely changing how Bitcoin flows, how easily you can trade it, and even how investors are thinking. You might think this is all ‘smart money’ with super-secret strategies, but here’s a surprise: actually beating these big institutions at their own game might be easier than you think.

Want to dive deeper into this idea? Take a look at this recent YouTube video:

Outperforming Bitcoin – Invest Like Institutions

Canary In The Bitcoin Coal Mine

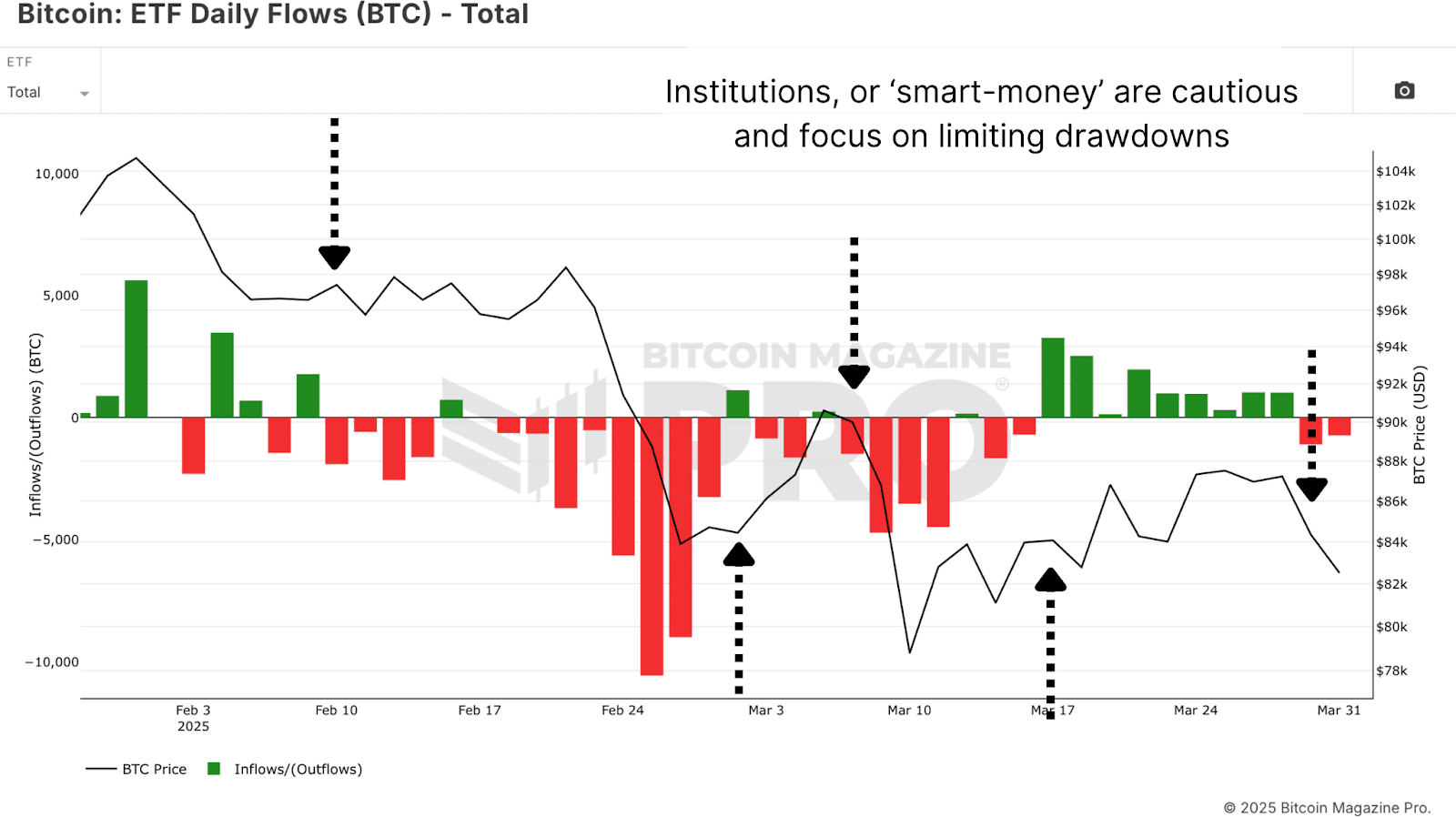

One of the coolest things we can track right now is daily Bitcoin ETF flow data. This data, shown in US dollars, tells us exactly how much money is moving into or out of Bitcoin ETFs each day. And get this – it’s shockingly linked to Bitcoin’s price changes in the short to medium term.

Now, these ETF flows do affect the price, but they’re not the *only* thing driving this massive, multi-trillion dollar market. Think of ETF activity more like a reflection of what the market already feels, especially when a lot of regular traders are jumping in during big trend changes.

Surprisingly Simple

Many regular investors feel like they’re always behind the curve, swamped by data, and don’t have the fancy tactics the big guys on Wall Street use. But here’s the thing: institutional strategies are often just simple trend-following – stuff you can totally copy, and even do better, if you’re disciplined and smart about risk.

Strategy Rules:

- Buy Bitcoin when the ETF flow data is positive for the day.

- Sell Bitcoin when the ETF flow data turns negative.

- Make your trades at the end of each day (daily close), using all your funds for this strategy – just to keep things clear.

- Forget complicated charts and lines – just follow where the ETF money is going.

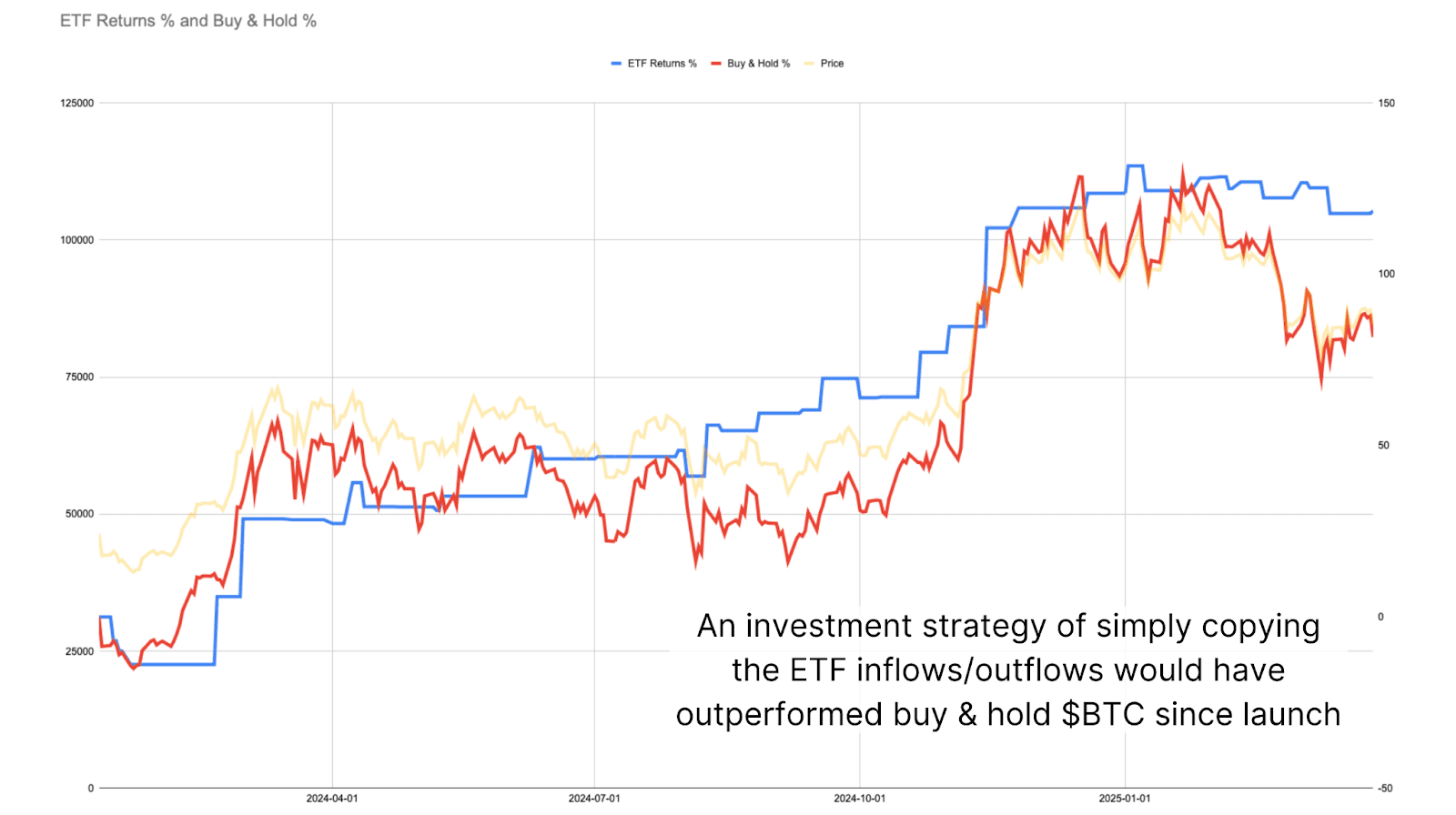

So, how does this actually work? We tested this strategy using Bitcoin Magazine Pro’s ETF data, starting in January 2024. We assumed you bought in for the first time on January 11, 2024, at around $46,434, and then just followed the ETF flows from there.

Performance vs. Buy-and-Hold

Guess what? When we tested this simple strategy (that’s “backtesting”), it showed a return of 118.5% by the end of March 2025. Now, just buying and holding Bitcoin over the same time would have given you 81.7% – which is not bad at all. But this ETF flow strategy beat it by nearly 40%!

And here’s a key thing: this strategy helps you avoid big losses. By selling when institutions are pulling out, you’re less exposed when prices drop. It’s more about sidestepping those big drops than perfectly timing the tops and bottoms – and that’s what really makes this strategy work so well over time.

Institutional Behavior

Everyone thinks institutions are super smart and have secret knowledge, right? But actually, when it comes to Bitcoin ETFs, their buying and selling mostly *confirms* trends, it doesn’t predict them. Institutions are all about managing risk and following rules. They’re often slower to jump in and quicker to pull out, based on the overall trend and what they’re allowed to do.

So, what does this mean for you? It means when institutions trade, they’re usually just pushing the market *further* in the direction it was already going, not starting a new trend. This actually makes using ETF flows as a signal even smarter! When you see ETFs buying, it’s like they’re confirming a trend that’s already happening, and you, as a regular investor, can ride that wave of money coming in.

Conclusion

Over the last year, we’ve seen proof that you *can* actually beat Bitcoin’s buy-and-hold strategy – which is saying something, because that’s a really hard thing to do! And you don’t need to use risky leverage or understand complex math. Instead, by simply watching what the big institutions are doing, regular investors can take advantage of changes in the market without having to guess what’s going to happen next.

Now, this doesn’t mean this strategy will work forever. But for now, as long as big institutions keep moving the market with these obvious ETF flows, there’s definitely an advantage for anyone who’s smart enough to just follow the money.

Want even *more* detailed analysis and up-to-the-minute data? Check out Bitcoin Magazine Pro – it’s packed with awesome insights into the Bitcoin market.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.