Bitcoin: Exploding Price Ahead as Liquidity Buy Signal Flashes

Bitcoin (BTC) has been showing some real muscle lately! After a solid 2.45% jump over the weekend, things are looking up. This positive move seems to be riding the wave of optimism in the US stock market and a general increase in money flowing globally. Basically, when there’s more cash around and stocks are doing well, investors tend to feel more adventurous and dive into riskier stuff – like Bitcoin. Interestingly, a key indicator called the global liquidity index Z score is currently flashing a “buy” signal, hinting that Bitcoin could be gearing up for some potentially explosive growth very soon.

Bitcoin Price Today

And the rally continues! Bitcoin’s price is up another 1.39% today, building on its weekend gains. It’s slowly but surely creeping towards that big $90,000 mark that everyone’s watching. Looking back, BTC had a pretty good week last week too, gaining 4.24%. That marks its second week in the green after a tough 15% drop in the first week of March. So, things seem to be turning around!

Odds of BTC Rally Improves as Global Liquidity Explodes

Now, let’s talk about why this rally might have legs. According to the folks at Alpha Edge, there’s this thing called the Global Liquidity Index. While the index itself might not be perfect, its Z-score seems to be quite insightful. Historically, whenever this Z-score dips down to -3, it’s been a pretty reliable sign to buy. Conversely, hitting +3 has signaled it might be time to sell. After that dip in early March, the Global Liquidity Index is now flashing a buy signal. This suggests we could be on the verge of a significant upward surge in Bitcoin’s price.

“This ‘Divergence metric’ between global cash availability and Bitcoin is throwing up a rare green ‘buy’ flag. Historically, these green (buy) or red (sell) signals have been good moments to either increase your Bitcoin holdings or take some profits.”

When there’s lots of liquidity in the market, it often encourages “risk-on” behavior, which is exactly what we saw in late 2021 and 2023. And guess what followed those periods? Big, exciting rallies in the price of BTC!

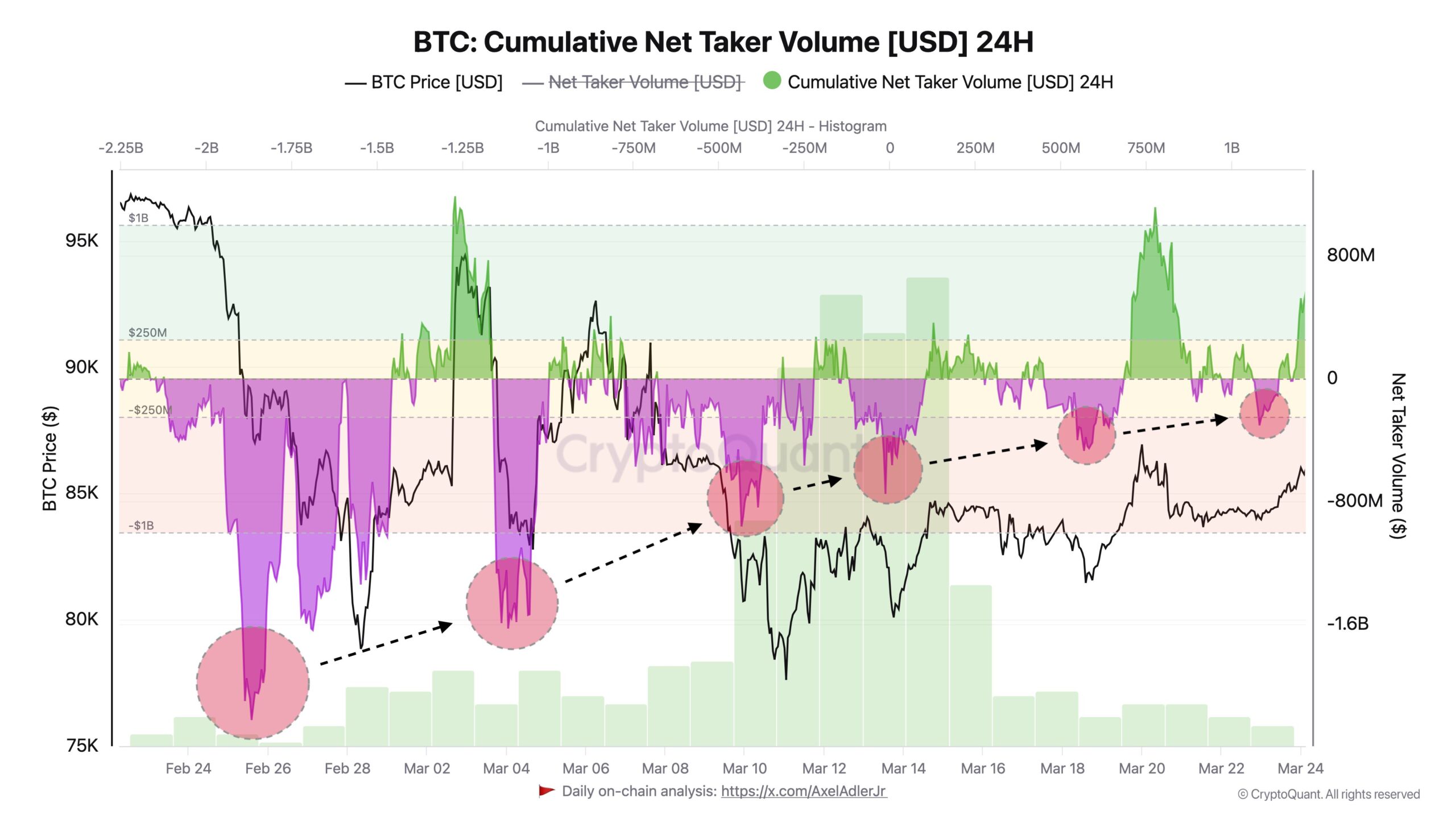

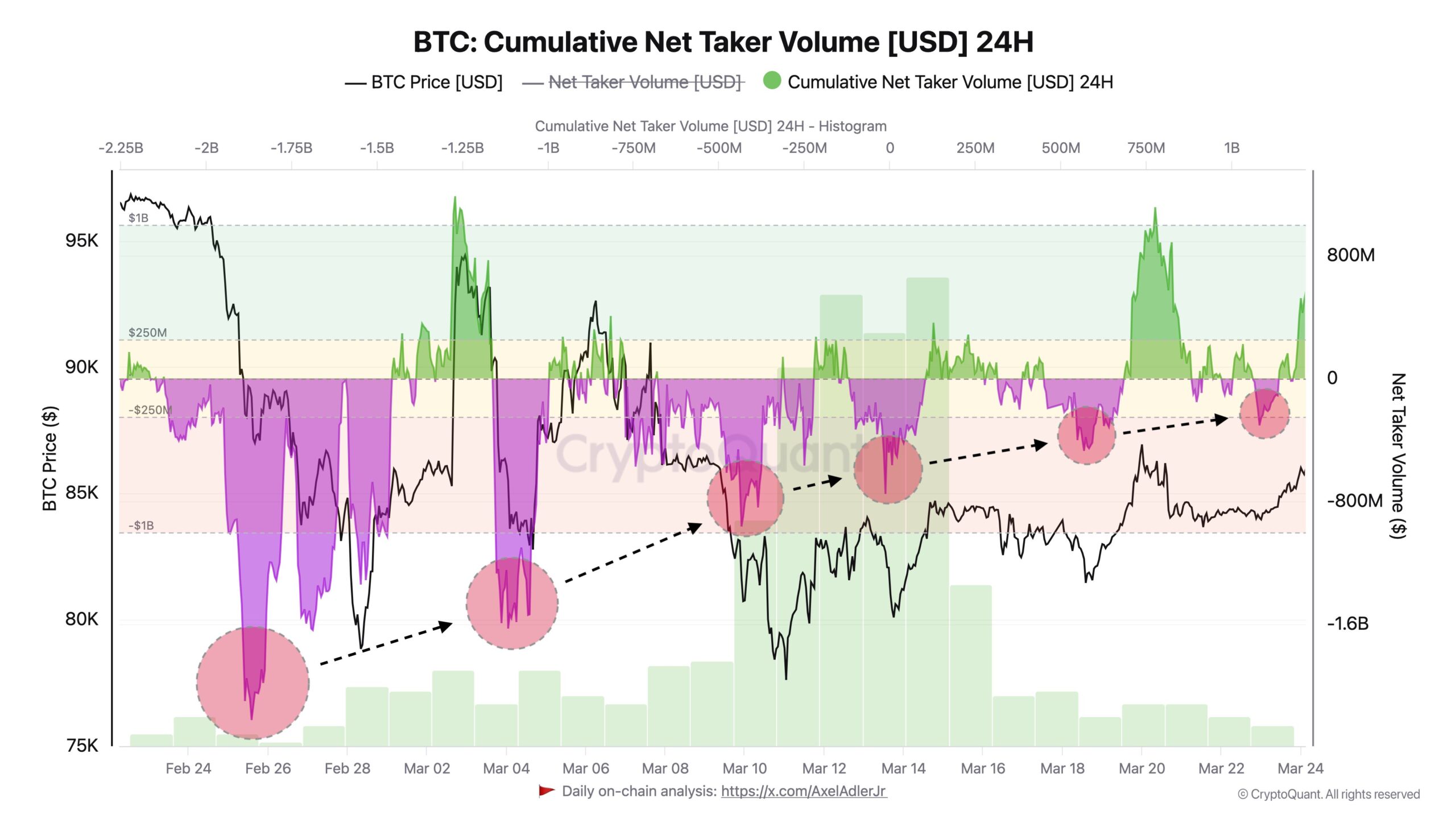

Reduced Selling Pressure Points to Bullish Bitcoin Outlook

Adding even more weight to this optimistic view is something called the “net Taker Volume” indicator. This has been trending downwards since late February 2025. A shrinking Taker Volume suggests that the sellers are losing steam. This drop in selling pressure further reinforces the idea that Bitcoin might be gearing up for a bullish turnaround.

Analyst Axel Adler Jr., who pointed this out, puts it this way:

“Assuming no major negative surprises from the economy or the markets, we could see some decent growth this week.”

So, putting it all together, the fact that we’ve had two positive weeks of price action, along with increased global liquidity and lower selling pressure, paints a pretty bullish picture for Bitcoin. Let’s take a look at some key price levels to keep an eye on as this potentially exciting scenario unfolds.

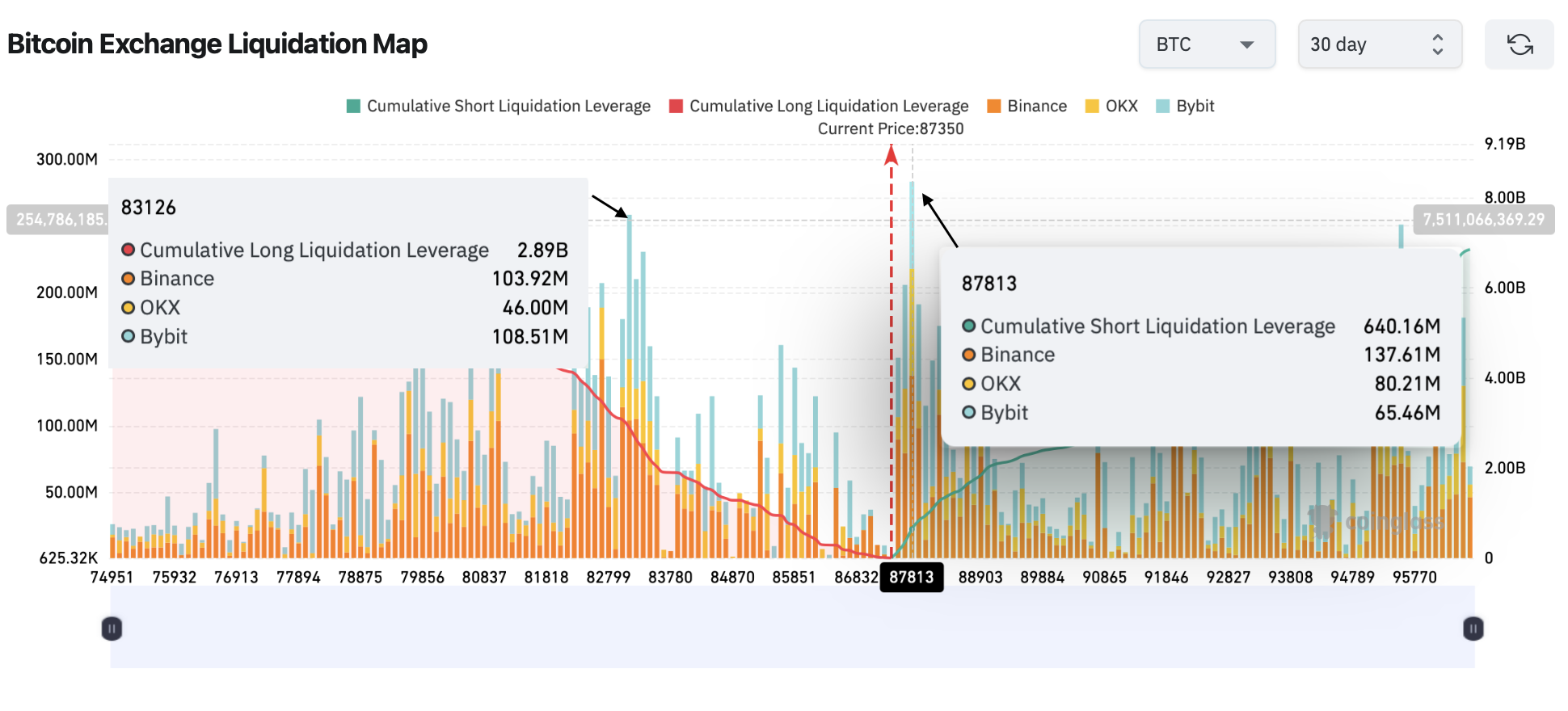

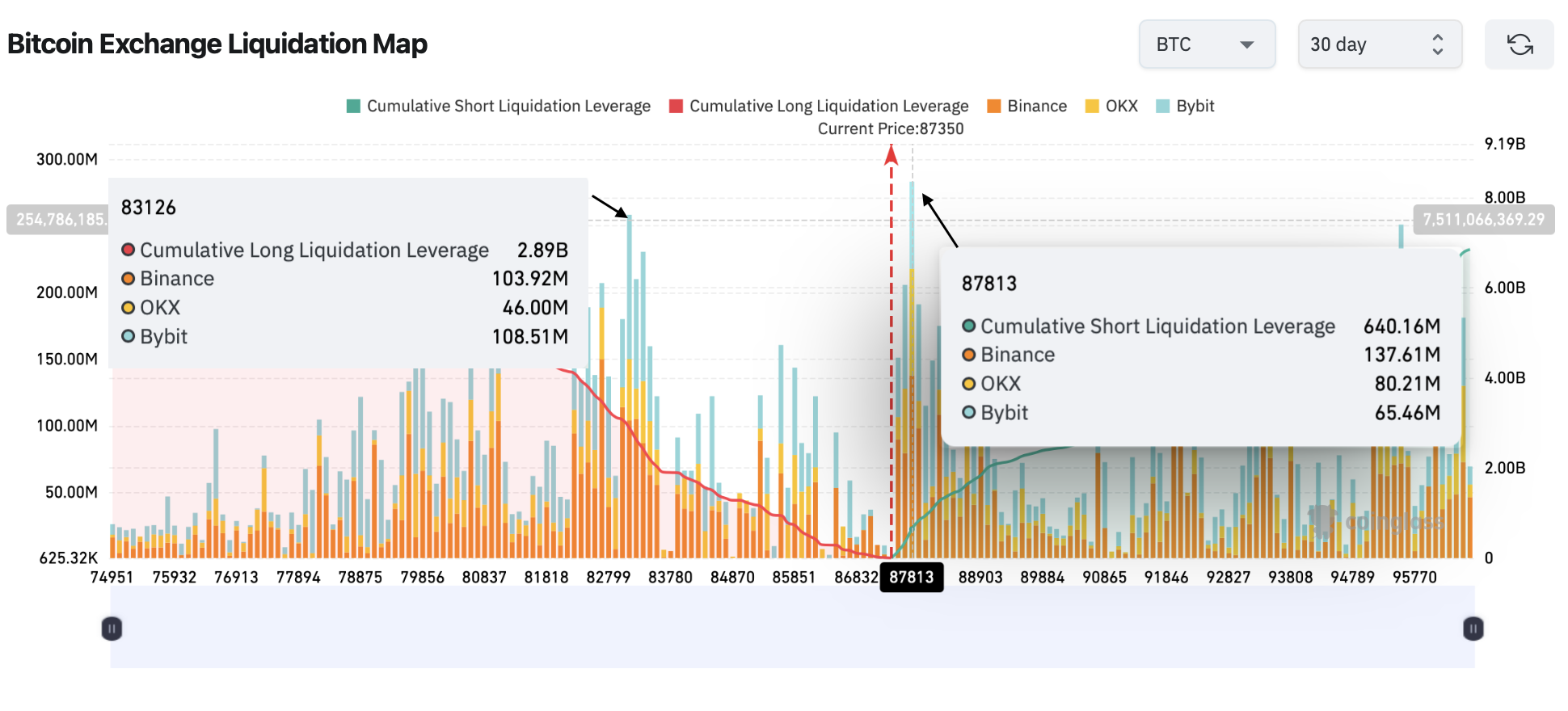

Key BTC Price Levels to Watch as $1.5B Positions At Risk of Liquidation

Now, for the nitty-gritty: liquidation data from CoinGlass reveals some interesting price points. Apparently, $87,813 is a crucial level. If Bitcoin breaks above that, it could trigger the liquidation of a whopping $640 million in bets against Bitcoin (short positions). On the other hand, if the price dips below $85,633, it could wipe out $942 million in bets for Bitcoin to go up (long positions).

In total, if Bitcoin first dips below $85,633 and then bounces back upwards towards $90K, we could be looking at a massive liquidation event potentially exceeding $1.5 billion! That’s a lot of movement in the market.

Conclusion

To sum it all up, with the Global Liquidity Index Z score signaling “buy,” the decreasing selling pressure shown by the net Taker Volume, and those recent positive weekly closes, the indicators are definitely pointing towards a potential surge in Bitcoin’s price in the near future. Keep watching!

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.