Bitcoin Leverage Plummets Amid Risk Aversion

- Bitcoin (BTC) has seen a 2.43% price decrease in the last 24 hours, as of now.

- Amidst ongoing economic uncertainty in the U.S., traders are pulling back on risky Bitcoin bets.

Yesterday felt like a tremor in the crypto world as the market wobbled due to economic jitters in the United States. Bitcoin [BTC], in particular, felt the chill, sinking to levels not seen since November 2024.

After hitting a low point of $76k, Bitcoin has shown some resilience, staging a bit of a comeback. Currently, Bitcoin is trading around $80,338. However, this is still a 2.43% drop from where it stood just 24 hours ago.

This recent turbulence in Bitcoin’s price, set against the backdrop of wobbly economics in the U.S., has understandably made investors uneasy, injecting more fear into already sensitive risk markets.

Bitcoin’s leveraged positions decline

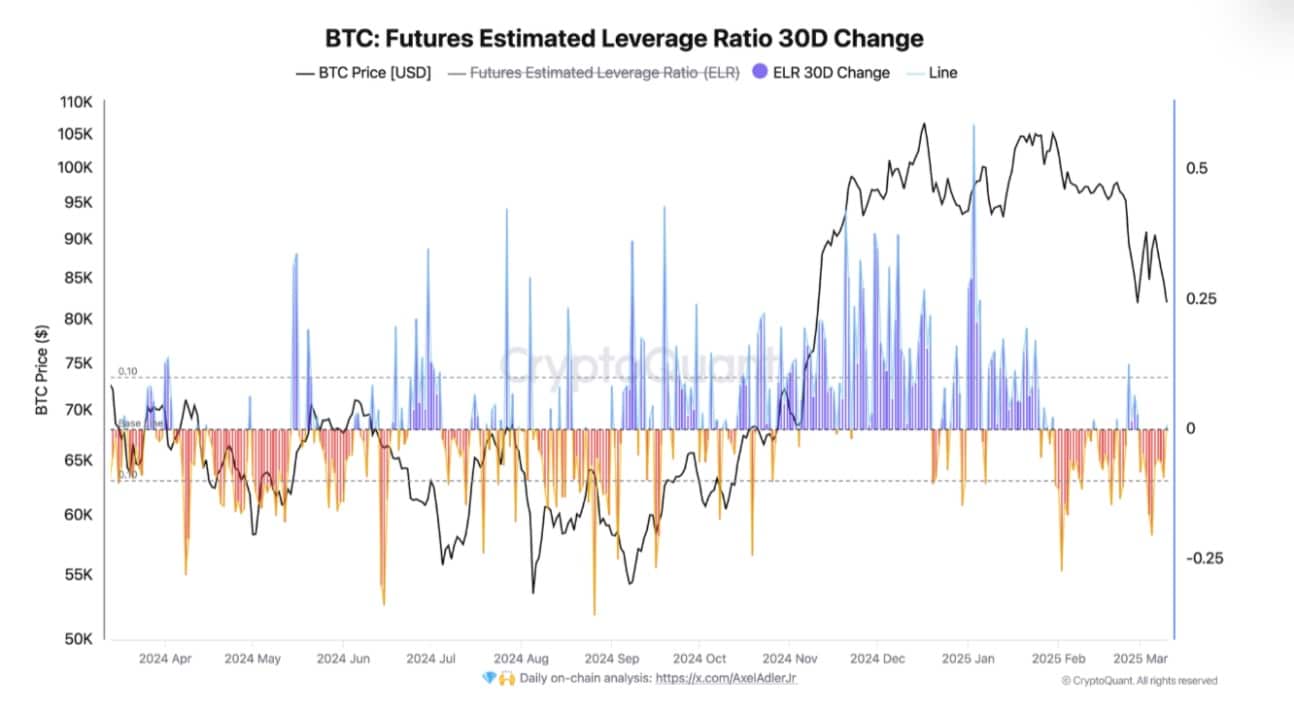

Data from CryptoQuant suggests that traders have been playing it safe since January 29th. The Futures Estimated Leverage Ratio, a measure of how much leverage traders are using, has been consistently negative.

Source: CryptoQuant

Currently, the Estimated Leverage Ratio (ELR) hovers around -0.13. Think of this as a signal that traders are dialing back on leverage, becoming more cautious as their appetite for risk diminishes.

This shift suggests a growing sense of unease among traders. They’re becoming less willing to gamble on market swings, opting instead for safer ground, which points to a prevailing bearish feeling.

Fueling this cautious market mood is the uncertainty surrounding potential policy changes from the U.S. government, particularly concerning Trump’s agenda. This political and economic ambiguity is spooking risk markets, leading traders to batten down the hatches and reduce their exposure to potential losses.

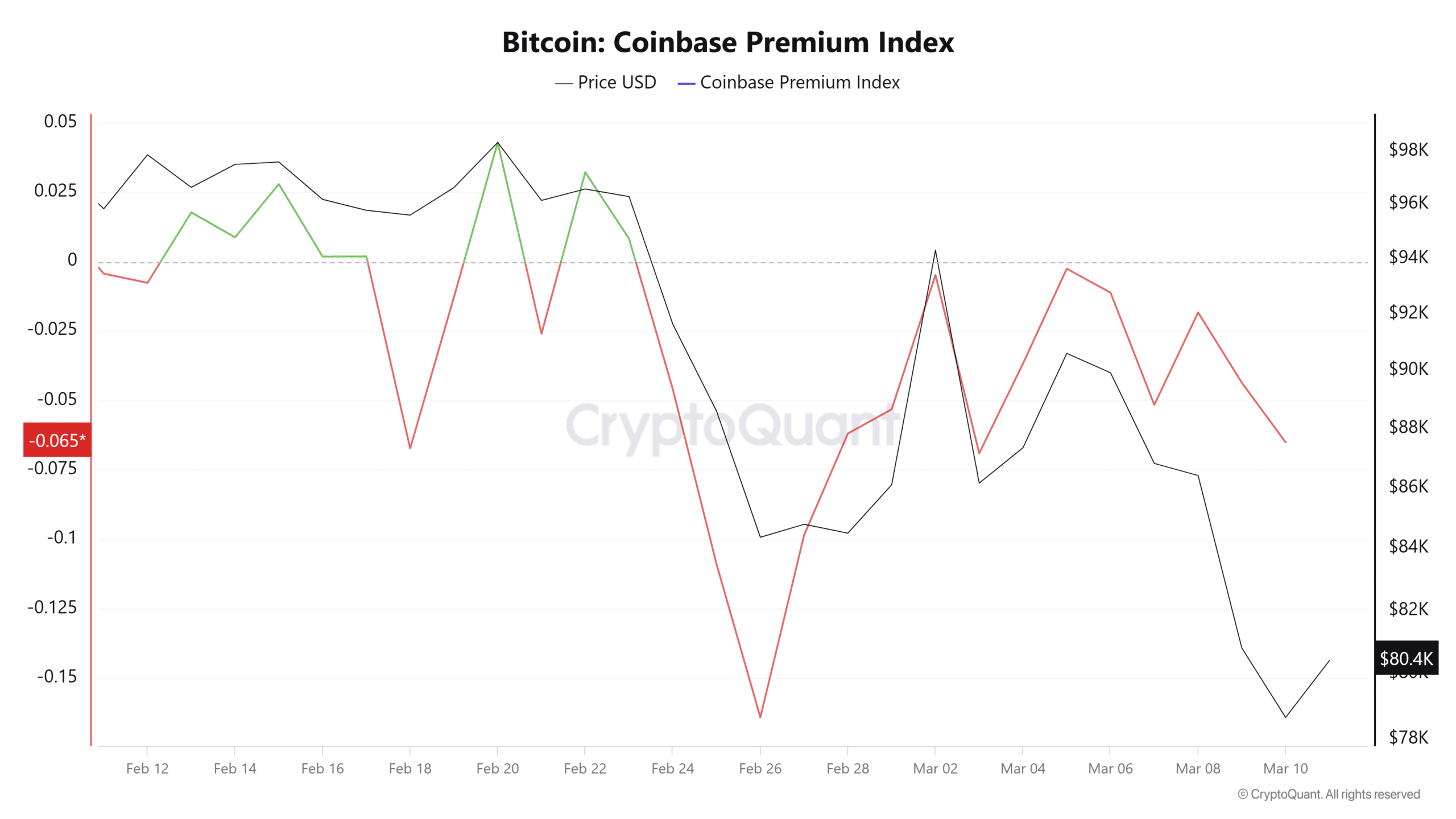

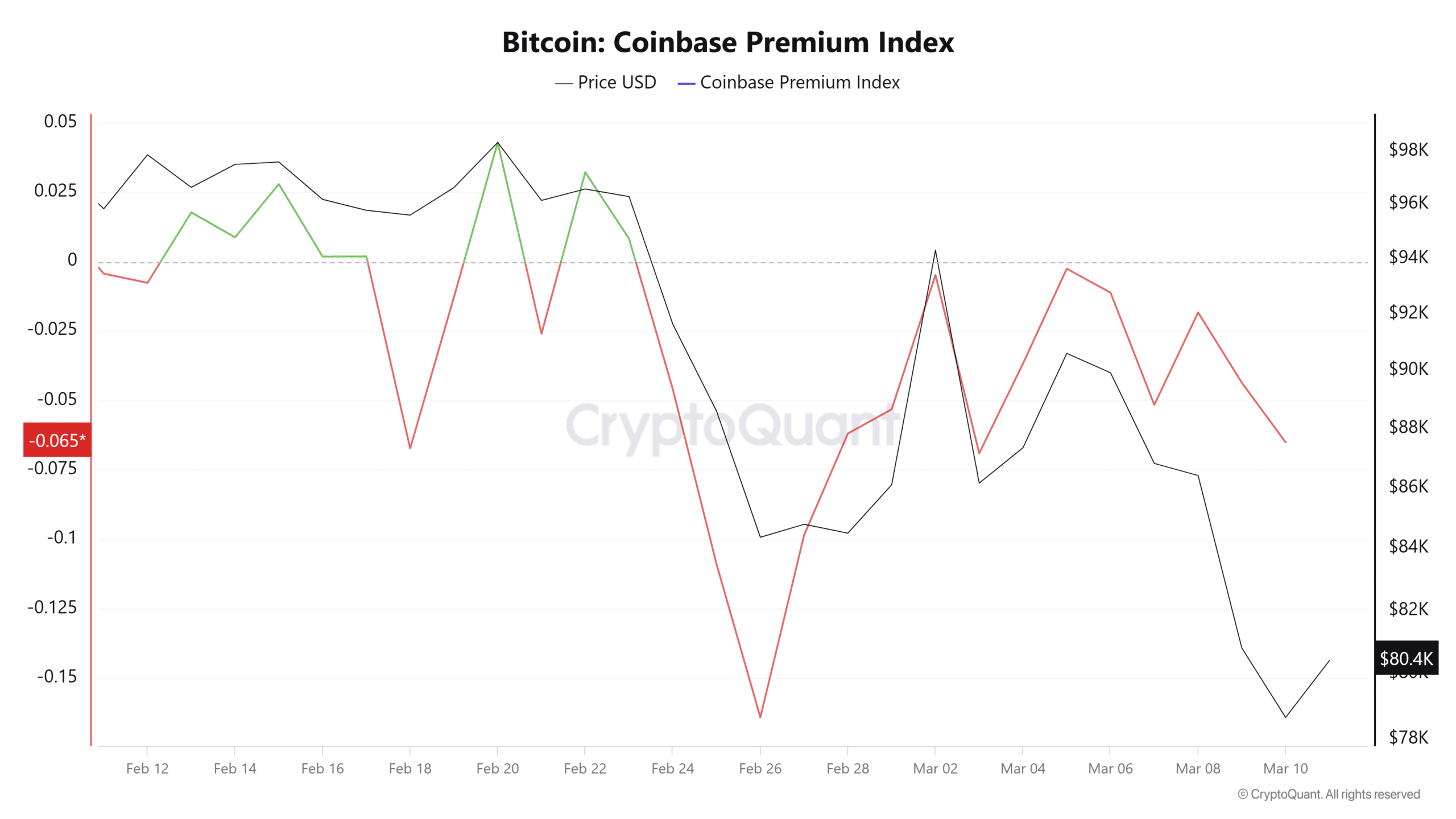

Source: CryptoQuant

Here at AMBCrypto, we’ve also been keeping a close eye on how these policies are impacting crypto, especially Bitcoin. The Coinbase Premium Index, for instance, has been showing negative values for the past couple of weeks.

A consistently negative Coinbase Premium Index often signals that U.S. investors are selling off their Bitcoin holdings, and it’s not being matched by big institutional buyers stepping in to accumulate. This reinforces the idea that general market sentiment among traders is still leaning towards a bearish outlook, expecting the downward trend to continue.

Source: X

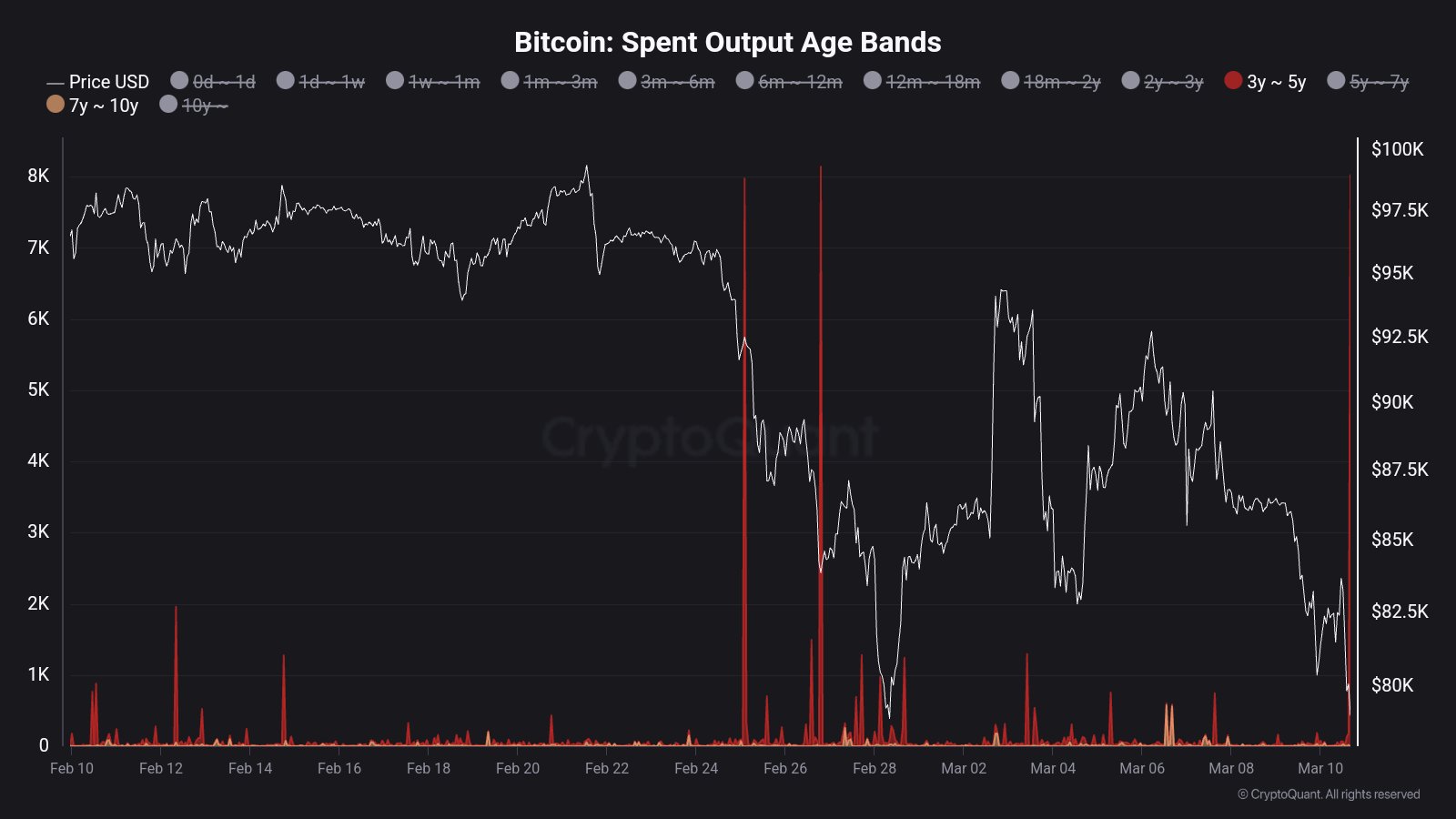

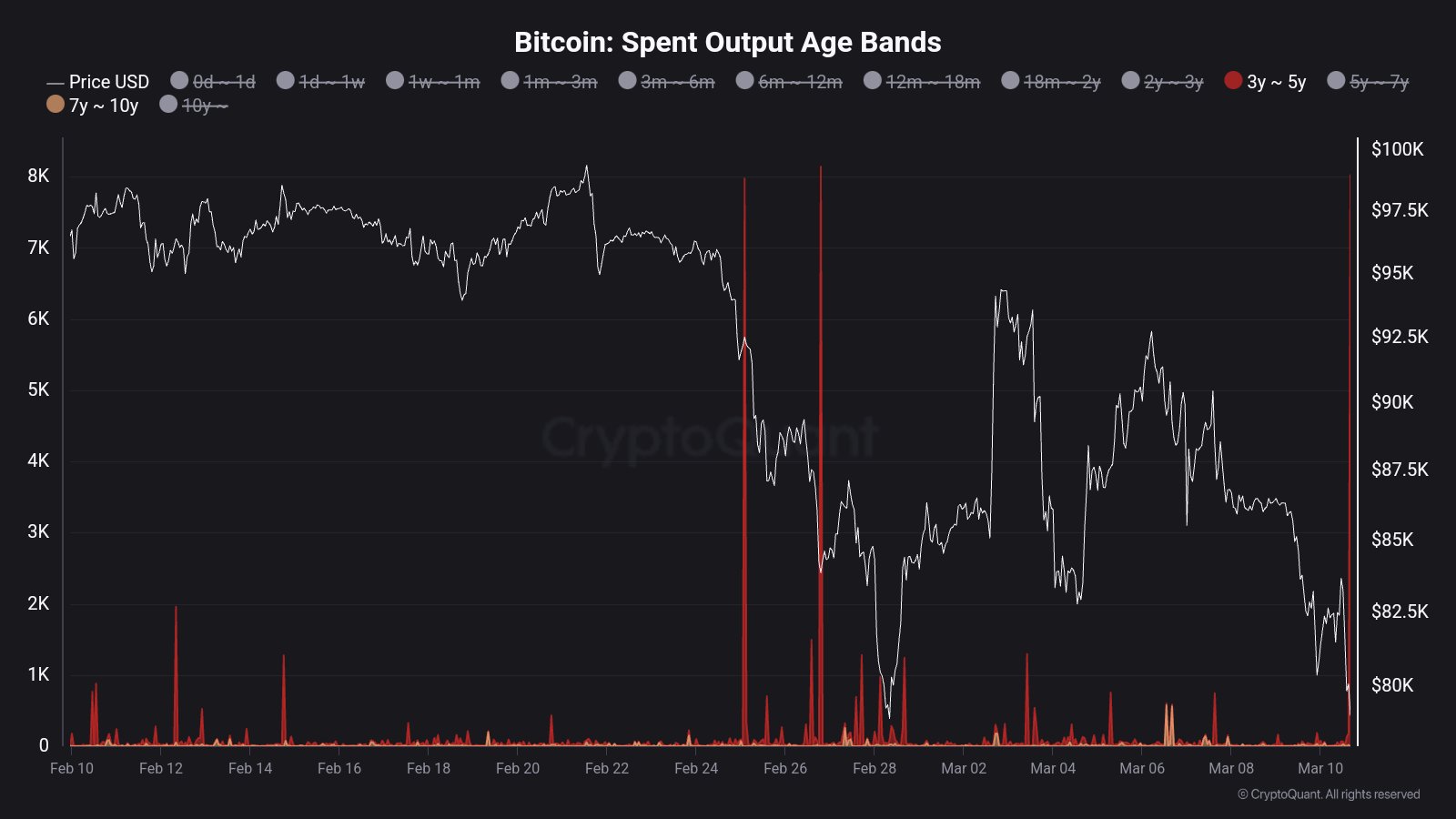

Adding to the sense of a market downturn, we’re seeing signs that even long-held Bitcoins are starting to move. In a notable event, 8,000 BTC that have been dormant for three to five years have suddenly become active again.

The concern is that if these older coins are heading to exchanges, it could easily trigger a wave of selling. Historically, when older, untouched Bitcoins start moving, it often precedes significant sell-offs, putting downward pressure on prices.

Source: CryptoQuant

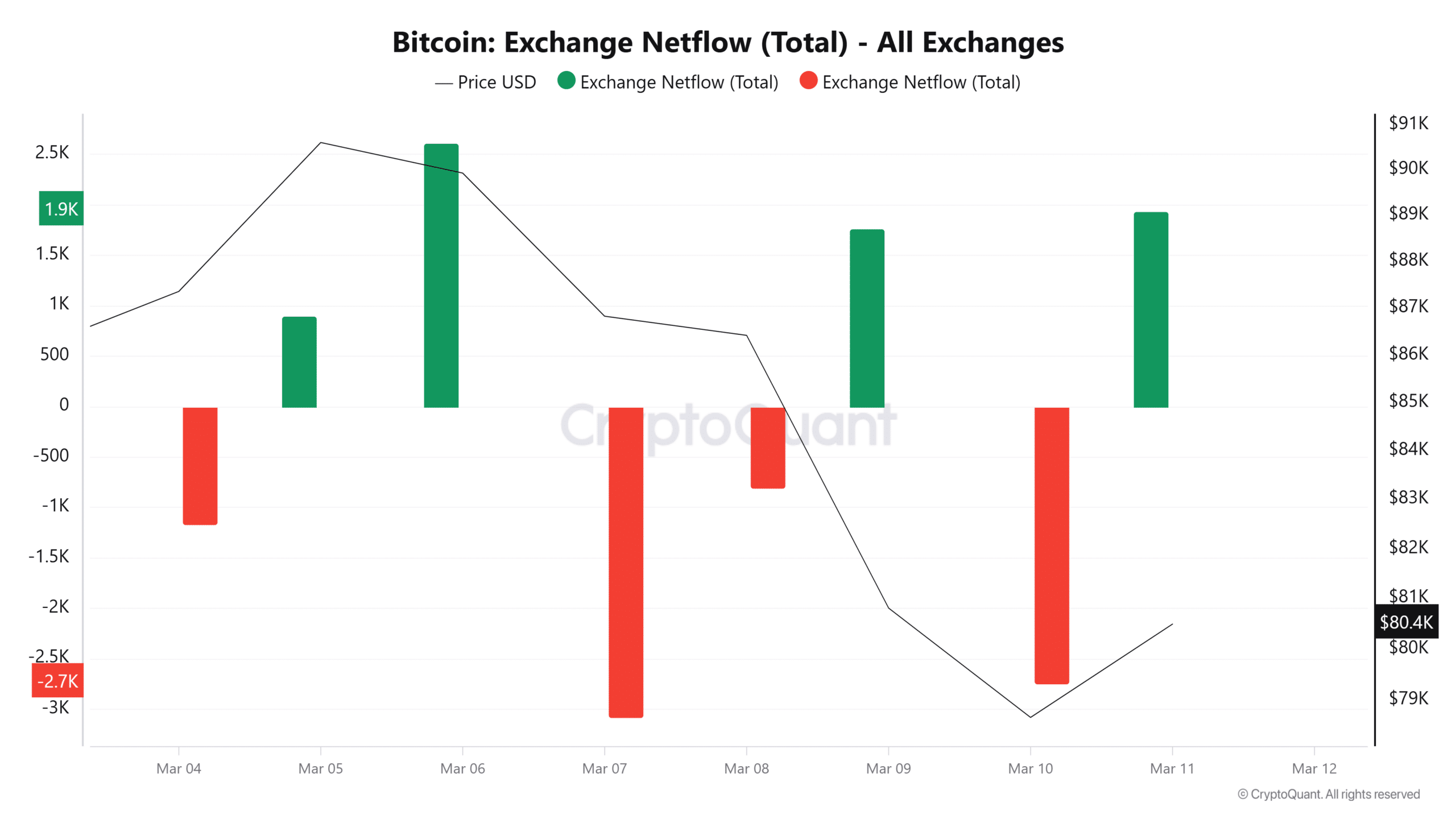

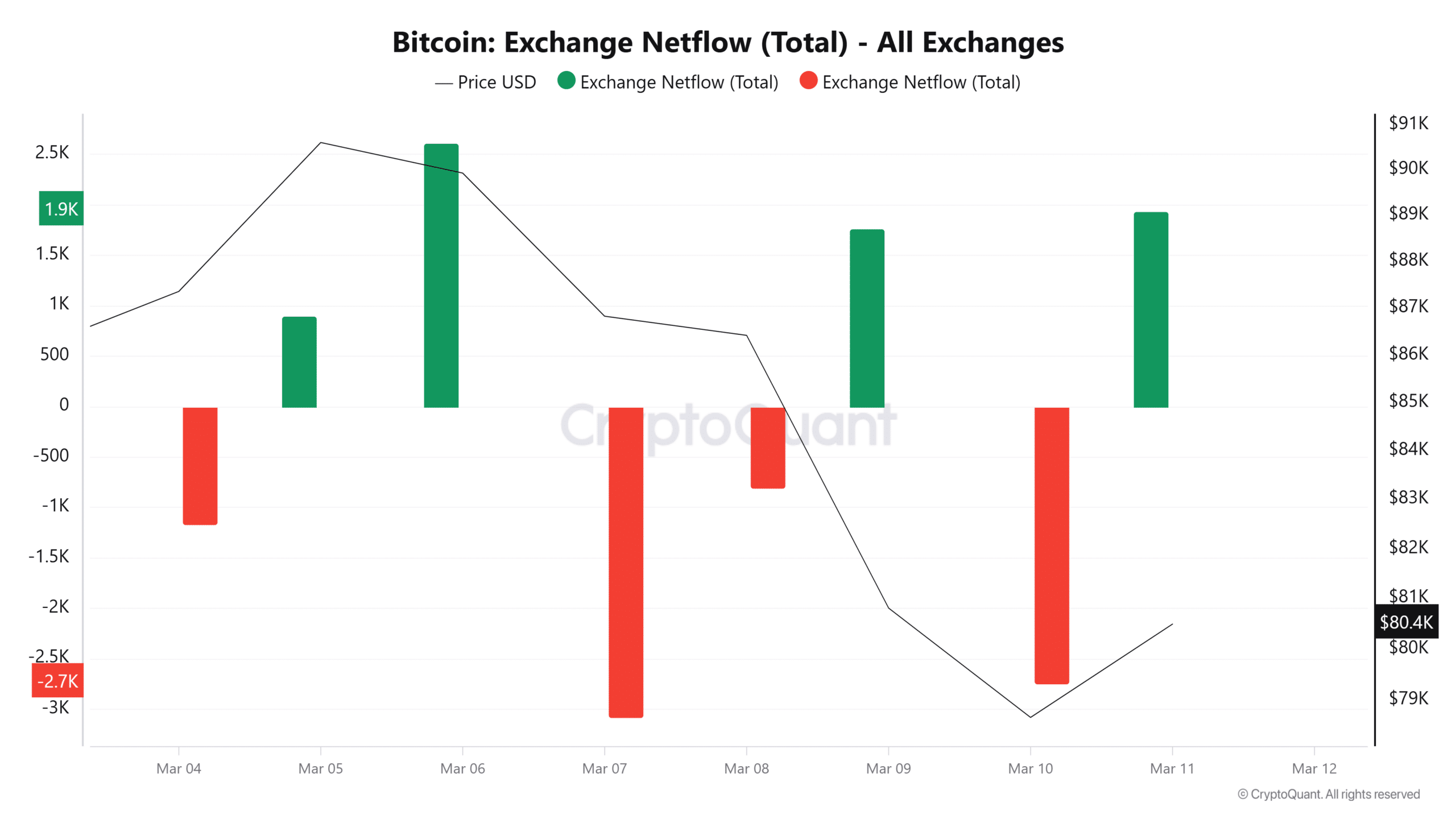

Looking at the Exchange Netflow, which tracks the flow of Bitcoin into and out of exchanges, we can see confirmation that these older coins are indeed on the move. The Netflow has turned positive, showing a significant inflow of over 1.6k BTC.

In fact, the past day alone witnessed over 50,000 BTC flowing into exchanges. This massive influx strongly indicates that bearish sentiment has truly taken hold in the markets recently.

What next for BTC

The fact that investors are reducing their leveraged positions clearly points to a strong sense of bearishness in the market right now. Looking ahead, Bitcoin’s path is heavily intertwined with the health of the U.S. economy and its macroeconomic policies. Therefore, it’s likely that we’ll continue to see Bitcoin price swings until the U.S. economic landscape finds more stable footing.

So, if the trends we’ve observed in the last day continue, Bitcoin could potentially dip further, maybe even down to around $77,592. However, if market sentiment shifts – perhaps as the U.S. economy starts to cool down – a move back up to $84k could be on the cards, which would likely restore some market confidence and potentially propel crypto prices to even higher levels.