Bitcoin: Not Losing Ground to Gold, Investor Claims

- Pompliano believes BTC has the potential to outperform gold.

- However, tariff uncertainty and current Bitcoin market sentiment could allow gold to maintain its lead in the near future.

In 2025, gold has been the stronger performer compared to Bitcoin [BTC], largely due to ongoing tariff uncertainties that are driving investors towards gold as a safe haven.

Interestingly, Bitcoin has been behaving more like a risk-associated asset, mirroring the performance of U.S. stocks until recently. Year-to-date, BTC has seen a 10% drop, while gold has surged by over 25%.

During a recent interview on CNBC, Anthony Pompliano, a well-known Bitcoin investor and the founder of Professional Capital Investments, shared his perspective that BTC could eventually outshine gold in the long run. He explained,

“Historically, gold tends to initiate market rallies. Once gold starts to climb, Bitcoin typically follows suit around 100 days later, often with even more significant gains.”

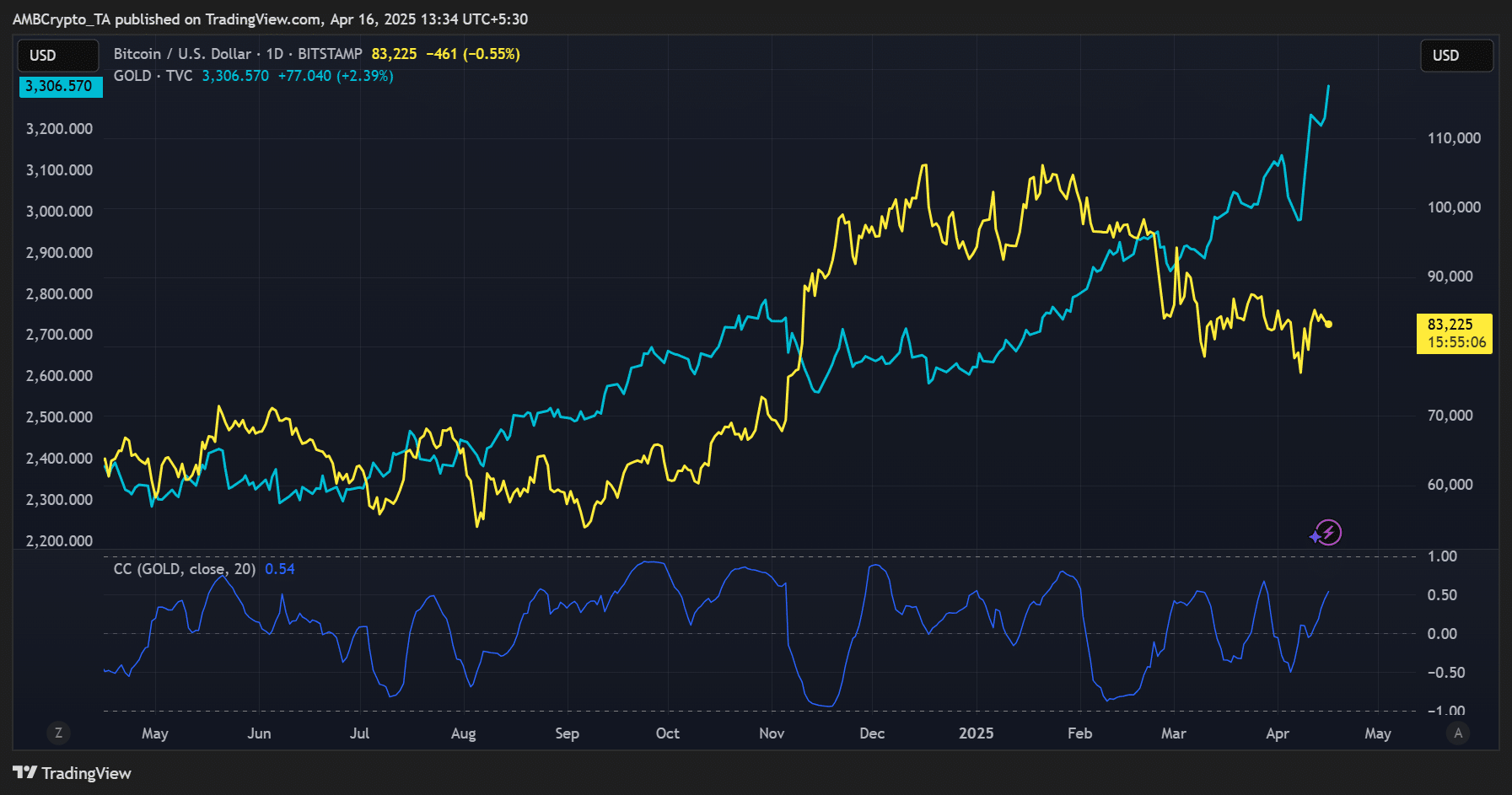

BTC vs. gold

Source: BTC vs. gold performance, TradingView

True to Pompliano’s observation, Bitcoin (represented in yellow) has historically shown a tendency to move in sync with gold (cyan) after periods where their price movements diverge.

Looking at the chart, we can see that Bitcoin and gold’s price actions separated in early November and February. However, they realigned and started moving together again in December and January.

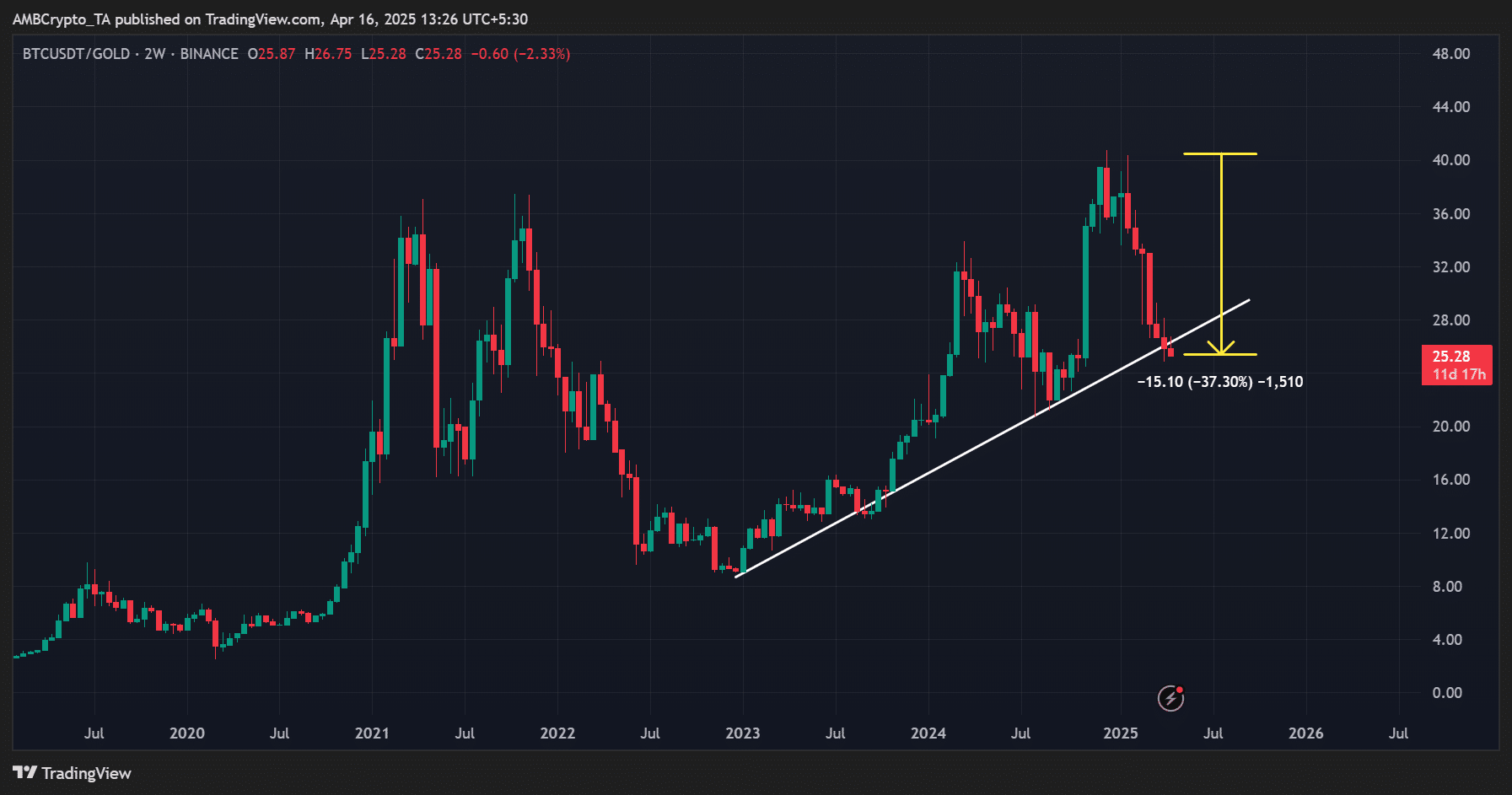

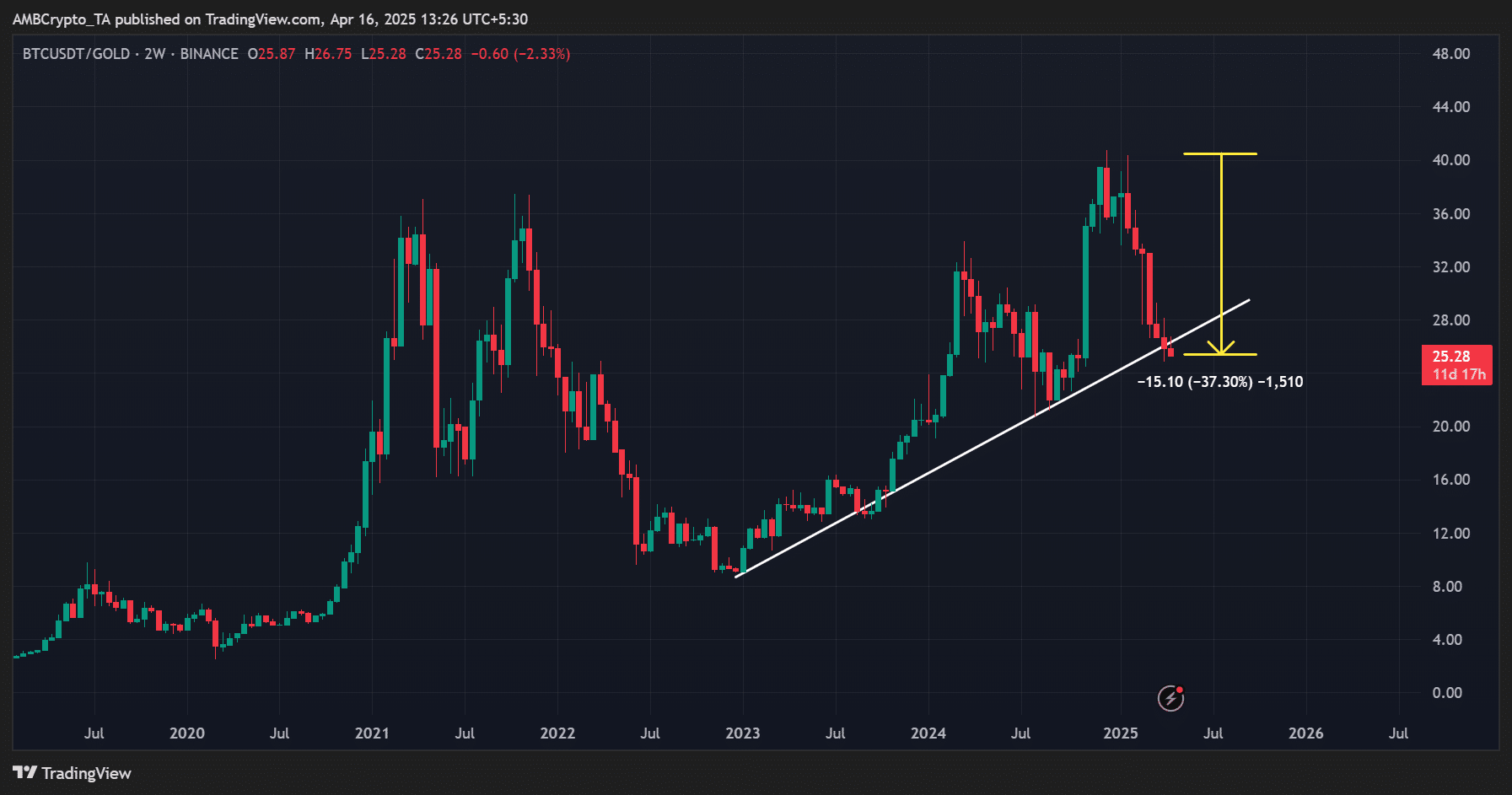

Despite this historical correlation, gold has still outperformed Bitcoin by a significant 37% in 2025, based on the BTC/gold ratio. Although this ratio has recently fallen back to a crucial trendline support level at the time of writing, it remains to be seen whether Bitcoin can recover its position against gold.

Source: Source: BTC/gold ratio, TradingView

In recent days, Bitcoin has shown resilience by consolidating tightly between $83,000 and $85,000, even as U.S. equities experienced a downturn.

Eric Balchunas, a Bloomberg ETF analyst, commented on this strength, stating,

“The fact that $MSTR is up 7% year-to-date while $QQQ is down 10% is something I wouldn’t have predicted. I’m also surprised and encouraged to see BTC holding at $85k amidst market pressures. This is a positive signal, indicating robustness and suggesting Bitcoin is more than just a highly volatile tech proxy.”

He further noted that substantial Bitcoin acquisitions by figures like Michael Saylor and through ETFs in the last year have established a stronger foundational support for Bitcoin compared to previous market cycles.

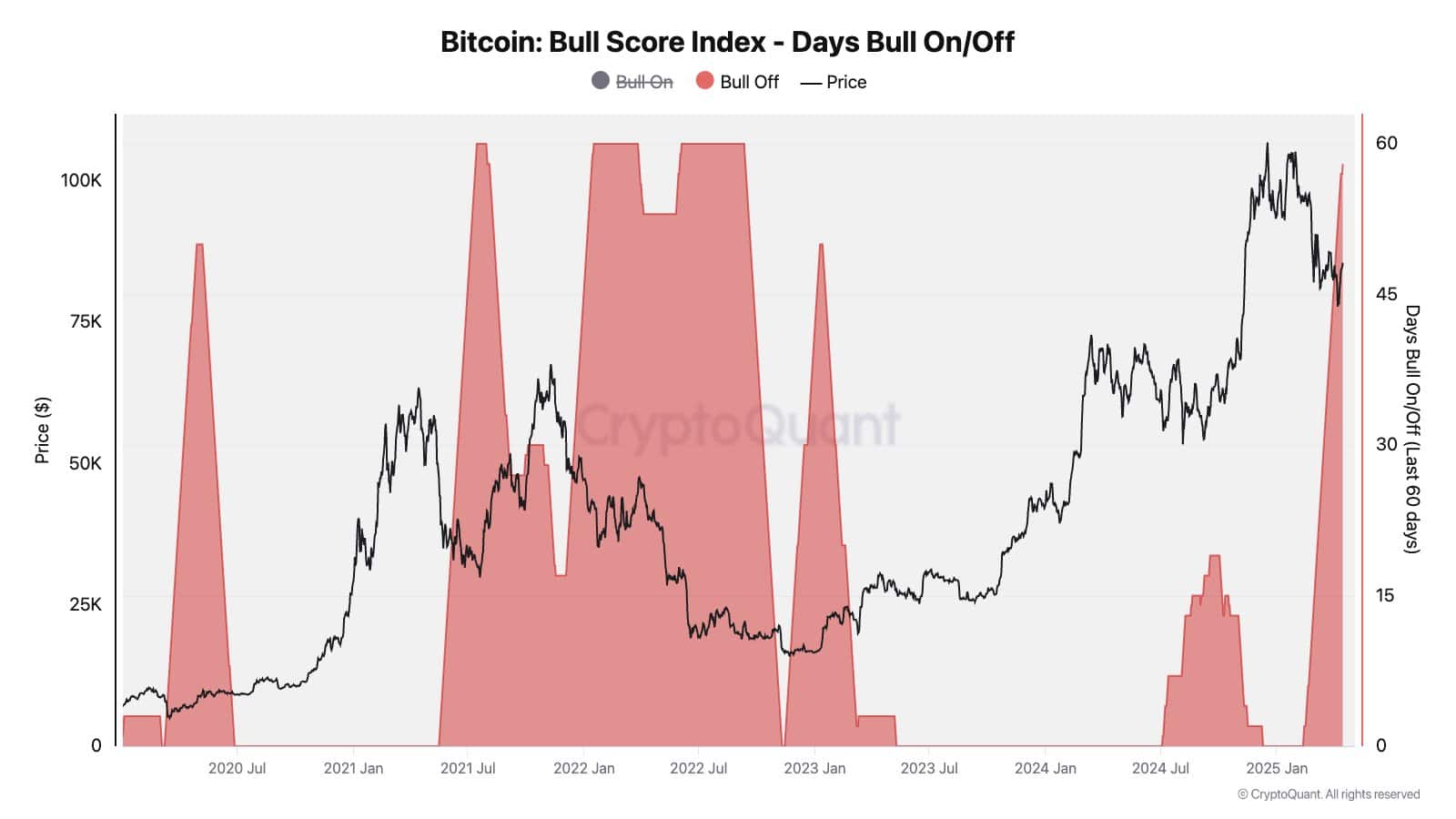

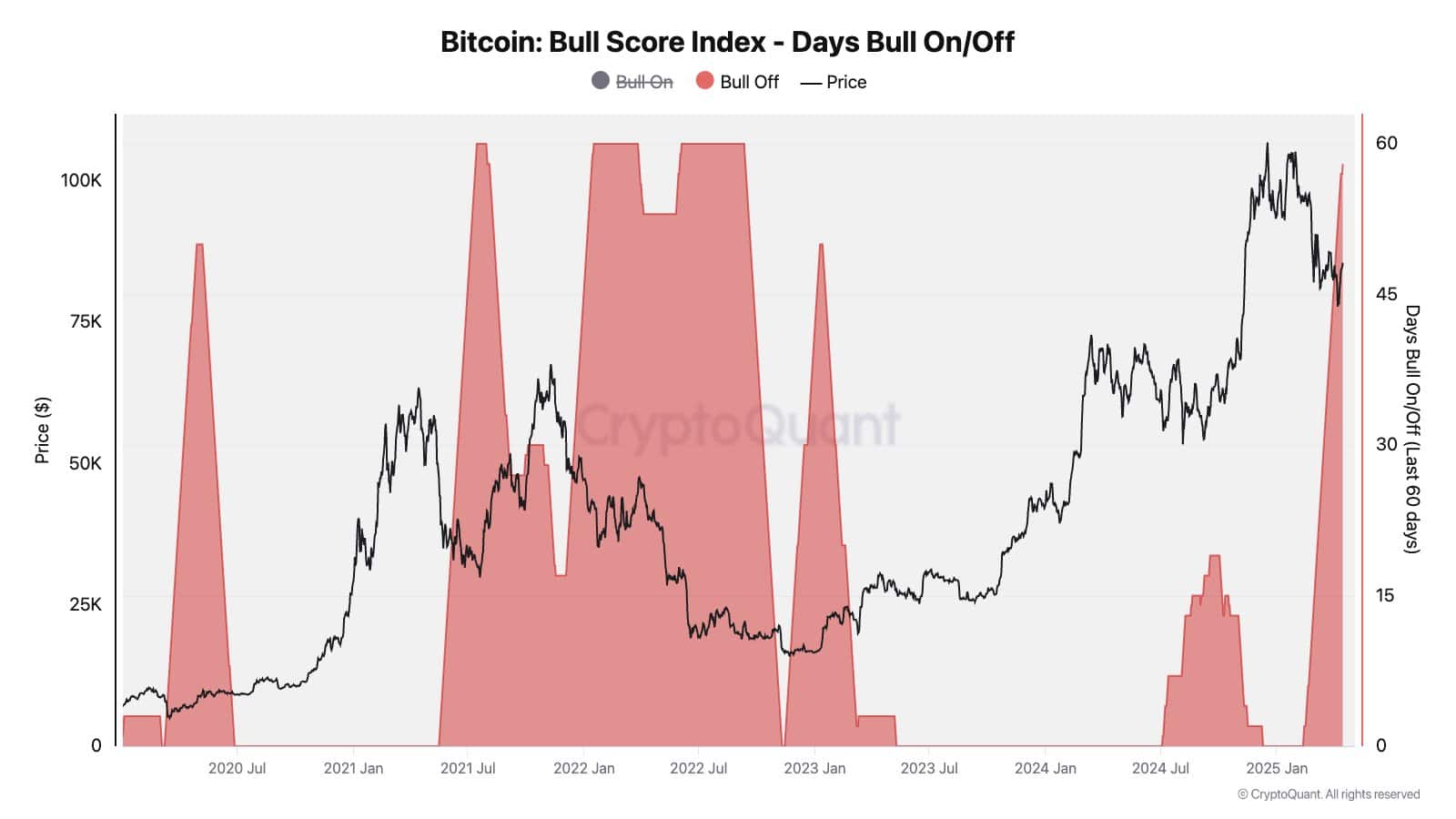

Despite this apparent strength, overall market demand and truly bullish conditions for Bitcoin are still not clearly present. According to CryptoQuant’s Bitcoin Bull Score Index, the market has been in a ‘Bull Off’ phase for the past 60 days.

This current phase echoes the weak market conditions experienced during the crypto winter of 2022, characterized by overall negative price movements.

Source: CryptoQuant

Market sentiment overall remains in a state of ‘fear’ since February. A definitive market turnaround likely hinges on a resolution to the existing uncertainties around tariffs.

Until these uncertainties are cleared, gold might very well extend its current run of outperforming Bitcoin.