Bitcoin Outperforms Gold, Stocks Despite 14.45% CAGR

Este artículo también está disponible en español.

While Bitcoin (BTC) has always been known for its impressive growth, its four-year compound annual growth rate (CAGR) has now dipped to a record low of 14.5%. Despite this decline, it’s worth noting that even at this level, the leading cryptocurrency is still outperforming traditional investments like gold and stocks.

Bitcoin CAGR Drops To Lowest Rate Ever

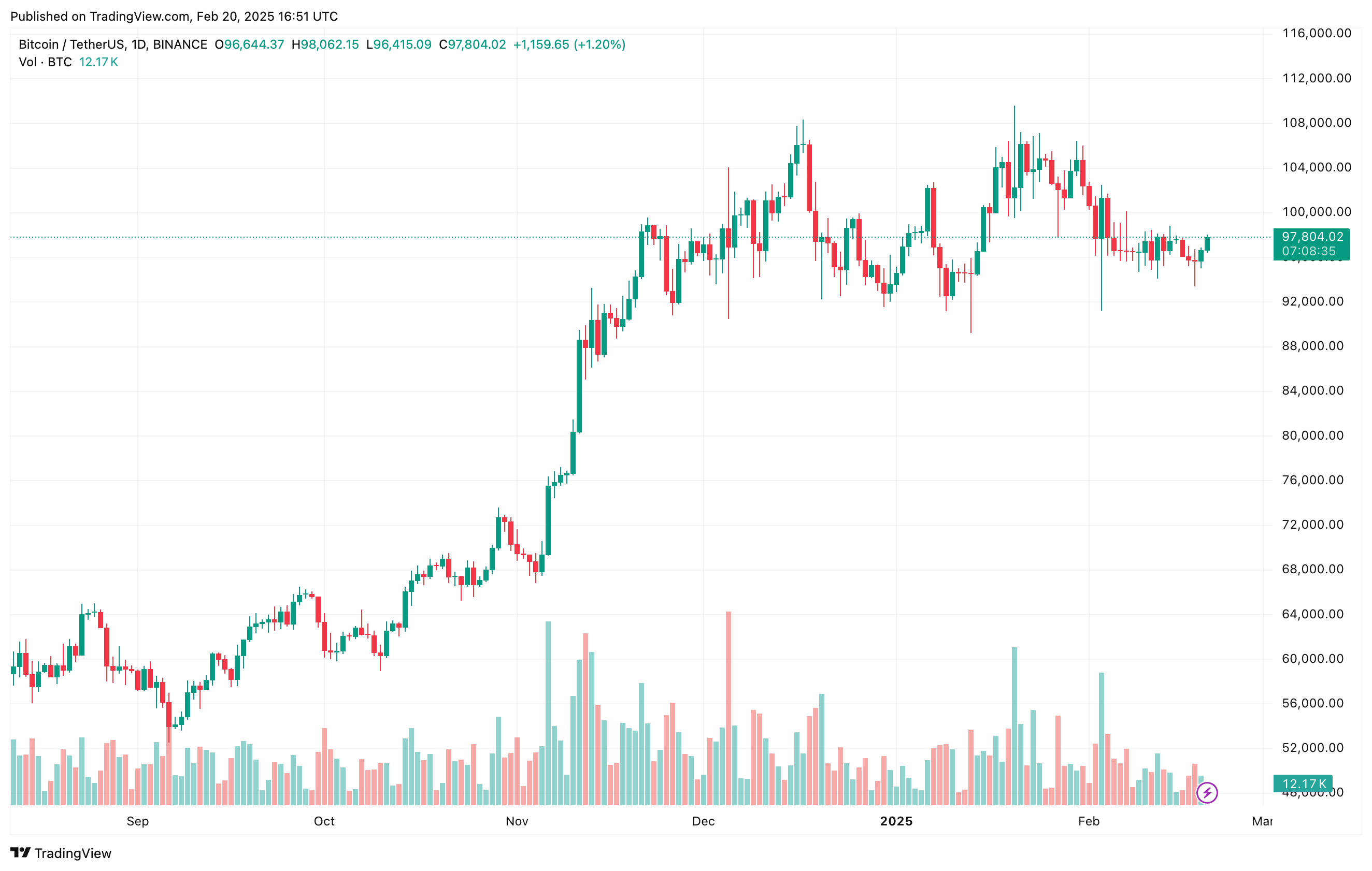

Bitcoin has been on a wild ride in the past year, demonstrating resilience by hitting numerous all-time highs. This price surge occurred even as the US Federal Reserve (Fed) adopted a hawkish approach to combat inflation, including raising interest rates. In fact, according to data from CoinGecko, BTC has impressively jumped by 88% in just the last year.

Related Reading

Even with its stellar performance in 2024, Bitcoin’s long-term growth metric, the four-year CAGR, has touched a historic low of 14.5%. Market analyst Mark Harvey shared a chart on platform X, illustrating this downward trend in the crypto’s four-year CAGR.

For those unfamiliar with the term, the four-year CAGR is essentially the average yearly growth rate of an asset over a four-year period, taking into account the power of compounding returns. It’s a useful metric for understanding long-term performance by smoothing out any short-term market noise.

Interestingly, despite the low point, Harvey remains optimistic about Bitcoin’s future CAGR. In response to a comment on his post, he agreed that the cryptocurrency could be gearing up for a significant surge upward soon.

While a 14.5% four-year CAGR is indeed Bitcoin’s lowest to date, it still outperforms the returns you’d see from gold and stocks. According to data from Checkonchain, the four-year CAGR for assets like gold, silver, the S&P 500, Nasdaq, and even the US dollar has hovered between 4% and 13%.

However, when compared to other major cryptocurrencies, Bitcoin’s four-year CAGR isn’t as impressive. For example, Solana (SOL) boasted a whopping CAGR of 118%, and XRP offered 49%. Notably, Ethereum (ETH) was the only large-cap crypto ranked below Bitcoin, with a CAGR of just around 8%.

Is BTC On Track To Replace Gold?

Currently, Bitcoin’s total market capitalization stands at just over $1.9 trillion. In comparison, gold’s market cap is still significantly larger, nearly 10 times greater, sitting at around $19 trillion. Despite this gap, many experts believe Bitcoin, often called ‘digital gold’, has substantial growth potential and could soon start challenging gold’s long-held dominance.

Related Reading

In a recent note to clients, analysts at the trading firm Bernstein predicted that Bitcoin is actually on a path to replace gold within the next decade. Their report suggests Bitcoin is poised to take over gold’s traditional role as a dependable safe-haven asset in the financial world.

As Bitcoin adoption continues to grow, an increasing number of financial minds are imagining a future where this cryptocurrency becomes a true rival to gold. Just recently, Matthew Sigel, Head of Digital Assets Research at VanEck, emphasized Bitcoin’s significant potential to evolve into a global monetary standard.

Adding to this sentiment, veteran trader Peter Brandt recently highlighted Bitcoin’s strengthening position against gold in the market. At the time of this report, Bitcoin is trading at $97,804, showing a 1.7% increase over the last 24 hours.