Bitcoin Price Dip Alert?:

- Experts at Standard Chartered are suggesting that Bitcoin (BTC) might see its price dip further from its current level of $88,000.

- Market analysis indicates that investor sentiment currently leans towards selling off their Bitcoin holdings.

Bitcoin [BTC] has faced headwinds over the past month, experiencing a consistent price decline. Just within the last 24 hours, it has slipped below the $90,000 mark – a level it had maintained for months – resulting in a monthly performance drop of 9.67%.

The prevailing market sentiment suggests that Bitcoin could potentially slide even further, possibly testing the $80,000 level as market pressures intensify.

Analyst predicts a 10% slide

Adding to this outlook, Geoff Kendrick, an analyst at Standard Chartered, believes Bitcoin remains vulnerable and could experience an additional 10% decrease. This could potentially push the asset down to the lower $80,000 range in the short term.

However, Kendrick’s analysis also points out a potential silver lining: he suggests that a decrease in U.S. Treasury yields, combined with Bitcoin trading at this lower price point, could actually trigger a price rebound.

Until such conditions materialize, Kendrick advises investors to exercise caution when trading Bitcoin. He highlights the significant surge in outflows from institutional investors as a key concern, indicating strong selling pressure from this group.

Furthermore, beyond these factors, Kendrick also points to the role of Solana [SOL] memecoins as a contributing factor to the recent price downturn.

To gain a deeper understanding of these market dynamics, AMBCrypto conducted further analysis to examine the behavior of investors, uncovering a mixed bag of sentiment within the market.

Traditional investors have turned bearish

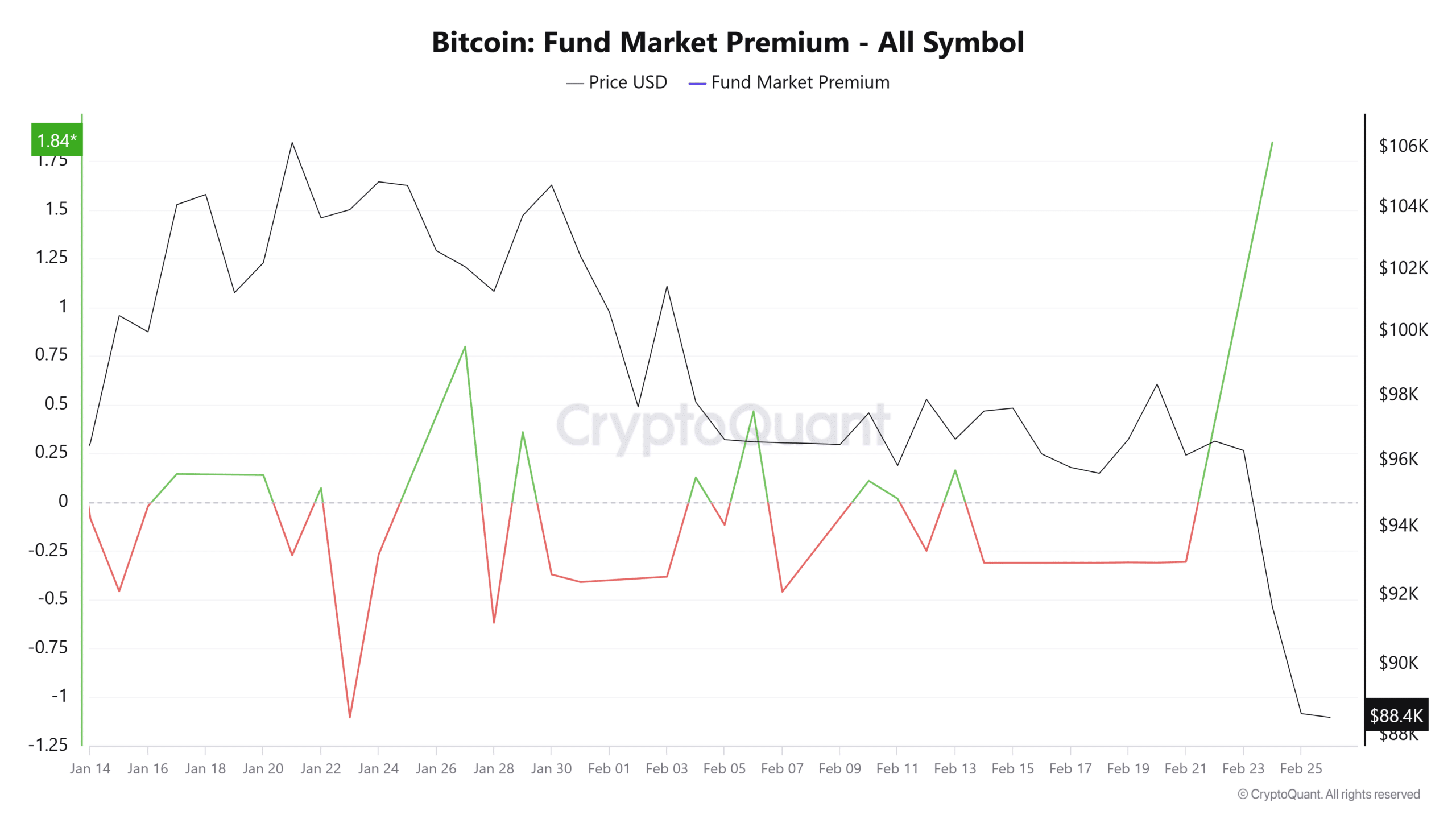

Interestingly, the Fund Market Premium, which measures the difference between a fund’s net asset value (NAV) and its market price (using a scale where values above 1 indicate bullish sentiment and below 0 bearish), currently shows ongoing bullish behavior.

At the time of writing, this metric registered a reading of 1.8. This high value suggests robust buying activity, as the fund’s market price is trading significantly above its NAV, entering a positive premium. This implies that a segment of investors in the market are actively accumulating Bitcoin.

Source: CryptoQuant

However, while a segment of the market remains bullish, another part is leaning towards bearishness.

The Binary Coin Day Destroyed (CDD) metric, which monitors Bitcoin movement by long-term investors to identify buying or selling patterns, indicates a prevailing bearish sentiment.

A Binary CDD reading of 1 – which is currently the case for Bitcoin – historically suggests that long-term investors are moving their Bitcoin, likely with the intention to sell.

Considering the significant role of institutional investors in the Bitcoin market and Geoff Kendrick’s price prediction, AMBCrypto further investigated the sentiment specifically among institutional Bitcoin investors.

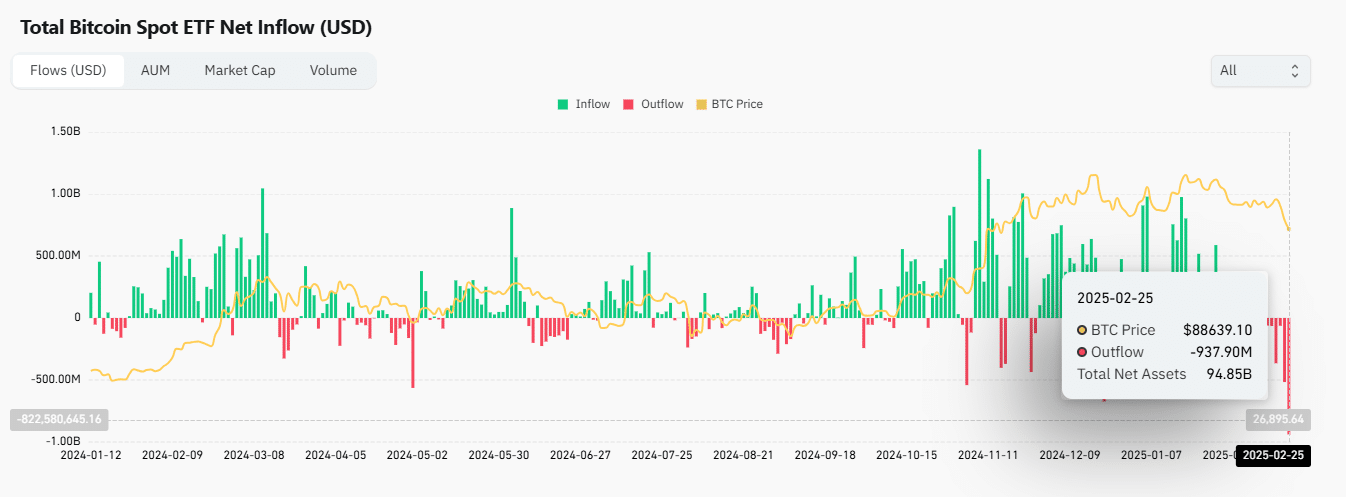

Bitcoin Spot ETF records largest outflow yet

Data from Coinglass reveals that Bitcoin Spot ETFs (Exchange-Traded Funds) have just experienced their largest single-day outflow to date, with institutional investors selling off a substantial $937.90 million worth of BTC.

Source: Coinglass

A significant negative net flow of this magnitude typically signals a decline in market confidence. This recent outflow could be attributed to several factors, including Bitcoin trading below $90,000 and dipping further into the cost basis for short-term holders.

Given the mixed sentiment currently prevailing, whether to buy Bitcoin remains uncertain. Therefore, it is crucial to closely monitor the flow of Bitcoin into and out of institutional spot holdings, alongside other fundamental market indicators, to better gauge future price movements.