Bitcoin Surges Past $90,000: Reasons Behind the Rally

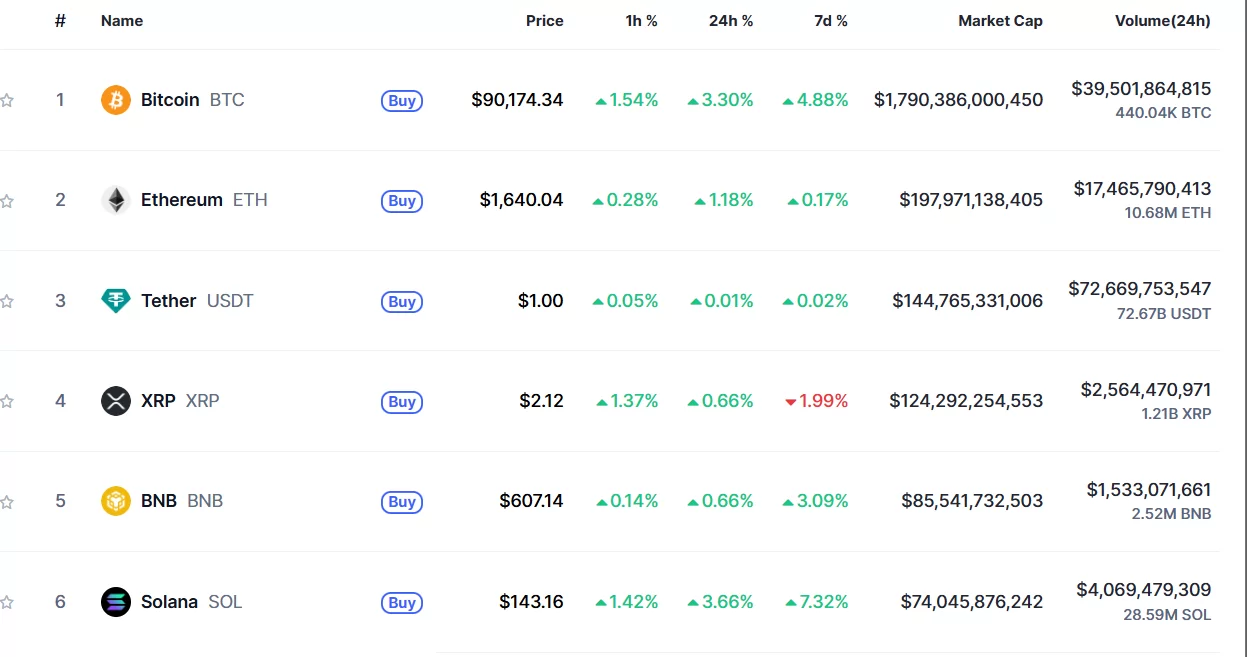

Bitcoin, the leading cryptocurrency, has been on a recovery path recently, and today, it achieved a significant milestone, surging past $90,000 for the first time since March 7th.

Interestingly, Bitcoin’s correlation with traditional stocks has diverged lately. This shift coincides with BTC gaining over 5% in the past week, propelling it back to the $90,000 level, a height not seen since March 7th.

Adding to the intrigue, Bitcoin’s rise is mirrored by gold’s impressive performance as it hits new record highs. However, the burning question remains: is this upward trend for Bitcoin sustainable, or just a temporary spike?

The bullish momentum wasn’t limited to Bitcoin alone. Altcoins also joined the rally, with Ethereum (ETH) climbing to $1650, XRP reaching $2.13, and Solana (SOL) hitting $143.

Several factors could be fueling Bitcoin’s current ascent. These include the growing correlation between BTC and gold, increasing anticipation of potential interest rate cuts by the Fed in May, and the renewed influx of capital into spot Bitcoin ETFs.

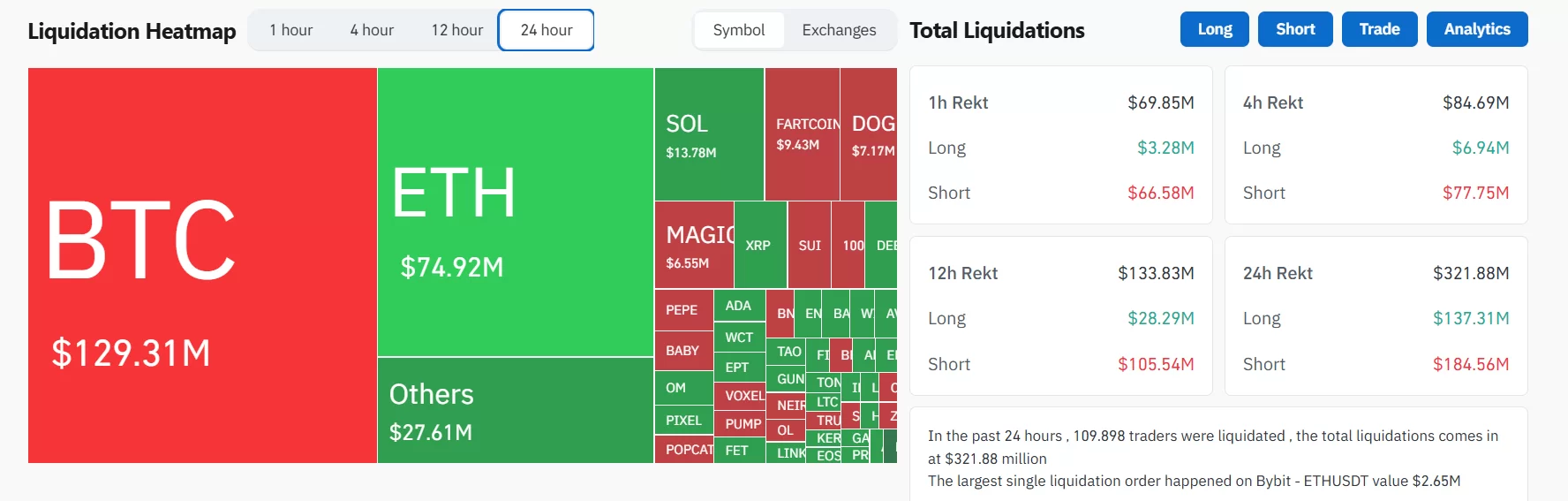

Breaking this down, short positions accounted for $184 million, while long positions contributed $137 million. In total, 109,848 traders faced liquidation within this period, with the largest single liquidation event happening on the ETH/USDT pair on Bybit.

*Please remember, this is not financial advice.