Bitcoin whales: Bullish Signals for Investments

Bitcoin whales: Bullish Signals for Investments

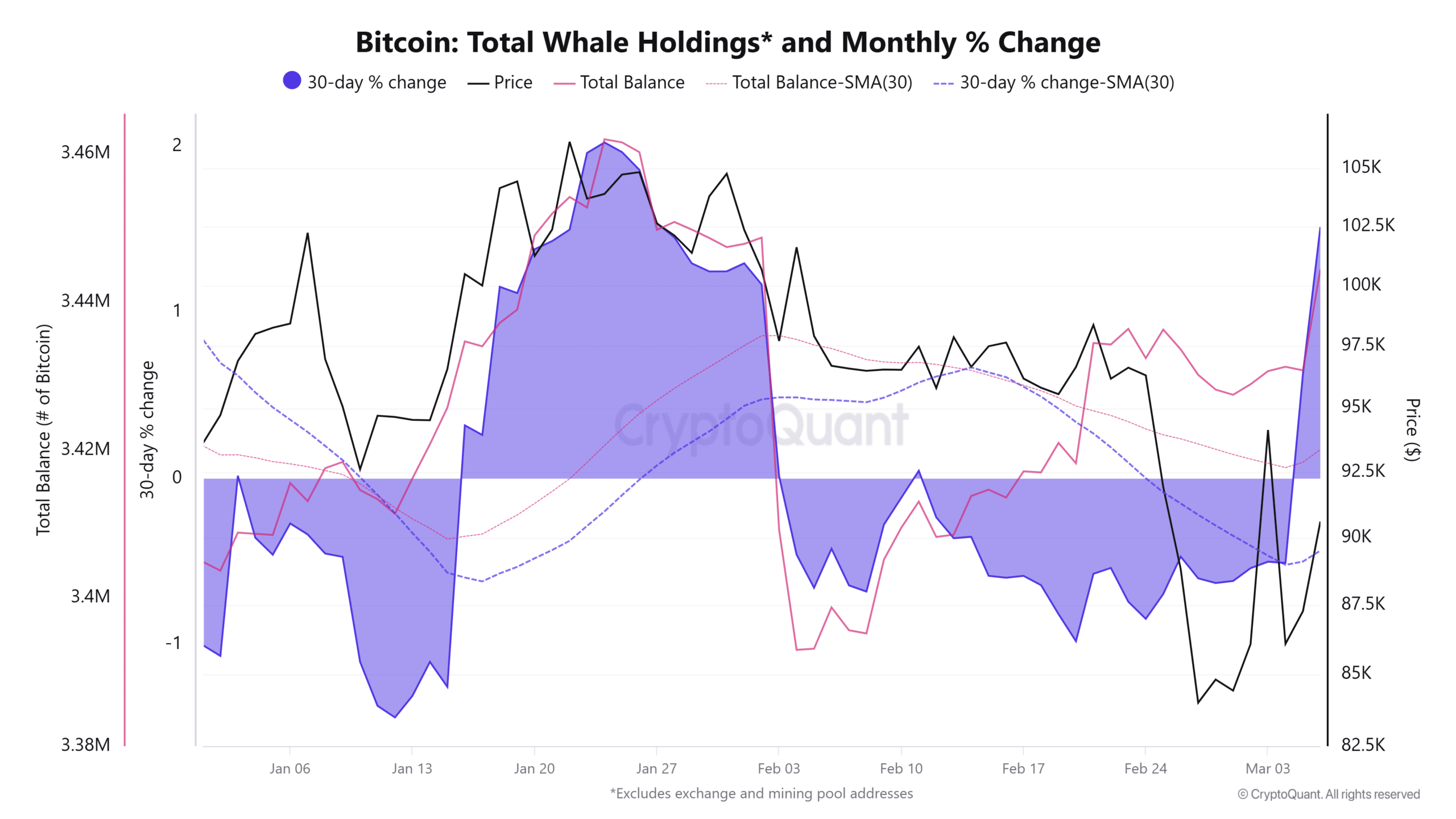

- Good news for Bitcoin bulls: those major investors, the Bitcoin whales, have stopped selling off their coins! In fact, they’re buying again, pushing the 30-day rate of accumulation into positive territory at +0.7%.

- If these big buys continue, could Bitcoin make another run for that $90,000 mark?

For over a month, the Bitcoin [BTC] market has been watching as whales, those holders with massive amounts of Bitcoin, steadily trimmed down their digital coffers. This selling spree marked the longest period of net outflow from these big wallets in a year. But hold on – the tide seems to be turning! Whales have shifted gears and are now starting to accumulate Bitcoin once more.

This shift from selling to buying has flipped the monthly percentage change in whale holdings back into the green. This positive movement could be a signal of a changing mood in the market. Now, the big question everyone’s asking is: could this renewed whale interest be the fuel for Bitcoin’s next big price surge, or is this just a temporary blip on the radar?

Bitcoin’s whale accumulation resumes – Is this the start of something big?

Fresh on-chain data reveals an interesting development: Bitcoin whales are back in the buying game! After weeks where their balances were shrinking, we’re now seeing their total Bitcoin holdings grow again. The numbers show a 30-day percentage increase of +0.7% in their holdings.

Historically speaking, when we’ve seen whales change their tune like this and start accumulating after selling, it’s often been a precursor to significant moves in Bitcoin’s price. Currently, the total Bitcoin held by these whales sits around 3.4 million coins.

Source: CryptoQuant

Looking back at historical trends, we can see a pattern: when whales go from selling to buying, Bitcoin often experiences periods of increased ups and downs – volatility, in market terms. And quite often, these shifts have been followed by price recoveries.

This could suggest that the whales, with their deep pockets and market insight, might be getting ready for a possible change in the market’s direction. Are they anticipating something?

Bitcoin’s price action – What could this mean for the price?

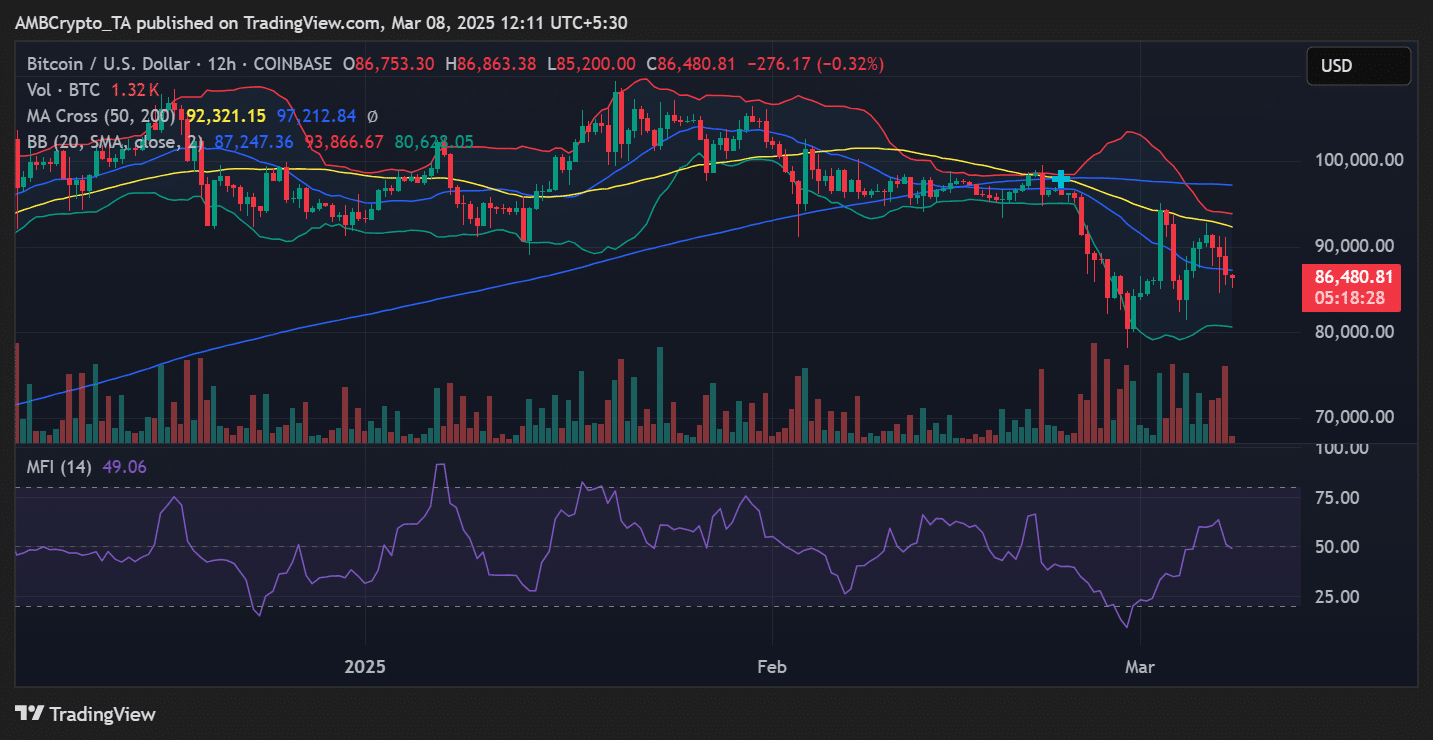

As of writing, Bitcoin is trading around $86,480, having dipped slightly by 0.32% in the last 12 hours. Looking at some key technical levels, the 50-day moving average is currently hovering around $92,321 and is acting as a significant hurdle for Bitcoin to overcome.

In the meantime, Bitcoin’s price seems to be bumping along the lower edge of the Bollinger Bands. For those not fluent in trading jargon, this often suggests that price swings might be getting bigger across the board for Bitcoin right now.

ç

ç

Source: TradingView

The Money Flow Index [MFI], a tool to gauge buying and selling pressure, currently sits at 49.06. This reading suggests Bitcoin isn’t leaning too heavily into ‘overbought’ or ‘oversold’ territory just yet.

If we see a sustained increase in whale buying, it could be the push Bitcoin needs to try and test that $90,000 level again. However, if Bitcoin struggles to climb back above those key moving averages, we might see the price drift back down towards its $82,000 support zone.

What could happen next in the Bitcoin saga?

When we’ve previously observed whales switching back to accumulation after a period of selling, AMBCrypto’s analysis indicates that Bitcoin often experiences increased buying activity in the weeks that follow.

However, it’s important to remember that just how much this whale activity impacts the price can depend on broader market forces, like what’s happening in the global economy and the overall mood of investors.

One crucial thing to figure out is who’s behind this whale accumulation: are these long-term holders with a strong belief in Bitcoin’s future, or are we seeing short-term traders looking to make a quick profit? If the current buying trend holds, it could signal a renewed sense of confidence in Bitcoin’s long-term prospects. On the flip side, if this buying slows down, Bitcoin might just trade sideways for a bit before making its next big move.

Will whales be the driving force behind the next Bitcoin rally?

This recent change in Bitcoin whale behavior certainly hints that these major players are starting to position themselves for what they believe could be a shift in the market. While history suggests that whale accumulation phases have often led to price increases, it’s still crucial to watch whether Bitcoin can actually overcome those key resistance levels we mentioned.

If whales keep buying aggressively, Bitcoin might just have the momentum to break through $90,000 and even retest $92,000. But, if this buying momentum falters, Bitcoin could remain stuck in a range, potentially bouncing between $82,000 and $88,000 in the short term.

For anyone keeping a close eye on the market, it’s worth diving into on-chain data and keeping track of those bigger economic signals to get a better sense of whether this whale-driven momentum is here to stay, or just a fleeting moment.