Bitcoin Woes: Tariff Hikes Threaten Record Hashrate

The Bitcoin mining world is heating up! Competition is fiercer than ever as the Bitcoin network’s hashrate has surged to a record high. In fact, by the close of March 2025, the hashrate impressively reached 850 million TH/s.

But it’s not all smooth sailing. This impressive growth is accompanied by some serious headwinds for the industry. Miners are facing rising production costs and new trade barriers, especially in the US. These challenges are really putting the squeeze on mining companies and could significantly change the landscape of Bitcoin mining going forward.

Hashrate Surges, Mining Costs Soar

Let’s break down hashrate: it’s essentially the muscle power behind the Bitcoin network. It’s the total computing energy miners are throwing at securing the network and verifying all those transactions. We measure it in terahashes per second (TH/s), which tells you how many calculations the network crunches every single second.

Data from Blockchain.com shows Bitcoin’s hashrate climbing past 850 million TH/s in March. This jump indicates more miners are joining the party, signaling increasing trust in Bitcoin’s future and its robust security.

“Each time the network gets stronger, Bitcoin becomes harder to attack, harder to ignore, and more justified in commanding a higher valuation. This isn’t just code. It’s economic gravity. Bitcoin has become the most secure monetary network humanity has ever seen. And it’s only getting stronger.” — Thomas Jeegers, CFO & COO of Relai commented.

However, even with this hashrate explosion, mining profits aren’t keeping pace. In fact, a report from Macromicro reveals that the cost to mine a single Bitcoin has doubled since early 2024, now hitting a hefty $87,000! This cost surge is mainly due to pricier electricity and the significant expenses of running those powerful, specialized mining computers (ASICs).

Given Bitcoin’s price volatility, many mining companies are facing the very real possibility of losses if they don’t become super efficient. This is especially tough for smaller miners who don’t have the benefits of large-scale operations or access to cheaper power that the big players do.

Tariff Challenges and Dependence on Chinese Hardware

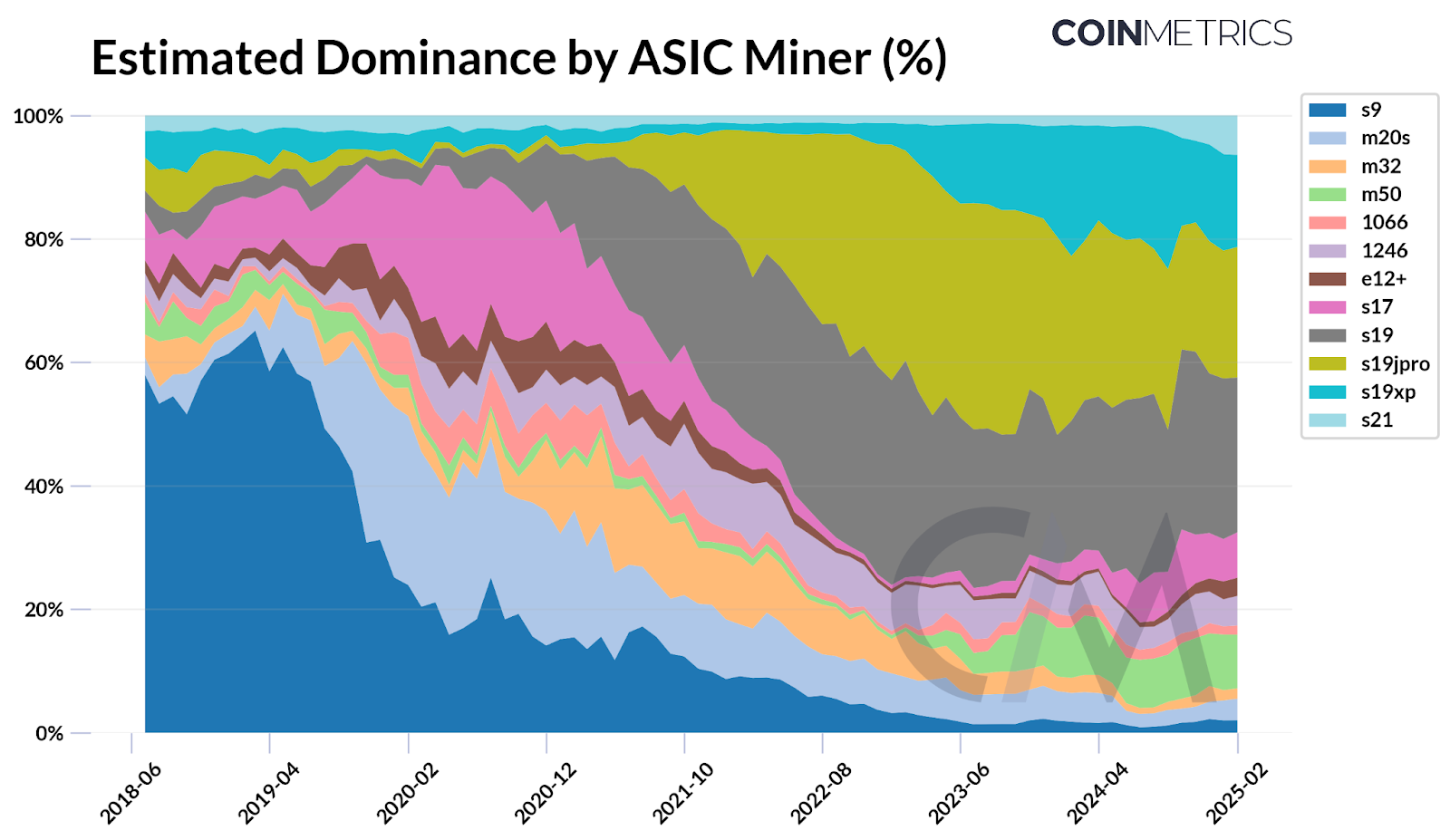

And it’s not just costs – Bitcoin miners are also grappling with significant trade hurdles, especially in the United States. CoinMetrics points out that a huge chunk of the mining hardware, about 59%–76% of Bitcoin’s total hashrate, comes from ASIC miners made by Bitmain, a Chinese company.

Bitmain has been the king of mining hardware for a while now, famous for super-efficient machines like the Antminer S19 and S21. However, in early 2025, things got bumpy for some US mining companies who faced delays in getting their Bitmain gear. This was due to stricter customs checks and those new tariffs slapped on Chinese imports.

“When one company, like Bitmain, controls the majority of Bitcoin’s network hashrate, it creates a potential vulnerability, even with backup supply plans. Because Bitmain is mainly based in China, its dominance underscores how global politics can impact the reliability of Bitcoin mining,” CoinMetrics reported.

Actually, these tariffs aren’t a recent development. SCMP reported that the US has been charging duties of up to 27.6% on mining gear imported from China way back since 2018.

But lately, we’re seeing even more regulatory attention and trade tensions, pushing those import costs for mining hardware even higher. This is squeezing the budgets of US-based miners, messing with their supply chains, and hindering their growth just as the global hashrate is climbing.

In a recent interesting development, Hut 8 Corp., a big name in Bitcoin mining and high-performance computing, teamed up with Eric and Donald Trump Jr. to launch American Bitcoin Corp.!

Their goal? To create the biggest and most efficient Bitcoin mining powerhouse in the world, while also building up a substantial Bitcoin reserve. This move really underscores the growing attraction of the competitive mining sector for major US investors.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.