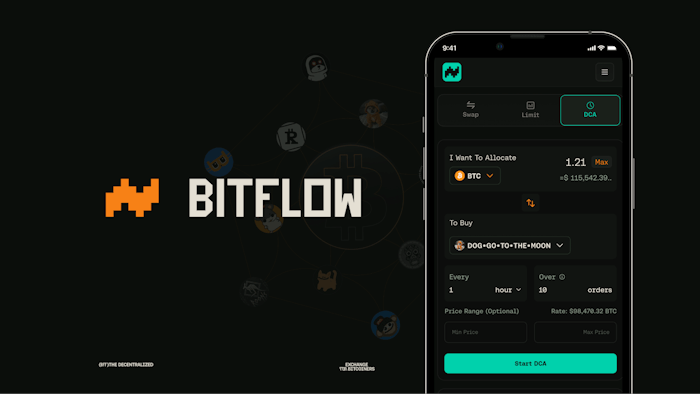

Bitflow: AI-Powered DeFi DCA for Bitcoin & Runes on Stacks

- Exciting news! Bitflow has launched Automated Dollar-Cost Averaging (DCA) for Bitcoin and Runes investments on Stacks.

- This innovative, AI-powered DCA tool makes recurring, trustless investments a breeze.

- Looking ahead, expect even more features like yield strategies and smooth cross-layer asset flow!

Great things are happening over at Bitflow, the decentralized exchange thriving within the Stacks ecosystem! They’ve just dropped a game-changer: Automated Dollar-Cost Averaging (DCA). This isn’t just any feature; it’s a smart, AI-driven approach to investing in Bitcoin and related digital assets.

Imagine effortlessly setting up regular buys of Bitcoin (BTC), stablecoins, Stacks’ own STX token, sBTC, and those hot Runes tokens like $DOG. With Bitflow’s automated DCA, you can do exactly that, and the best part? You stay in complete control of your funds the whole time.

Bitflow is making it easier and better to get involved in the growing world of Bitcoin-based finance. This new automated DCA feature is a real step forward for decentralized finance (DeFi) on the Stacks Layer 2 network, opening up new possibilities for everyone.

Investing in Bitcoin DeFi Just Got Simpler with Automation

What’s the secret sauce behind this Automated Dollar-Cost Averaging (DCA)? It’s Bitflow Keepers, their clever automation engine. This tech is what makes those trustless, recurring investments possible. Forget about trying to time the market or manually making trades – Bitflow handles it smoothly.

And it’s not just about Bitcoin! Bitflow’s DCA supports a wide range of assets, including SIP-10 tokens and even the viral memecoin $DOG (DOG•GO•TO•THE•MOON). This means easy portfolio diversification for everyone.

Stacks DeFi users are getting something truly special here – the ability to program their investment strategies. This is about to turn Bitcoin into a dynamic asset that can actually generate yield for you.

Security and transparency are key, and Bitflow delivers. Their non-custodial setup means every transaction is fully onchain. You get clear visibility and solid security without relying on any middlemen.

Dylan Floyd, Bitflow’s Co-Founder and Lead Developer, is clearly excited about the future. He highlights that we’re entering a fresh era for Bitcoin DeFi, where automation offers powerful tools for users to grow their crypto holdings efficiently.

This Automated DCA feature is just the beginning! Bitflow has big plans to weave AI-powered automation even deeper into DeFi. Next up? Automated yield farming strategies designed to maximize your returns on BTC assets, all with minimal oversight needed from you.

Thinking ahead, market-triggered swaps are also on the horizon. Imagine setting conditions for trades to happen automatically based on price changes or market swings – adding a smart layer to your Bitcoin trading.

Liquidity is crucial, and Bitflow is working on making asset movement between Bitcoin’s main layer (Layer 1) and Stacks (Layer 2) super smooth. They’re really connecting these two ecosystems.

All of this underscores Bitflow’s position as a leader in the Stacks world. They’re becoming the go-to place for trading Bitcoin assets, a real liquidity hub.

By bringing Runes and SIP-10 tokens into their decentralized exchange, Bitflow is expanding what’s possible with Bitcoin-based finance. They’re appealing to experienced traders while also making it easier for newcomers to jump into the market in a smart, efficient way.