BlackRock’s digital asset inflows surge to $3B in Q1, AUM hits $11.6T

Key Takeaways

- BlackRock saw a significant $3 billion investment boost into their digital asset products during the first quarter of 2025.

- While noteworthy, digital assets still constitute a modest portion of BlackRock’s overall business, representing about 0.5% of their total assets under management.

Share this article

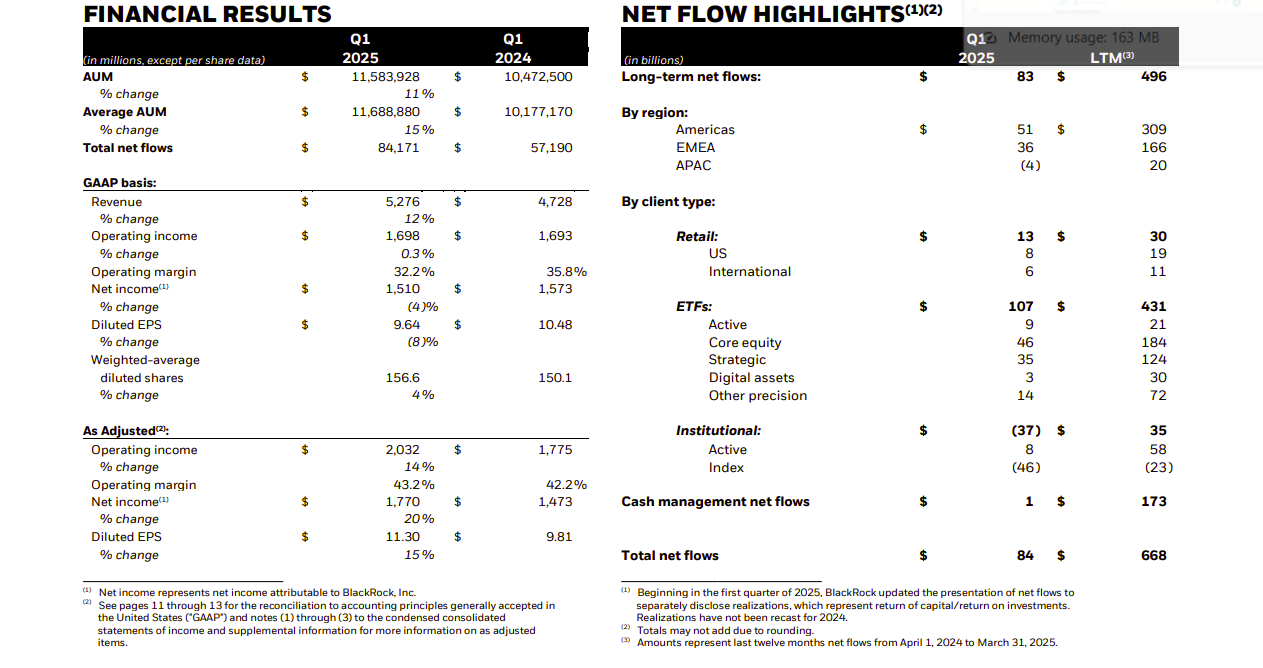

In the first quarter of 2025, investors turned to BlackRock’s digital asset offerings, injecting approximately $3 billion into these products. This influx contributed to the company’s overall impressive net inflows of $84 billion for the quarter, as highlighted in their first-quarter earnings release on April 11th.

A significant portion of these inflows came through BlackRock’s iShares ETF platform, which attracted a robust $107 billion in net inflows during Q1 2025. However, when considering the entire firm, total net inflows landed at $84 billion. This slight decrease is due to outflows in other areas, most notably a $45.5 billion pullback from institutional index funds, which partially offset the strong ETF gains.

By the close of Q1, BlackRock’s digital assets under management had risen to over $50 billion, a substantial leap from $17.5 billion just a year prior. This remarkable growth represents a 187% increase year-over-year, outpacing the growth of even well-performing asset classes like equities, which saw an 8% YoY increase to $5.7 trillion.

Interestingly, the first quarter also presented a mixed bag due to market fluctuations. While digital assets proved popular with investors, attracting over $3 billion in net inflows, market depreciation actually diminished their value by more than $8 billion during the same period.

Looking at the bigger picture, as of March 31st, this global investment giant managed a staggering $11.6 trillion in client assets.

Despite the buzz around digital assets, they still constitute a relatively small slice of BlackRock’s massive portfolio. They make up only 1% of BlackRock’s total Assets Under Management (AUM). Furthermore, while the $3 billion in net inflows into digital assets is notable, it only accounts for 2.8% of the total ETF inflows in Q1 2025. To put things in perspective, private market investments attracted even more capital, bringing in $9.3 billion during the same timeframe.

The investment advisory and administration fees associated with digital assets reached $34 million in Q1. While this is a substantial figure, it represents less than 1% of BlackRock’s total long-term revenue of $4.1 billion as of March 31st.

This proportion aligns with digital assets’ share of AUM but highlights the typically lower fee structures associated with digital offerings.

Consider, for example, the iShares Bitcoin Trust (IBIT), BlackRock’s leading crypto ETF that launched in early 2024. It operates with a competitively low fee of 0.25% after a fee waiver period.

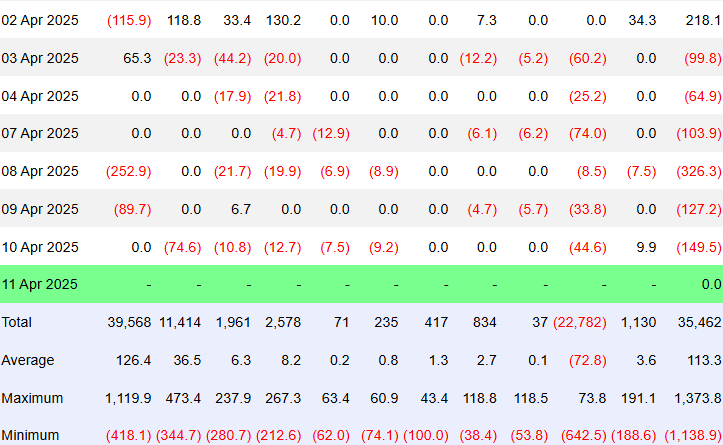

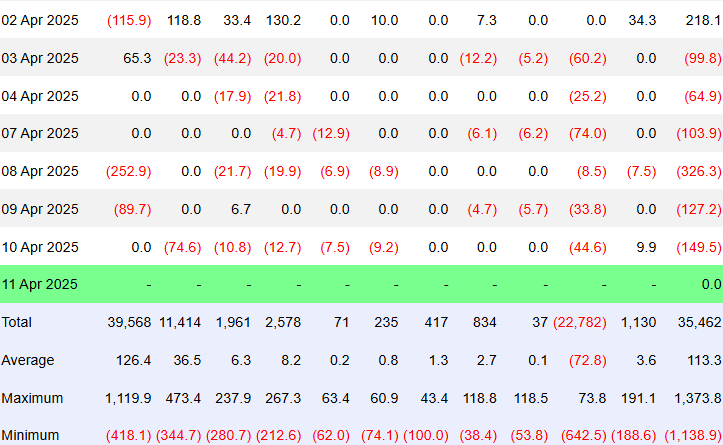

This report emerges as US-listed spot Bitcoin ETFs are experiencing a downturn, marking their sixth consecutive day of net outflows. Yesterday alone saw $149 million in redemptions, according to data from Farside Investors.

These withdrawals were mainly driven by Fidelity’s FBTC and Grayscale’s GBTC. This trend is happening amidst a broader market shift where investors are seeking refuge in assets perceived as safer, like gold and cash. This shift seems to be influenced by increasing tensions in US-China trade relations and market instability linked to evolving US policy.

Share this article