Brazil Launches World’s First XRP Spot ETF

Brazil Launches World’s First XRP Spot ETF

- Good news for crypto investors in Brazil: Hashdex has been approved to launch Brazil’s first-ever XRP ETF!

- XRP’s popularity is clear – it’s the third-largest digital asset by market capitalization.

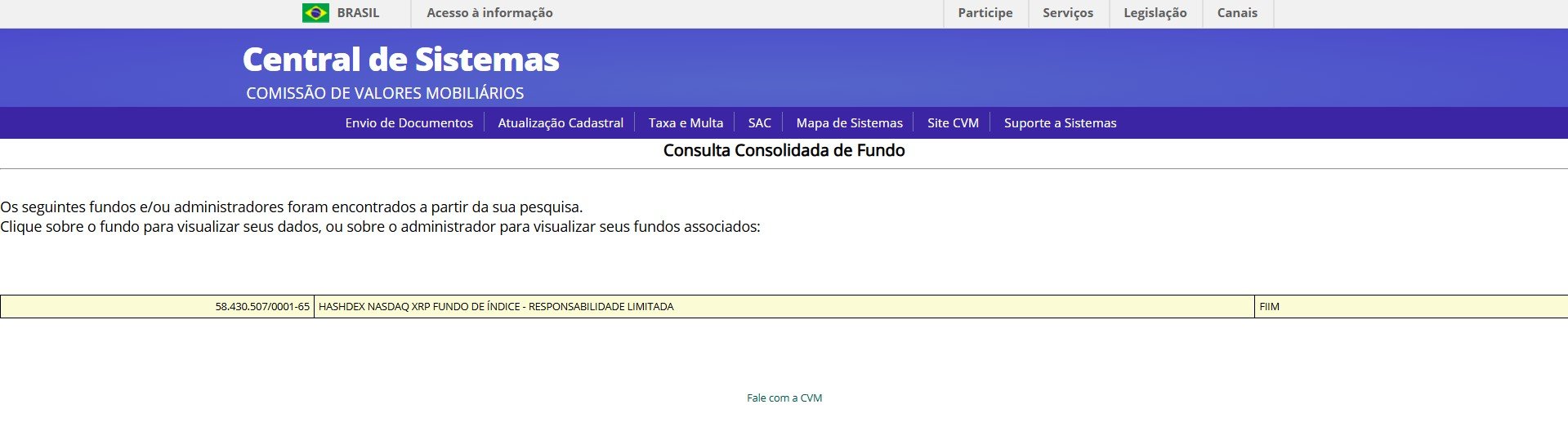

In a groundbreaking move for the crypto world, Brazil’s Securities and Exchange Commission (CVM) has given the green light to the first-ever exchange-traded fund (ETF) that directly invests in XRP. This innovative ETF comes from Hashdex and is officially documented in the CVM database. The news was initially reported by Portal do Bitcoin.

Dubbed the “Hashdex NASDAQ XRP Index Fund,” this freshly approved ETF is set to debut on B3, Brazil’s premier stock exchange. While the official launch date and specifics about trading are still under wraps, Hashdex has confirmed the approval and hinted that details will be shared shortly.

According to information from the CVM, the fund was officially established on December 10, 2024. Leading financial services company, Genial Investimentos, will act as the fund’s administrator.

“XRP is a natural choice for an ETF due to its real-world utility, growing institutional demand, and its overall market cap,” said Silvio Pegado, managing director of Ripple in Latin America.

Data from CoinGecko shows that XRP currently holds its position as the third-largest cryptocurrency globally, boasting a market cap of $152 billion – only behind Bitcoin and Ethereum.

Hashdex, a well-known asset manager specializing in crypto investment products, has a track record of launching crypto ETFs, both in Brazil and the United States.

Just last August, Hashdex received the go-ahead to launch the Hashdex Nasdaq Solana Index Fund, offering investors a way to get exposure to Solana. They also have existing funds linked to Bitcoin and Ethereum.

“The approval of the first XRP ETF by the CVM demonstrates Brazil’s visionary approach to crypto markets and financial advancements,” Pegado added. “Through regulation and public consultations, Brazil continues to position itself as a country open to innovation, and we expect it to be central to more pioneering advancements in the crypto sector in the future.”

While Brazil is clearly embracing crypto ETFs, the United States has historically been more cautious, even despite recent approvals for Bitcoin and Ethereum ETFs. However, the changing regulatory landscape under the new administration could potentially open doors for more crypto ETFs to be approved in the US.

Looking ahead, JP Morgan analysts predict that if spot Solana and XRP ETFs were to be approved by the SEC in the US, they could attract up to $14 billion in investments within their first year alone.