Buffett Stock Dump: $116 Million Sale

You know Warren Buffett, right? The ‘Oracle of Omaha’? Well, he’s pretty much the definition of value investing. Forget those risky, quick trades – Buffett’s all about finding solid companies selling for a good price.

And guess what? This billionaire, along with his company Berkshire Hathaway (NYSE: BRK.B), has actually been selling off more stocks than buying recently. Plus, Buffett’s Berkshire is currently holding a record amount of cash – think of it as being ready to pounce when the right opportunities in the market come along.

If you’re curious about what stocks Buffett’s been holding, Berkshire just dropped their latest update. Their 13-F filing, released on February 14th, gives us a peek into his stock portfolio as of December 31, 2024.

But hold on, it looks like February has been a busy month for the billionaire philanthropist! He’s been buying and selling quite a bit. For example, he pumped $35 million into Occidental Petroleum stock (NYSE: OXY), and also invested another $50 million in SiriusXM stock (NASDAQ: SIRI) in February. On the other side, he also sold off $31 million worth of DaVita stock (NYSE: DVA).

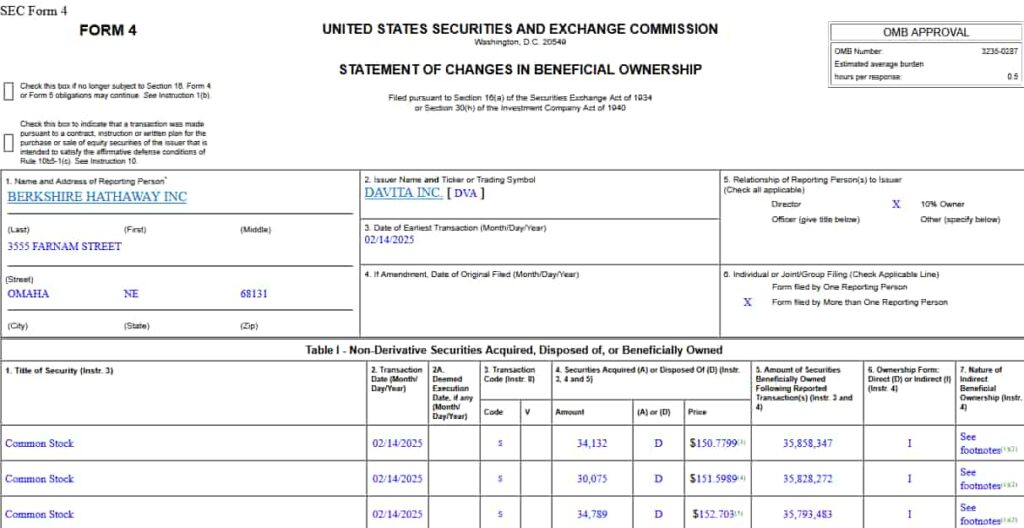

And get this – Finbold’s insider trading radar just spotted yet another DaVita stock sale! A recent Form 4 filing shows Buffett selling even more DaVita shares between February 14th and 19th.

Receive Signals on SEC-verified Insider Stock Trades

This signal is triggered upon the reporting of the trade to the Securities and Exchange Commission (SEC).

Warren Buffett trims stake in DaVita by 2%

In total, it looks like Buffett made 18 separate sales, totaling 750,000 DaVita shares. These shares were sold at prices between $150.77 and $159.15 each.

Putting it all together, Finbold’s calculations suggest this latest round of trading by the billionaire amounted to roughly $116,055,616.

This recent sale reduced Buffett’s ownership in the dialysis company by about 2%. Still, he remains the largest shareholder, holding onto a substantial 44% stake with 35,142,479 shares.

The likely reason for Buffett’s selling? DaVita’s recent Q4 2024 earnings call didn’t exactly inspire confidence. Even though they beat expectations for earnings and revenue, their outlook for the future was weak. The market reacted fast, and the stock price plummeted 11% in a single day, down to $157.42. And as of right now, DVA stock is at $154.50, marking a 9.10% drop in the last month.

It’s worth remembering that Buffett’s earlier $31 million sale was actually part of a pre-planned share repurchase agreement. However, with this recent disappointing outlook and the fact that even its biggest backer is selling shares, the market is getting nervous about DaVita. It’s looking like 2025 could be a tough year for the company.

Disclaimer: The featured image in this article is for illustrative purposes only and may not accurately reflect the true likeness of the individuals depicted.